Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Project investment problem The project development division of Cyber.IL, a major company in the field of cyber security, has allocated $160 million to invest in

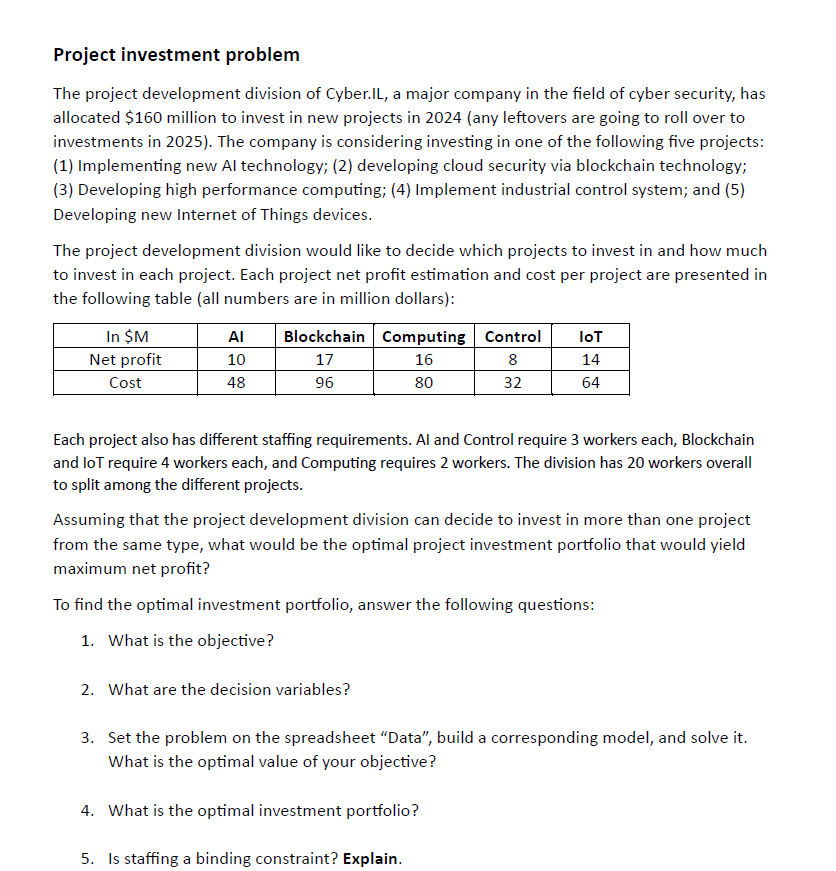

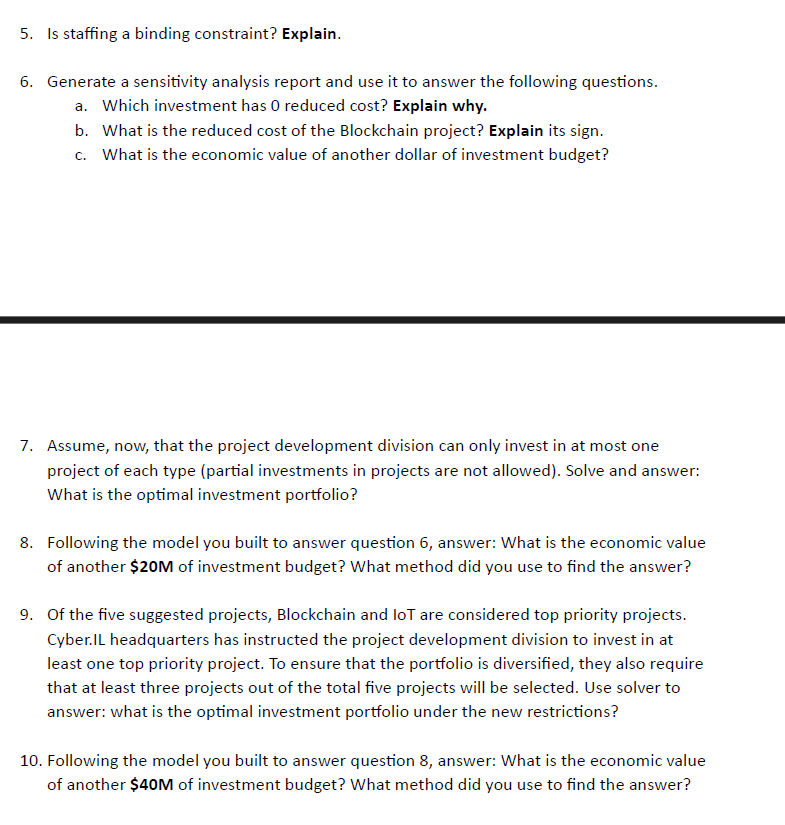

Project investment problem The project development division of Cyber.IL, a major company in the field of cyber security, has allocated $160 million to invest in new projects in 2024 (any leftovers are going to roll over to investments in 2025). The company is considering investing in one of the following five projects: (1) Implementing new Al technology; (2) developing cloud security via blockchain technology; (3) Developing high performance computing; (4) Implement industrial control system; and (5) Developing new Internet of Things devices. The project development division would like to decide which projects to invest in and how much to invest in each project. Each project net profit estimation and cost per project are presented in the following table (all numbers are in million dollars): Each project also has different staffing requirements. Al and Control require 3 workers each, Blockchain and loT require 4 workers each, and Computing requires 2 workers. The division has 20 workers overall to split among the different projects. Assuming that the project development division can decide to invest in more than one project from the same type, what would be the optimal project investment portfolio that would yield maximum net profit? To find the optimal investment portfolio, answer the following questions: 1. What is the objective? 2. What are the decision variables? 3. Set the problem on the spreadsheet "Data", build a corresponding model, and solve it. What is the optimal value of your objective? 4. What is the optimal investment portfolio? 5. Is staffing a binding constraint? Explain. 5. Is staffing a binding constraint? Explain. 6. Generate a sensitivity analysis report and use it to answer the following questions. a. Which investment has 0 reduced cost? Explain why. b. What is the reduced cost of the Blockchain project? Explain its sign. c. What is the economic value of another dollar of investment budget? 7. Assume, now, that the project development division can only invest in at most one project of each type (partial investments in projects are not allowed). Solve and answer: What is the optimal investment portfolio? 8. Following the model you built to answer question 6 , answer: What is the economic value of another $20M of investment budget? What method did you use to find the answer? 9. Of the five suggested projects, Blockchain and loT are considered top priority projects. Cyber.IL headquarters has instructed the project development division to invest in at least one top priority project. To ensure that the portfolio is diversified, they also require that at least three projects out of the total five projects will be selected. Use solver to answer: what is the optimal investment portfolio under the new restrictions? 10. Following the model you built to answer question 8 , answer: What is the economic value of another $40M of investment budget? What method did you use to find the

