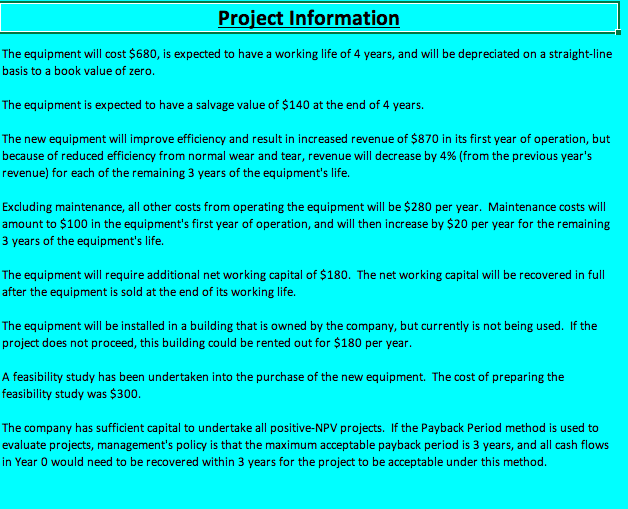

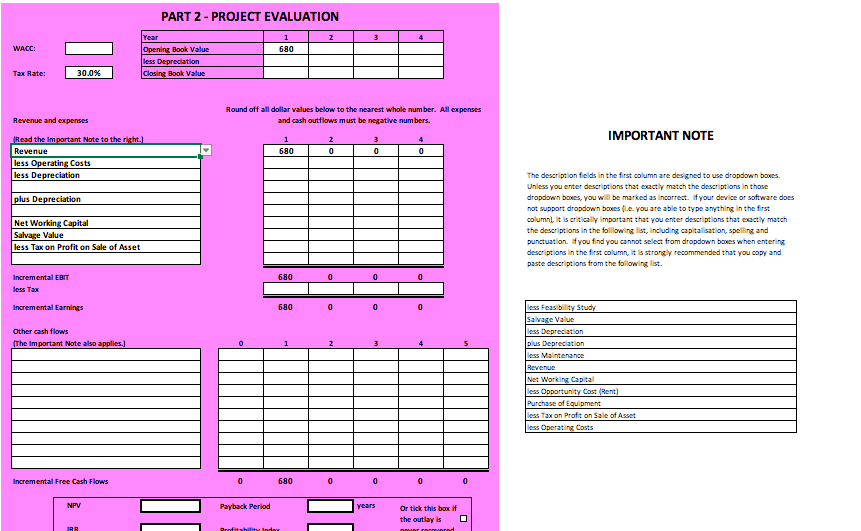

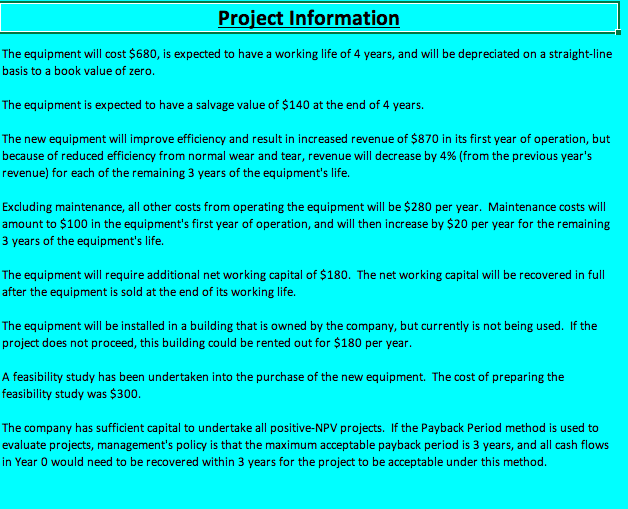

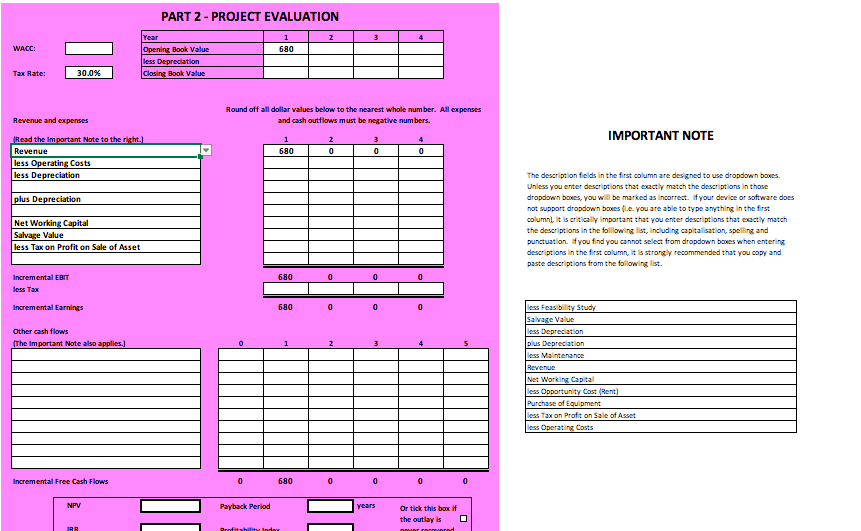

Project Information The equipment will cost $680, is expected to have a working life of 4 years, and will be depreciated on a straight-line basis to a book value of zero. The equipment is expected to have a salvage value of $140 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $870 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 4% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $280 per year. Maintenance costs will amount to $100 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $180. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $180 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $300. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year O would need to be recovered within 3 years for the project to be acceptable under this method. PART 2 - PROJECT EVALUATION 1 2 3 4 WACC: 680 Year Opening Book Value less Depreciation Closing Book Value Tax Rate: 30.0% Revenue and expenses Round off all dollar values below to the nearest whole number. All expenses and cash outflows must be negative numbers. IMPORTANT NOTE 3 1 680 2 0 0 0 Read the important Note to the right. Revenue less Operating costs less Depreciation plus Depreciation Net Working Capital Salvage Value less Tax on Profit on Sale of Asset The description fields in the first column are designed to use dropdown boxes. Unless you enter descriptions that exactly match the descriptions in those dropdown boxes, you will be marked as incorrect. If your device or software does not support dropdown boxes (Le you are able to type anything in the first column. It is critically important that you enter descriptions that exectly match the descriptions in the following list, including capitalisation, spelling and punctuation. If you find you cannot select from dropdown boxes when entering descriptions in the first column, it is strongly recommended that you copy and paste descriptions from the following list. 680 0 0 0 Incremental EBIT less Tax Incremental Earnings 680 Other cash flows (The Important Note also applies. 1 2 5 less Feas bility Study Salvare Value less Depreciation plus Depreciation less Maintenance Revenue Net Working Capital less Opportunity Cost (Rent) Purchase of Equipment less Tax on Profit on Sale of Asset less Operating costs Incremental Free Cash Flows 0 680 0 0 NPV Payback Period years A Or tick this box if the outlay is IRR rofitability in Project Information The equipment will cost $680, is expected to have a working life of 4 years, and will be depreciated on a straight-line basis to a book value of zero. The equipment is expected to have a salvage value of $140 at the end of 4 years. The new equipment will improve efficiency and result in increased revenue of $870 in its first year