Question

September 1- The Company received bookkeeping contract from Little Tot Company. Work begins immediately. Little Tot Company paid $25,000 today and remaining $10,000 is due

September 1- The Company received bookkeeping contract from Little Tot Company. Work begins immediately. Little Tot Company paid $25,000 today and remaining $10,000 is due on September 16.

September 2- The business issued 1,000 additional shares, $4 par to four shareholders for $5,000 cash.

September 3- The Company provided bookkeeping services to Comfort Cleaning Services, Inc. on account, $4,500.

September 5- The Company received a bill from Anne B. Becker, CPA, for $3,500 for accounting services in helping to incorporate the business. Check # 344 was processed and mailed immediately to Anne B Becker.

September 10- The Company signed a contract with for Wilbur Day Care for a six-month bookkeeping services for $36,000. The customer paid $21,600 deposit for the work schedule to begin on September 15 and final payment of $14,400 is due on January 1 of next year.

September 15- The Company paid its employees $7,500 for work performed from September 1 – September 15.

September 19- The Company purchased additional supplies from Wal-Mart, $800 on account.

September 22- The Company paid $300 for its van registration, repairs, and maintenance.

September 23- The Company paid $300 for its van registration, repairs, and maintenance.

September 26- The Company paid its telephone expenses for the month $260.

September 29- The Company paid its employees $7,500 for work performed from September 16 – September 29.

September 30- The Company received its utility bill from Reading Gas Company for the month and paid the bill immediately $440.

September 30- The Company paid its rent for the month for office building rental $2,500.

Submit the complete journal entries, the trial balance, the income statement (Standard), and

The balance sheet (Standard) for your Accounting and Bookkeeping Services for the month ended September 30. By assigning account numbers to each account, you are organizing the accounts in a systematic way (not in alphabetical order, but by “account number”). For example, CASH could have an account number of 10001 (so that it is shown first); ACCOUNTS RECEIVABLE could be 10100; INVENTORY could be 10200; and so forth. The default number scheme in QuickBooks follows this system: Accounts that start with a number 1 are Assets Accounts that start with a number 2 are Liabilities Accounts that start with a number 3 are Equity Accounts that start with a number 4 are Revenues Accounts that start with a number 5 are Expenses

Part 1-

Business Transactions and Events - Facts:

Incorporate a new business Accounting & Bookkeeping Services, Inc. (Use your last name and first letter of your first as the company name; see instructions in Section V) on August 1st, 2021. The company has adopted a calendar year ending December 31, 2021. The address is: 1940 Albright Road. Reading, PA 19604. The business offers Accounting and Bookkeeping Services and other related services to businesses in the greater Reading and Berks county area.

Starting August l, 2021 business events/transactions are as follows: Project Part 1:

August 1- Invested $50,000 cash in the business in exchange for 10,000 shares, $4 par value. The cash was deposited in the company’s checking accounting with Green County Bank

August 1- The business borrows $60,000 from the Green County Bank; interest rate is 5% due 18 months from now.

August 3- The business purchased building worth $69,000; paying $15,000 cash and the bank financed the balance with a note for 10 years at 5% annual interest rate. Interest is payable annually on July 1st of each year. The principal will be paid when the note matures.

August 5- The Company purchased Copier, Computer, and Printer from Office Equipment, Inc. for $20,000. Terms are 2/10, n/30.

August 10- The Company purchased merchandise inventory from Local Supply Company $20,000 on account. Credit term: 2/10, n/30.

August 15- The Company purchased Office Supplies from Staples on account, $2,500, 1/15, n/30.

August 18- The Company purchased Office Furniture for the business at Wal-Mart on account, $1,250

August 23- The Company returned $400 of office supplies purchased on August 15 to Staples. Vendor issued a credit memo to reduce the amount due on account.

August 28- Paid Local Supply Company $10,500 for supplies purchased on August 10.

August 31- The Company hired an administrative assistant for $20 per hour for a forty-hour work week.

This is what I did from part one I have to add the journal entries from part 2 but I need help and an explanation of how to do it please.

