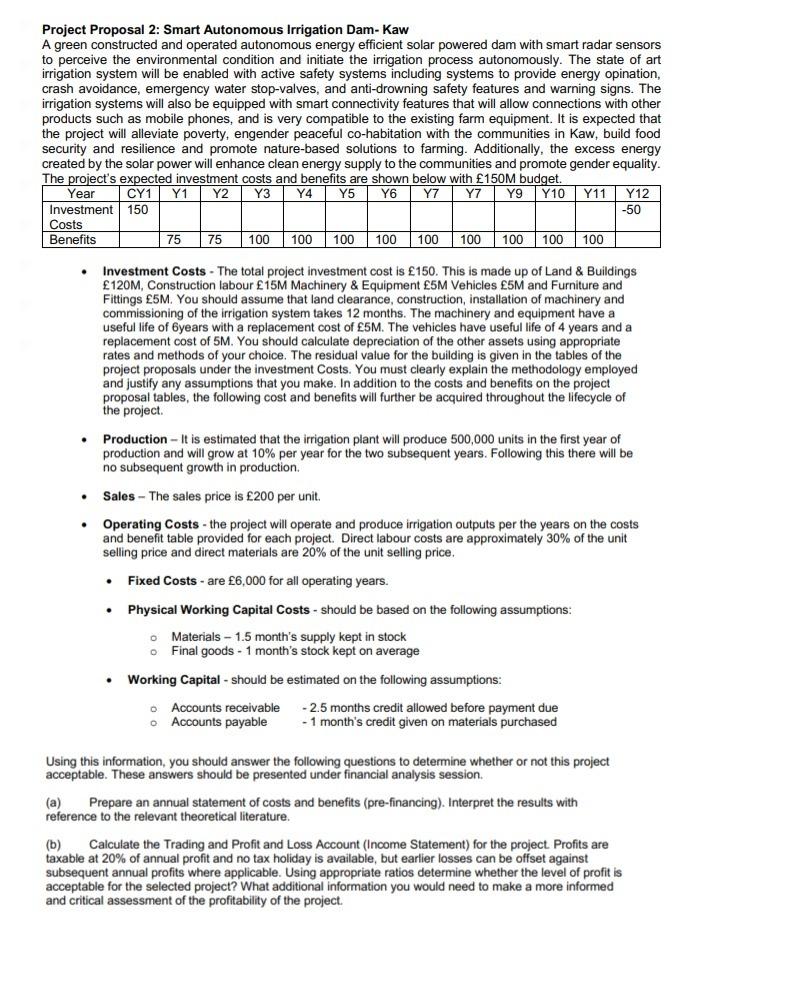

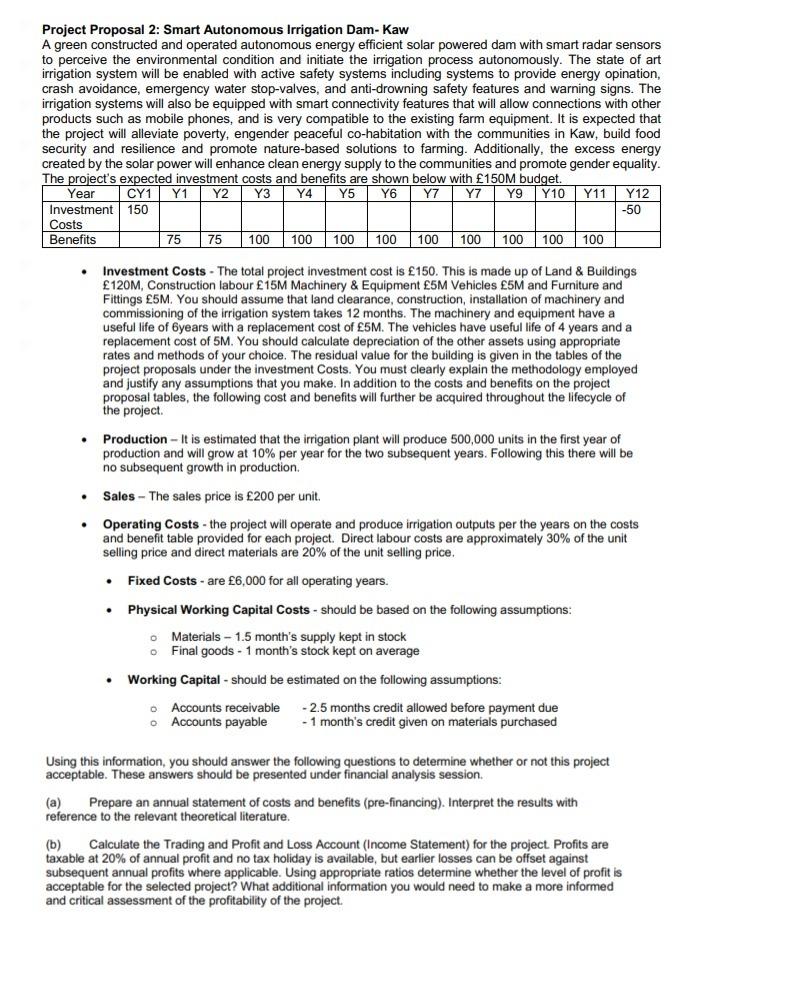

Project Proposal 2: Smart Autonomous Irrigation Dam- Kaw A green constructed and operated autonomous energy efficient solar powered dam with smart radar sensors to perceive the environmental condition and initiate the irrigation process autonomously. The state of art irrigation system will be enabled with active safety systems including systems to provide energy opination, crash avoidance, emergency water stop-valves, and anti-drowning safety features and warning signs. The irrigation systems will also be equipped with smart connectivity features that will allow connections with other products such as mobile phones, and is very compatible to the existing farm equipment. It is expected that the project will alleviate poverty, engender peaceful co-habitation with the communities in Kaw, build food security and resilience and promote nature-based solutions to farming. Additionally, the excess energy created by the solar power will enhance clean energy supply to the communities and promote gender equality The project's expected investment costs and benefits are shown below with 150M budget. Year CY1Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y7 Y9 Y10 Y11 Y12 Investment 150 -50 Costs Benefits 75 75 100 100 100 100 100 100 100 100 100 . Investment Costs - The total project investment cost is 150. This is made up of Land & Buildings 120M, Construction labour 15M Machinery & Equipment 5M Vehicles 5M and Furniture and Fittings 5M. You should assume that land clearance, construction, installation of machinery and commissioning of the irrigation system takes 12 months. The machinery and equipment have a useful life of years with a replacement cost of 5M. The vehicles have useful life of 4 years and a replacement cost of 5M. You should calculate depreciation of the other assets using appropriate rates and methods of your choice. The residual value for the building is given in the tables of the project proposals under the investment Costs. You must clearly explain the methodology employed and justify any assumptions that you make. In addition to the costs and benefits on the project proposal tables, the following cost and benefits will further be acquired throughout the lifecycle of the project Production - It is estimated that the irrigation plant will produce 500,000 units in the first year of production and will grow at 10% per year for the two subsequent years. Following this there will be no subsequent growth in production. . Sales - The sales price is 200 per unit. Operating Costs - the project will operate and produce irrigation outputs per the years on the costs and benefit table provided for each project. Direct labour costs are approximately 30% of the unit selling price and direct materials are 20% of the unit