Project investment problem The project development division of Cyber.IL, a major company in the field of cyber security, has allocated $160 million to invest in new projects in 2024 (any leftovers are going to roll over to investments in 2025). The company is considering investing in one of the following five projects: (1) Implementing new Al technology; (2) developing cloud security via blockchain technology; (3) Developing high performance computing; (4) Implement industrial control system; and (5) Developing new Internet of Things devices. The project development division would like to decide which projects to invest in and how much to invest in each project. Each project net profit estimation and cost per project are presented in the following table (all numbers are in million dollars): Each project also has different staffing requirements. Al and Control require 3 workers each, Blockchain and loT require 4 workers each, and Computing requires 2 workers. The division has 20 workers overall to split among the different projects. Assuming that the project development division can decide to invest in more than one project from the same type, what would be the optimal project investment portfolio that would yield maximum net profit? To find the optimal investment portfolio, answer the following questions: 1. What is the objective? 2. What are the decision variables? 3. Set the problem on the spreadsheet "Data", build a corresponding model, and solve it. What is the optimal value of your objective? 4. What is the optimal investment portfolio? 5. Is staffing a binding constraint? Explain. 5. Is staffing a binding constraint? Explain. 6. Generate a sensitivity analysis report and use it to answer the following questions. a. Which investment has 0 reduced cost? Explain why. b. What is the reduced cost of the Blockchain project? Explain its sign. c. What is the economic value of another dollar of investment budget? 7. Assume, now, that the project development division can only invest in at most one project of each type (partial investments in projects are not allowed). Solve and answer: What is the optimal investment portfolio? 8. Following the model you built to answer question 6 , answer: What is the economic value of another $20M of investment budget? What method did you use to find the answer? 9. Of the five suggested projects, Blockchain and loT are considered top priority projects. Cyber.IL headquarters has instructed the project development division to invest in at least one top priority project. To ensure that the portfolio is diversified, they also require that at least three projects out of the total five projects will be selected. Use solver to answer: what is the optimal investment portfolio under the new restrictions? 10. Following the model you built to answer question 8 , answer: What is the economic value of another $40M of investment budget? What method did you use to find the Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started