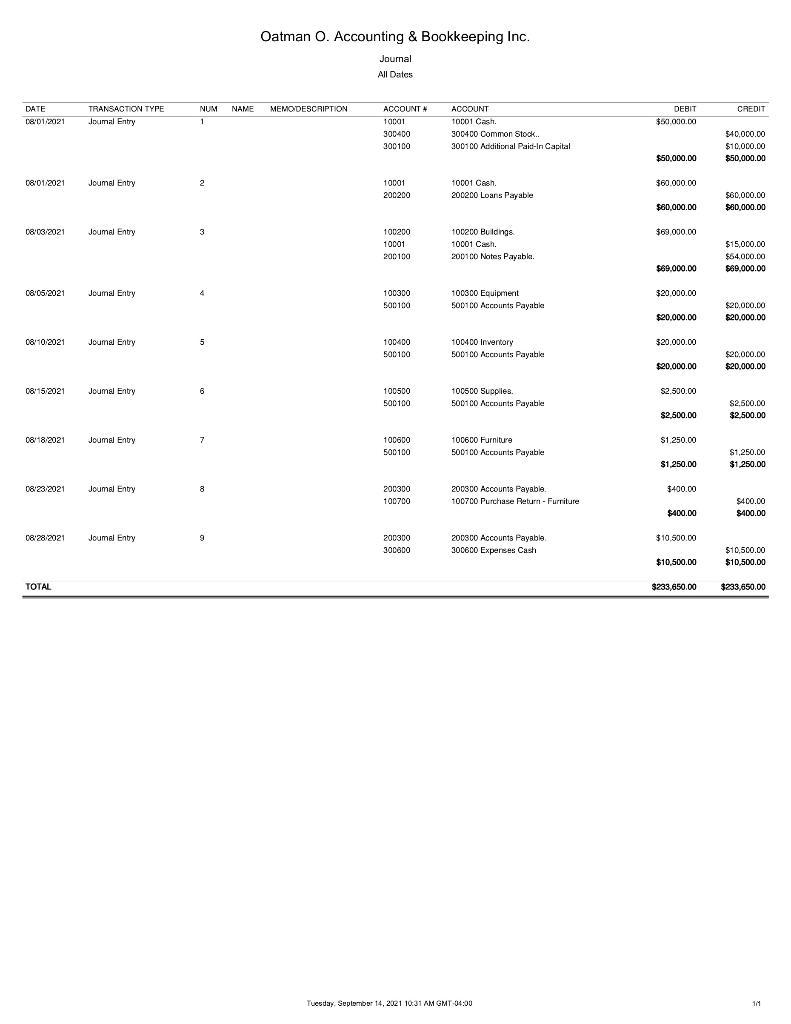

Oatman O. Accounting & Bookkeeping Inc. Journal All Dates DATE TRANSACTICoN TYPE NUM MEMODESCRIPTION NAME ACCOUNT A ACCOUNT DEBIT CREDIT D&'01/2021 Joumal Entry 10001 Cash. $50.000.00 1 10c01 3004D0 300400 Common Stock. $40,000.00 300100 3001 00 Aiditional Paid-In Capital $10,000.00 $50,000.00 $50,000.00 C8'01/2021 Joumal Entry 2 1001 10001 Cesh. $60.000.00 200200 200200 Loans Payable S60.000.00 $60,000.00 $80,000.00 C8'03/2021 Joumel Entry 3 100200 100200 Buldings $69,000.00 10001 10001 Cash. $15.000.00 200100 200100 Notes Payabk. $54,000.00 $69.000.00 $69.000.00 C8'05/2021 Joumal Entry 100300 100300 Equipment $20,000.00 500100 5001 00 Accounts Payabka $20,000.00 $20.000.00 $20,000.00 1004 00 Inventory 5001 00 Accounts Payable 08/10/2021 Joumal Entry 5 1004DO 320,000.00 500100 s20.000.00 $20,000.00 $20,000.00 0815/2021 Joumal Entry 100500 100500 Supplies. $2.500.00 500100 5001 00 Accounts Payable $2,500.00 $2,500.00 $2,500.00 08/18/2021 Joumel Entry 7 100600 100600 Furniture $1,250.00 500100 5001 C0 Accounts Payable $1,250.00 $1.250.00 $1.250.00 08/23/2021 Joumal Entry 8 200300 2003c0 Accounta Payable. $400.00 100700 100700 Purchase Return - Furriture $400.00 1 $400.00 $400.00 08:28/2021 Joumal Entry 200300 200300 Accounta Payable $10.500.00 300800 300600 Experses Cash $10,500.00 $10,500.00 $10,500.00 OTAL $233,650.00 $233.650.00 Tuesday, Seplomber 14, 2021 10:31 AM GMT 04:00

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started