Answered step by step

Verified Expert Solution

Question

1 Approved Answer

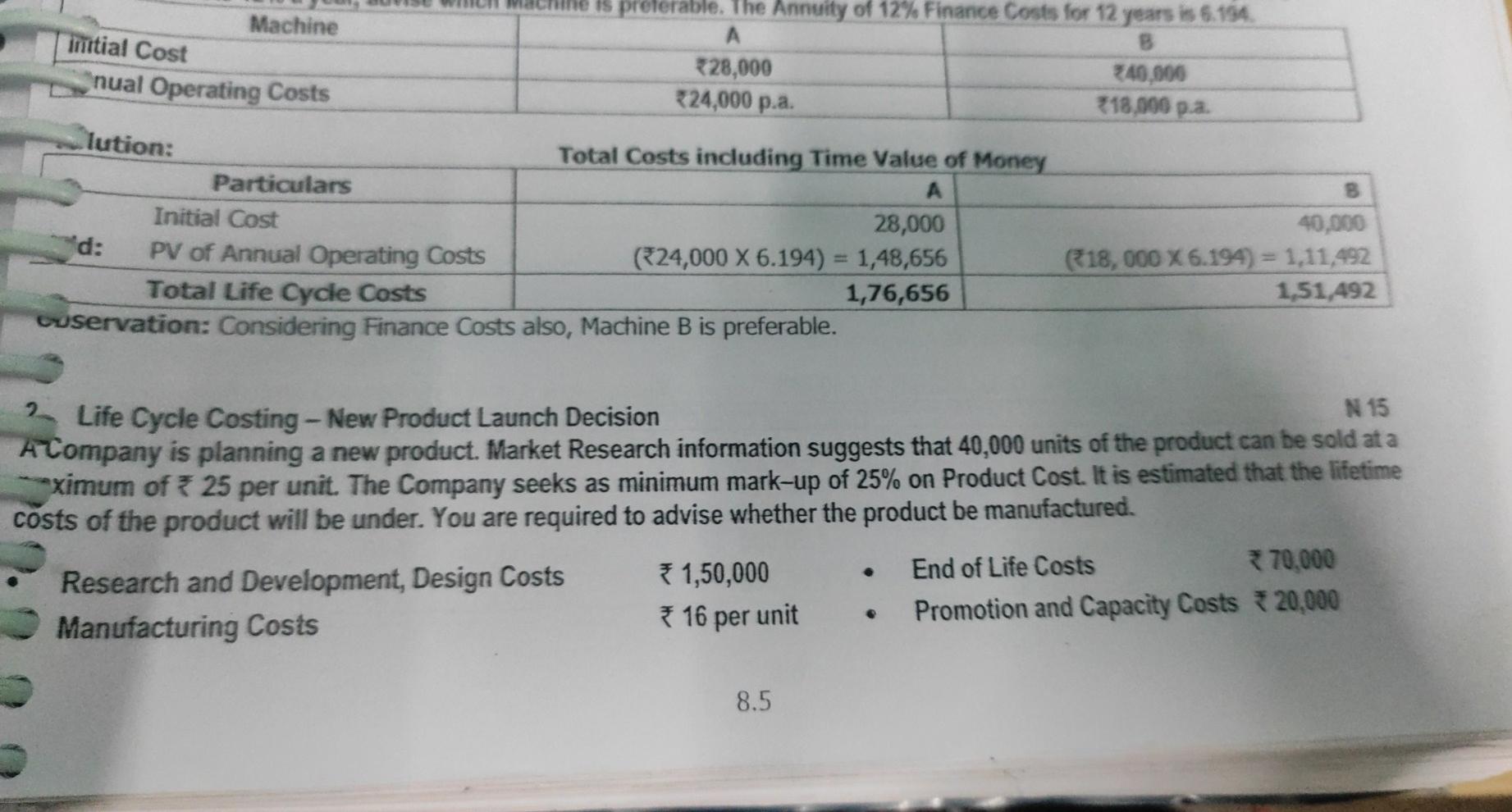

project note Machine Initial Cost is preferable. The Annuity of 12% Finance Costs for 12 years is 6.154. B 28,000 240,000 *24,000 p.a. 318,000 pa

project note

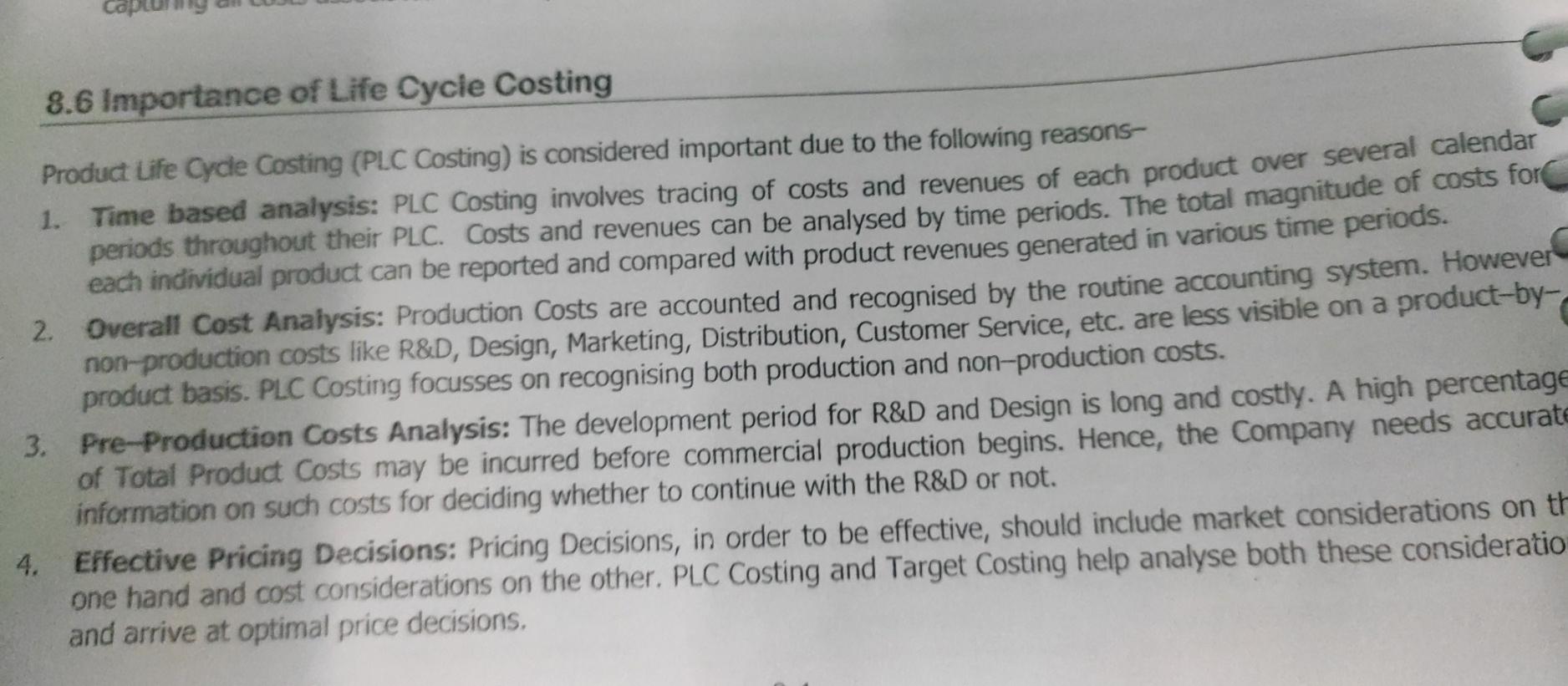

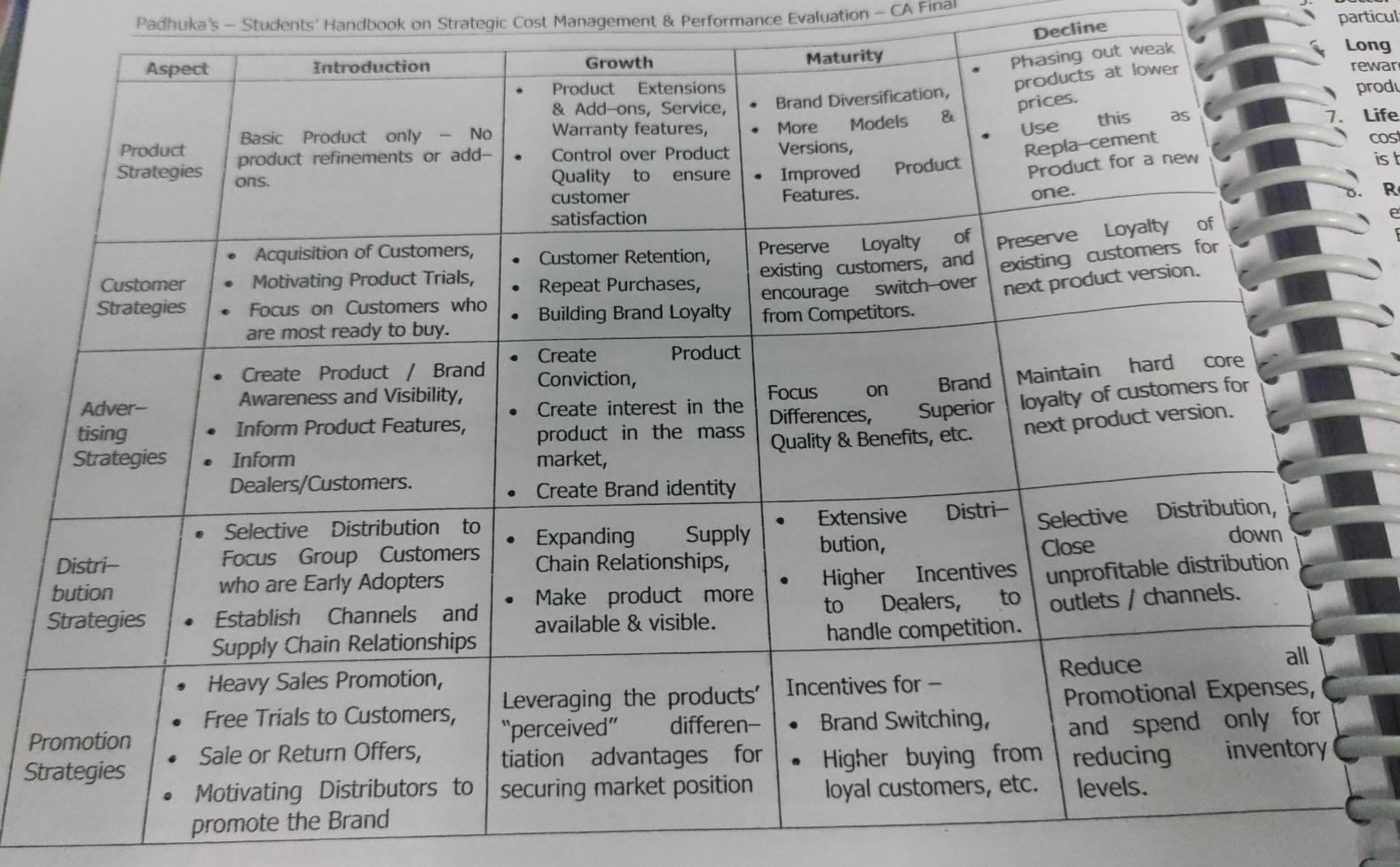

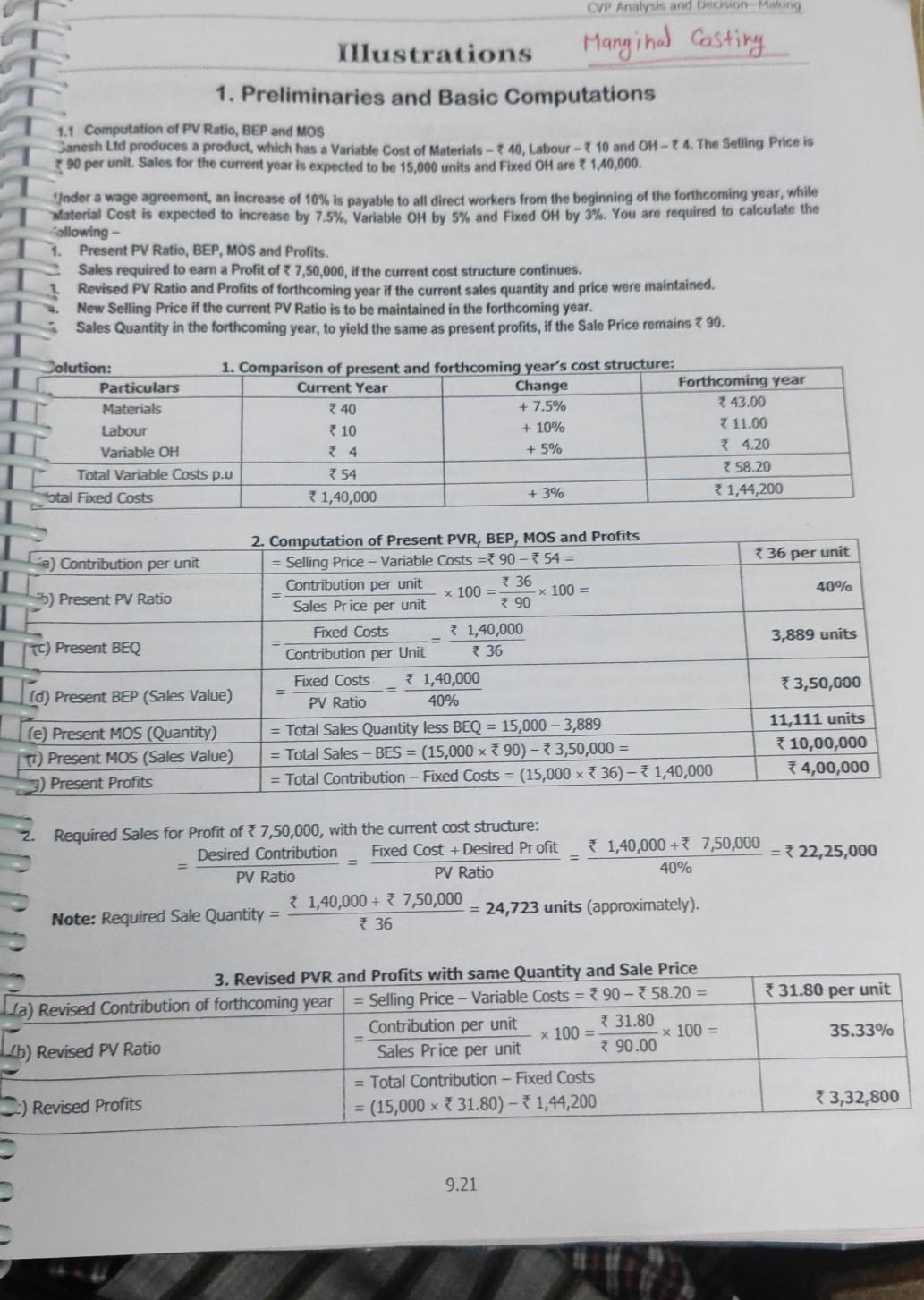

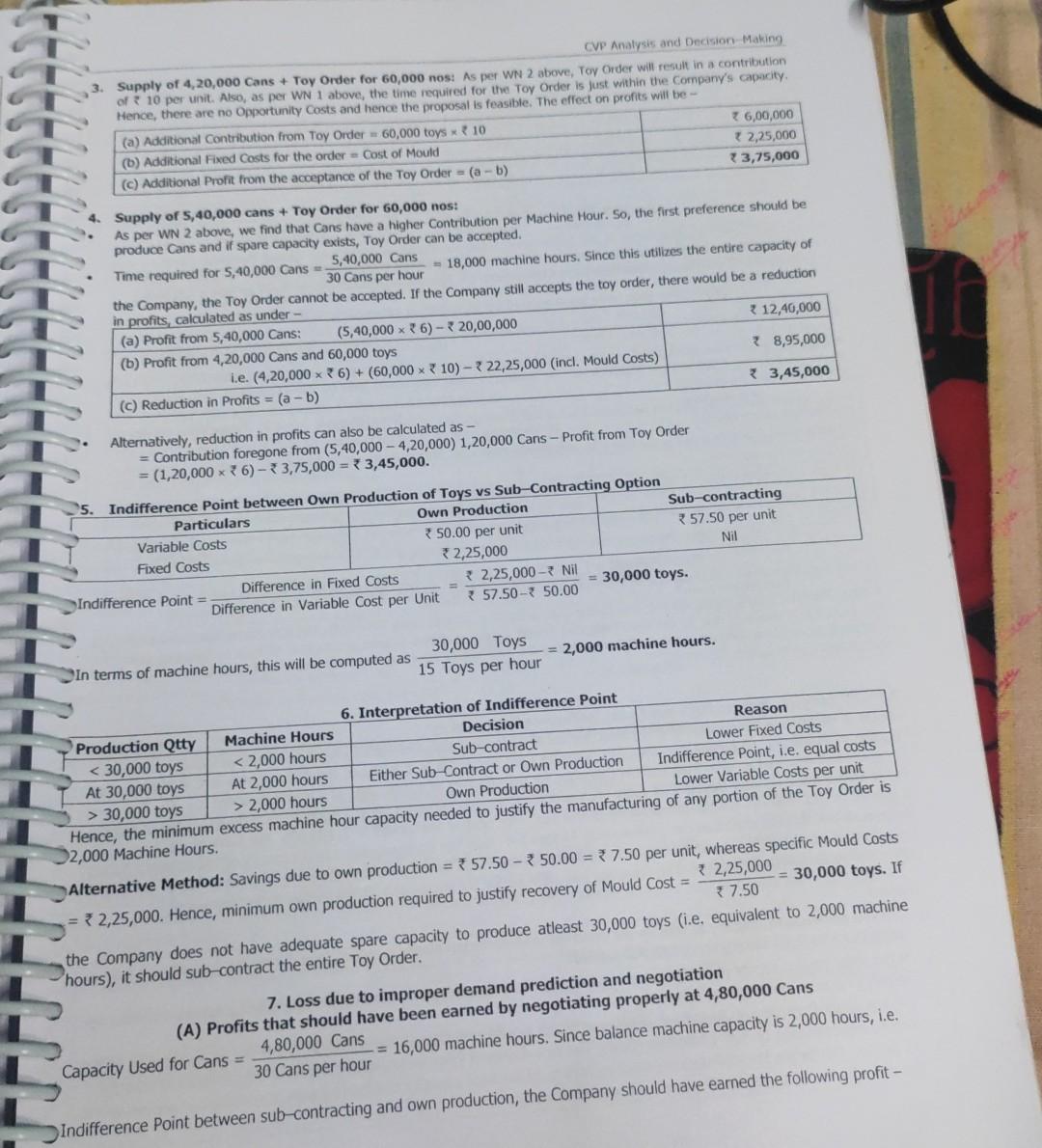

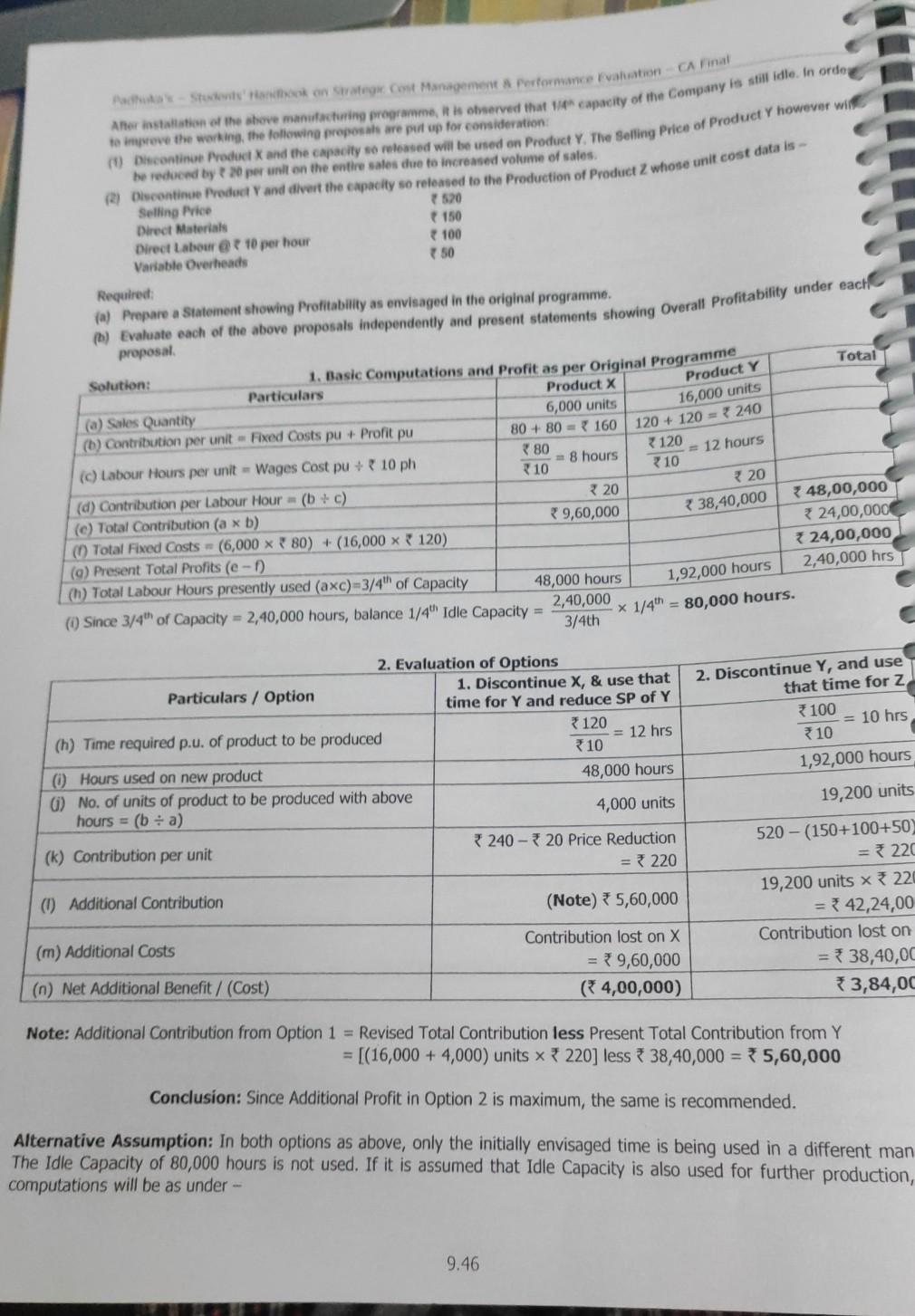

Machine Initial Cost is preferable. The Annuity of 12% Finance Costs for 12 years is 6.154. B 28,000 240,000 *24,000 p.a. 318,000 pa nual Operating Costs lution: Total Costs including Time Value of Money Particulars A Initial Cost 28,000 d: PV of Annual Operating costs (24,000 X 6.194) = 1,48,656 Total Life Cycle Costs 1,76,656 cuservation: Considering Finance Costs also, Machine B is preferable. 40,000 18,000 X 6.194) = 1.11,492 1,51,492 2. Life Cycle Costing - New Product Launch Decision N 15 A Company is planning a new product Market Research information suggests that 40,000 units of the product can be sold at a aximum