of operation, but because of reduced efficiency from normal wear and tear, revenue will decrease by 4% (from the previous year's revenue) for each of the remaining 3 years of the equipment's life. Excluding maintenance, all other costs from operating the equipment will be $280 per year. Maintenance costs will amount to $100 in the equipment's first year of operation, and will then increase by $20 per year for the remaining 3 years of the equipment's life. The equipment will require additional net working capital of $180. The net working capital will be recovered in full after the equipment is sold at the end of its working life. The equipment will be installed in a building that is owned by the company, but currently is not being used. If the project does not proceed, this building could be rented out for $180 per year. A feasibility study has been undertaken into the purchase of the new equipment. The cost of preparing the feasibility study was $300. The company has sufficient capital to undertake all positive-NPV projects. If the Payback Period method is used to evaluate projects, management's policy is that the maximum acceptable payback period is 3 years, and all cash flows in Year O would need to be recovered within 3 years for the project to be acceptable under this method. PART 2 - PROJECT EVALUATION 1 2 3 4 WACC: 680 Year Opening Book Value less Depreciation Closing Book Value Tax Rate: 30.0% Revenue and expenses Round off all dollar values below to the nearest whole number. All expenses and cash outflows must be negative numbers. IMPORTANT NOTE 3 1 680 2 0 0 0 Read the important Note to the right. Revenue less Operating costs less Depreciation plus Depreciation Net Working Capital Salvage Value less Tax on Profit on Sale of Asset The description fields in the first column are designed to use dropdown boxes. Unless you enter descriptions that exactly match the descriptions in those dropdown boxes, you will be marked as incorrect. If your device or software does not support dropdown boxes (Le you are able to type anything in the first column. It is critically important that you enter descriptions that exectly match the descriptions in the following list, including capitalisation, spelling and punctuation. If you find you cannot select from dropdown boxes when entering descriptions in the first column, it is strongly recommended that you copy and paste descriptions from the following list. 680 0 0 0 Incremental EBIT less Tax Incremental Earnings 680 Other cash flows (The Important Note also applies. 1 2 5 less Feas bility Study Salvare Value less Depreciation plus Depreciation less Maintenance Revenue Net Working Capital less Opportunity Cost (Rent) Purchase of Equipment less Tax on Profit on Sale of Asset less Operating costs Incremental Free Cash Flows 0 680 0 0 NPV Payback Period years A Or tick this box if the outlay is IRR rofitability in