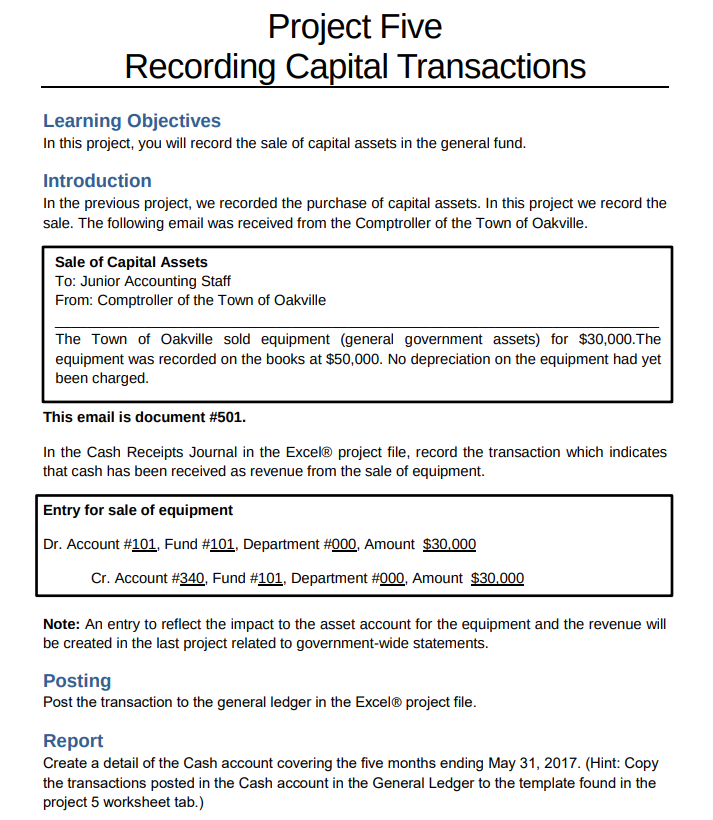

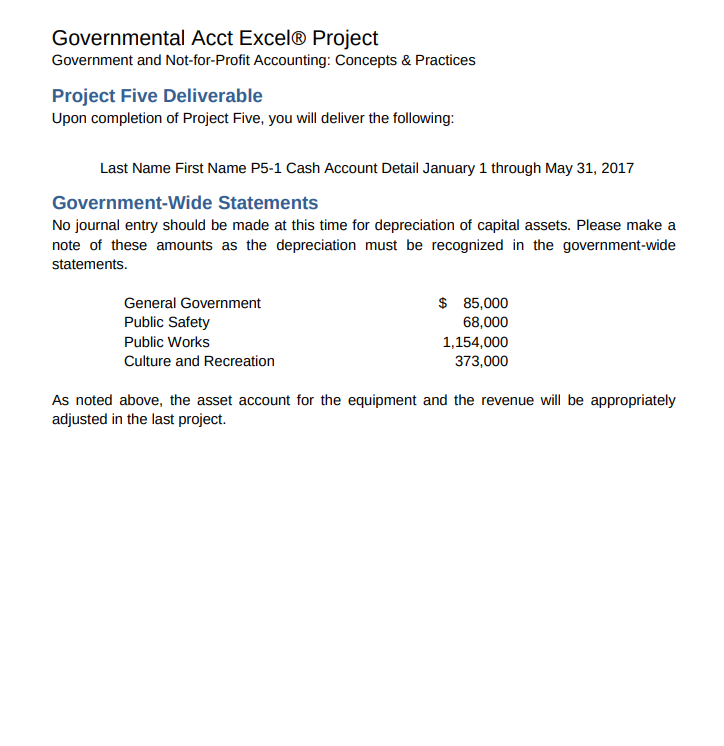

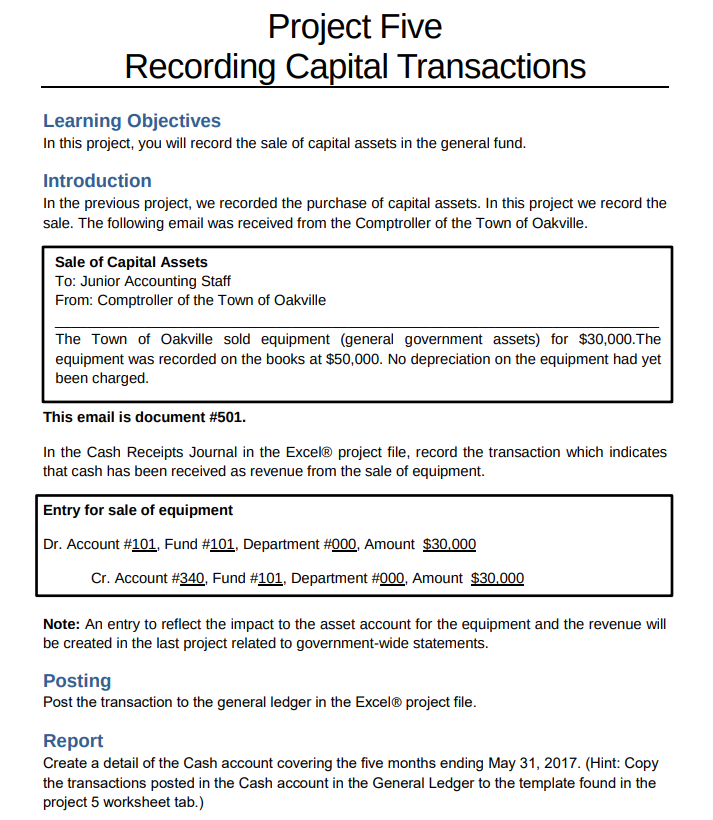

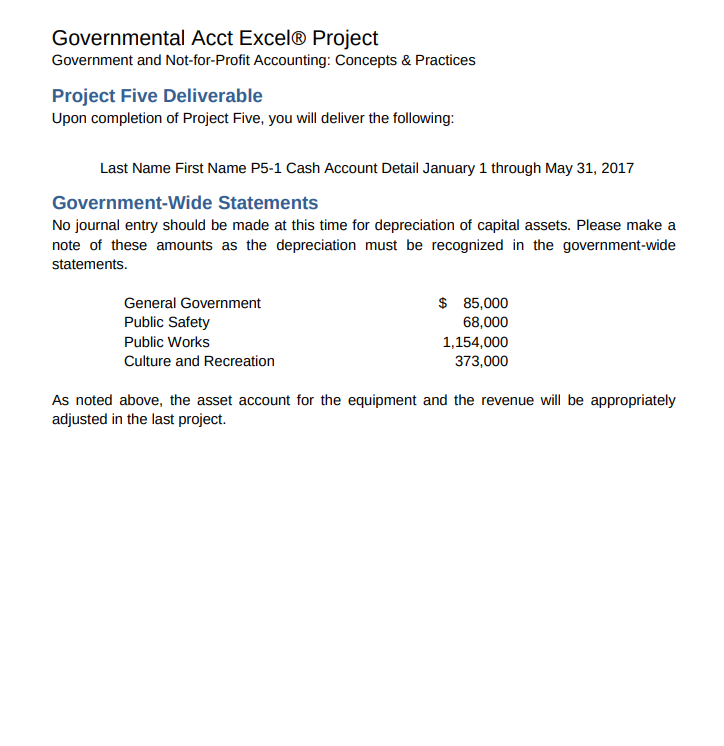

Project Five Recording Capital Transactions Learning Objectives In this project, you will record the sale of capital assets in the general fund. Introduction In the previous project, we recorded the purchase of capital assets. In this project we record the sale. The following email was received from the Comptroller of the Town of Oakville. Sale of Capital Assets To: Junior Accounting Staff From: Comptroller of the Town of Oakville The Town of Oakville sold equipment (general government assets) for $30,000. The equipment was recorded on the books at $50,000. No depreciation on the equipment had yet been charged. This email is document #501. In the Cash Receipts Journal in the Excel project file, record the transaction which indicates that cash has been received as revenue from the sale of equipment. Entry for sale of equipment Dr. Account #101, Fund #101, Department #000, Amount $30,000 Cr. Account #340, Fund #101, Department #000, Amount $30.000 Note: An entry to reflect the impact to the asset account for the equipment and the revenue will be created in the last project related to government-wide statements. Posting Post the transaction to the general ledger in the Excel project file. Report Create a detail of the Cash account covering the five months ending May 31, 2017. (Hint: Copy the transactions posted in the Cash account in the General Ledger to the template found in the project 5 worksheet tab.) Governmental Acct Excel Project Government and Not-for-Profit Accounting: Concepts & Practices Project Five Deliverable Upon completion of Project Five, you will deliver the following: Last Name First Name P5-1 Cash Account Detail January 1 through May 31, 2017 Government-Wide Statements No journal entry should be made at this time for depreciation of capital assets. Please make a note of these amounts as the depreciation must be recognized in the government-wide statements. General Government Public Safety Public Works Culture and Recreation $ 85,000 68,000 1,154,000 373,000 As noted above, the asset account