of 25 per unit. The Company seeks as minimum mark-up of 25% on Product Cost. It is estimated that the lifetime costs of the product will be under. You are required to advise whether the product be manufactured Research and Development, Design Costs 1,50,000 End of Life Costs 70,000 Manufacturing Costs 16 per unit Promotion and Capacity Costs 20,000 8.5 8.6 Importance of Life Cycle Costing Product Life Cycle Costing (PLC Costing) is considered important due to the following reasons- 1. Time based analysis: PLC Costing involves tracing of costs and revenues of each product over several calendar periods throughout their PLC. Costs and revenues can be analysed by time periods. The total magnitude of costs for each individual product can be reported and compared with product revenues generated in various time periods. 2. Overall Cost Analysis: Production Costs are accounted and recognised by the routine accounting system. However non-production costs like R&D, Design, Marketing, Distribution, Customer Service, etc. are less visible on a product-by- product basis. PLC Costing focusses on recognising both production and non-production costs. 3. Pre-Production Costs Analysis: The development period for R&D and Design is long and costly. A high percentage of Total Product Costs may be incurred before commercial production begins. Hence, the Company needs accurate information on such costs for deciding whether to continue with the R&D or not. 4. Effective Pricing Decisions: Pricing Decisions, in order to be effective, should include market considerations on th one hand and cost considerations on the other. PLC Costing and Target Costing help analyse both these consideratio and arrive at optimal price decisions, Padhuka's - Students' Handbook on Strategic Cost Management & Performance Evaluation - CA Final . particul Long rewar prody 7. Life COS ist Decline Phasing out weak products at lower prices. Use this Repla-cement Product for a new one. & as R e Preserve Loyalty of existing customers for next product version. Aspect Introduction Growth Maturity Product Extensions & Add-ons, Service, Brand Diversification, Basic Product only - No Product Warranty features, More Models Strategies product refinements or