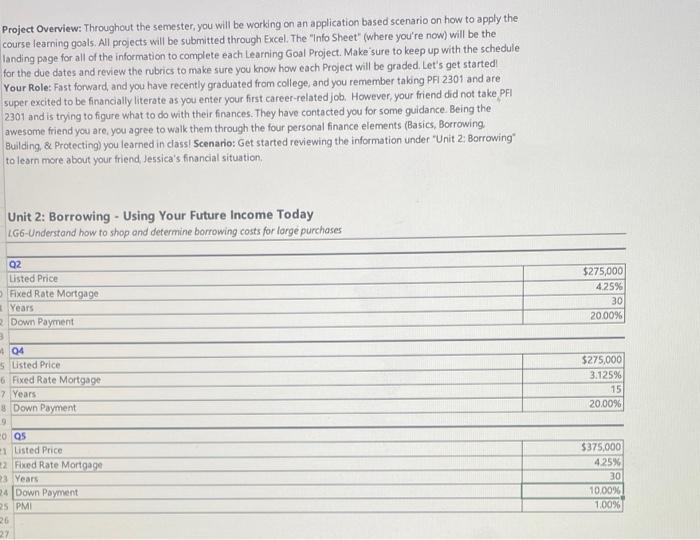

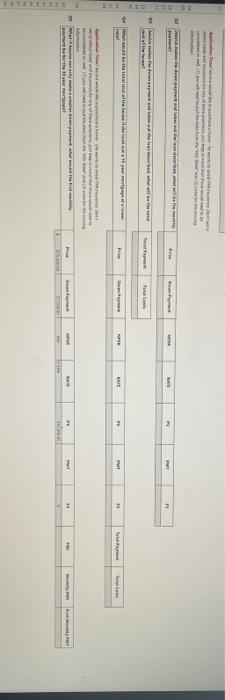

Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course learning goals. All projects will be submitted through Excel. The "Info Sheet" (where you're now) will be the landing page for all of the information to complete each Learning Goal Project. Make sure to keep up with the schedule for the due dates and review the rubrics to make sure you know how each Project will be graded. Let's get started! Your Role: Fast forward, and you have recently graduated from college, and you remember taking PFI 2301 and are super excited to be financially literate as you enter your first career-related job. However, your friend did not take PFI 2301 and is trying to figure what to do with their finances. They have contacted you for some guidance. Being the awesome friend you are, you agree to walk them through the four personal finance elements (Basics, Borrowing, Building, & Protecting) you learned in class! Scenario: Get started reviewing the information under "Unit 2: Borrowing" to learn more about your friend, Jessica's financial situation. Unit 2: Borrowing - Using Your Future Income Today LG6-Understand how to shop and determine borrowing costs for large purchases Q2 Listed Price Fixed Rate Mortgage Years 2 Down Payment 3 4 04 5 Listed Price 6 Fixed Rate Mortgage 7 Years 8 Down Payment 9 20 Q5 21 Listed Price. 2 Fixed Rate Mortgage 23 Years 24 Down Payment 25 PMI 26 27 $275,000 4.25% 30. 20.00% $275,000 3.125% 15 20.00% $375,000 4.25% 30 10.00% 1.00% f out G4 W rata met Wat Te shoudand payment and take the total matter drapentecostare xanly make a smaller depan what the first m Fize Frie Prive SOPH Da 55 TE APER THE KAIR SA MAY 2 W FF aband Pat IN PHY FY TV TY . : i P PHR My Project Overview: Throughout the semester, you will be working on an application based scenario on how to apply the course learning goals. All projects will be submitted through Excel. The "Info Sheet" (where you're now) will be the landing page for all of the information to complete each Learning Goal Project. Make sure to keep up with the schedule for the due dates and review the rubrics to make sure you know how each Project will be graded. Let's get started! Your Role: Fast forward, and you have recently graduated from college, and you remember taking PFI 2301 and are super excited to be financially literate as you enter your first career-related job. However, your friend did not take PFI 2301 and is trying to figure what to do with their finances. They have contacted you for some guidance. Being the awesome friend you are, you agree to walk them through the four personal finance elements (Basics, Borrowing, Building, & Protecting) you learned in class! Scenario: Get started reviewing the information under "Unit 2: Borrowing" to learn more about your friend, Jessica's financial situation. Unit 2: Borrowing - Using Your Future Income Today LG6-Understand how to shop and determine borrowing costs for large purchases Q2 Listed Price Fixed Rate Mortgage Years 2 Down Payment 3 4 04 5 Listed Price 6 Fixed Rate Mortgage 7 Years 8 Down Payment 9 20 Q5 21 Listed Price. 2 Fixed Rate Mortgage 23 Years 24 Down Payment 25 PMI 26 27 $275,000 4.25% 30. 20.00% $275,000 3.125% 15 20.00% $375,000 4.25% 30 10.00% 1.00% f out G4 W rata met Wat Te shoudand payment and take the total matter drapentecostare xanly make a smaller depan what the first m Fize Frie Prive SOPH Da 55 TE APER THE KAIR SA MAY 2 W FF aband Pat IN PHY FY TV TY . : i P PHR My