for the equipment and the revenue will be appropriately adjusted in the last project. Project Five Recording Capital Transactions Learning Objectives In this project, you will record the sale of capital assets in the general fund. Introduction In the previous project, we recorded the purchase of capital assets. In this project we record the sale. The following email was received from the Comptroller of the Town of Oakville. Sale of Capital Assets To: Junior Accounting Staff From: Comptroller of the Town of Oakville The Town of Oakville sold equipment (general government assets) for $30,000. The equipment was recorded on the books at $50,000. No depreciation on the equipment had yet been charged. This email is document #501. In the Cash Receipts Journal in the Excel project file, record the transaction which indicates that cash has been received as revenue from the sale of equipment. Entry for sale of equipment Dr. Account #101, Fund #101, Department #000, Amount $30,000 Cr. Account #340, Fund #101, Department #000, Amount $30.000 Note: An entry to reflect the impact to the asset account for the equipment and the revenue will be created in the last project related to government-wide statements. Posting Post the transaction to the general ledger in the Excel project file. Report Create a detail of the Cash account covering the five months ending May 31, 2017. (Hint: Copy the transactions posted in the Cash account in the General Ledger to the template found in the project 5 worksheet tab.) Governmental Acct Excel Project Government and Not-for-Profit Accounting: Concepts & Practices Project Five Deliverable Upon completion of Project Five, you will deliver the following: Last Name First Name P5-1 Cash Account Detail January 1 through May 31, 2017 Government-Wide Statements No journal entry should be made at this time for depreciation of capital assets. Please make a note of these amounts as the depreciation must be recognized in the government-wide statements. General Government Public Safety Public Works Culture and Recreation $ 85,000 68,000 1,154,000 373,000 As noted above, the asset account for the equipment and the revenue will be appropriately adjusted in the last project