add- Control over Product Versions, Ons. Quality to ensure Improved Product customer Features. satisfaction Acquisition of Customers, of Preserve Customer Retention, Loyalty Customer Motivating Product Trials, Repeat Purchases, existing customers, and Strategies Focus on Customers who encourage switch-over Building Brand Loyalty are most ready to buy. from Competitors. Create Product Create Product 1 Brand Conviction, Adver- Awareness and Visibility, Focus on Create interest in the tising Inform Product Features, product in the mass Differences, Strategies Inform market, Dealers/Customers. Create Brand identity . Selective Distribution to Extensive Distri- Expanding Supply Selective Distribution, Distri- Focus Group Customers bution, down Close Chain Relationships, who are Early Adopters bution Higher Incentives Make product more unprofitable distribution Strategies Establish Channels and to Dealers, to available & visible. outlets / channels. Supply Chain Relationships handle competition. Heavy Sales Promotion, Reduce all Free Trials to Customers, Leveraging the products' Incentives for - Promotional Expenses, Promotion "perceived" differen- Brand Switching, and Sale or Return Offers, spend only for Strategies tiation advantages for Higher buying from reducing inventory Motivating Distributors to securing market position loyal customers, etc. levels. promote the Brand Brand Maintain hard core Superior loyalty of customers for Quality & Benefits, etc. next product version. . . CVP Analysis and decision Making Marginal Casting Illustrations 1. Preliminaries and Basic Computations 1.1 Computation of PV Ratio, BEP and MOS Sanesh Ltd produces a product, which has a Variable Cost of Materials - 40, Labour - 30,000 toys > 2,000 hours Own Production Lower Variable Costs per unit Hence, the minimum excess machine hour capacity needed to justify the manufacturing of any portion of the Toy Order is 2,000 Machine Hours. Alternative Method: Savings due to own production = 57.50 - 50.00 = 7.50 per unit, whereas specific Mould Costs 3 2,25,000 = * 2,25,000. Hence, minimum own production required to justify recovery of Mould Cost = = 30,000 toys. If 7.50 the Company does not have adequate spare capacity to produce atleast 30,000 toys (i.e. equivalent to 2,000 machine hours), it should sub-contract the entire Toy Order 7. Loss due to improper demand prediction and negotiation (A) Profits that should have been earned by negotiating properly at 4,80,000 Cans 4,80,000 Cans Capacity Used for Cans = = 16,000 machine hours. Since balance machine capacity is 2,000 hours, i.e. 30 Cans per hour Indifference Point between sub-contracting and own production, the Company should have earned the following profit - Pada - Stutente Park on Saratogi Cont Management a rotormance atuation Carina After installation of the above manufacturing programme, it is olvserved that the capacity of the Company is still idle. In orde to improve the working the following proposals are put up for consideration (1) Discontine Product and the capacity to released will be used on Product Y. The Selling Price of Product Y however wil he by per volume of (2) continue Product and divert the capacity so rotened to the production of Product Z whose unit cost data is - Selling Price 7520 Direct Materials 150 Direct Labour @ 10 per hour 100 Variable Overheads 50 Required: (a) Prepare a Statement showing Profitability as envisaged in the original programme (0) Evaluate each of the above proposals independently and present statements showing Overall Profitability under each Product Y 16,000 units 120 + 120 = 240 = 12 hours proposal Solution: 1. Basic Computations and Profit as per Original Programme Total Particulars Product x (a) Sales Quantity 6,000 units (1) Contribution per unit - Fixed Costs pu Profit pu 80 + 80 - 160 120 380 (c) Labour Hours per unit Wages Cost pu + 10 ph 8 hours 10 310 (d) Contribution per Labour Hour(b + c) 20 320 (c) Total Contribution (a xb) 48,00,000 9,60,000 Total Fixed Costs - (6,000 x 80) + (16,000 x 120) 24,00,000 (9) Present Total Profits (e- 724,00,000 (1) Total Labour Hours presently used (axc)-3/4th of Capacity 2,40,000 hrs 48,000 hours (1) Since 3/4th of Capacity = 2,40,000 hours, balance 1/4" Idle Capacity = 2,40,000 * 1/4th = 80,000 hours. 3/4th 38,40,000 1,92,000 hours 2. Discontinue Y, and use that time for Z 100 -= 10 hrs 10 1,92,000 hours 2. Evaluation of Options Particulars / Option 1. Discontinue X, & use that time for Y and reduce SP of Y 120 (h) Time required p.u. of product to be produced = 12 hrs 10 (1) Hours used on new product 48,000 hours 6) No. of units of product to be produced with above hours = (b + a) 4,000 units (k) Contribution per unit 240-320 Price Reduction = 220 (1) Additional Contribution (Note) 5,60,000 19,200 units 520 - (150+100+50) = 220 19,200 units x 220 = 42,24,00 Contribution lost on = * 38,40,00 3,84,00 (m) Additional Costs Contribution lost on X = 9,60,000 ( 4,00,000) (n) Net Additional Benefit / (Cost) Note: Additional Contribution from Option 1 = Revised Total Contribution less Present Total Contribution from Y = [(16,000 + 4,000) units x 220) less 38,40,000 = 5,60,000 Conclusion: Since Additional Profit in Option 2 is maximum, the same is recommended. Alternative Assumption: In both options as above, only the initially envisaged time is being used in different man The Idle Capacity of 80,000 hours is not used. If it is assumed that Idle Capacity is also used for further production, computations will be as under - 9.46Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started