selling price. Fixed Costs - are 6,000 for all operating years. . Physical Working Capital Costs - should be based on the following assumptions: o Materials - 1.5 month's supply kept in stock o Final goods - 1 month's stock kept on average . Working Capital - should be estimated on the following assumptions: Accounts receivable - 2.5 months credit allowed before payment due O Accounts payable - 1 month's credit given on materials purchased Using this information, you should answer the following questions to determine whether or not this project acceptable. These answers should be presented under financial analysis session. (a) Prepare an annual statement of costs and benefits (pre-financing). Interpret the results with reference to the relevant theoretical literature. (b) Calculate the Trading and Profit and Loss Account (Income Statement) for the project. Profits are taxable at 20% of annual profit and no tax holiday is available, but earlier losses can be offset against subsequent annual profits where applicable. Using appropriate ratios determine whether the level of profit is acceptable for the selected project? What additional information you would need to make a more informed and critical assessment of the profitability of the project. Project Proposal 2: Smart Autonomous Irrigation Dam- Kaw A green constructed and operated autonomous energy efficient solar powered dam with smart radar sensors to perceive the environmental condition and initiate the irrigation process autonomously. The state of art irrigation system will be enabled with active safety systems including systems to provide energy opination, crash avoidance, emergency water stop-valves, and anti-drowning safety features and warning signs. The irrigation systems will also be equipped with smart connectivity features that will allow connections with other products such as mobile phones, and is very compatible to the existing farm equipment. It is expected that the project will alleviate poverty, engender peaceful co-habitation with the communities in Kaw, build food security and resilience and promote nature-based solutions to farming. Additionally, the excess energy created by the solar power will enhance clean energy supply to the communities and promote gender equality The project's expected investment costs and benefits are shown below with 150M budget. Year CY1Y1 Y2 Y3 Y4 Y5 Y6 Y7 Y7 Y9 Y10 Y11 Y12 Investment 150 -50 Costs Benefits 75 75 100 100 100 100 100 100 100 100 100 . Investment Costs - The total project investment cost is 150. This is made up of Land & Buildings 120M, Construction labour 15M Machinery & Equipment 5M Vehicles 5M and Furniture and Fittings 5M. You should assume that land clearance, construction, installation of machinery and commissioning of the irrigation system takes 12 months. The machinery and equipment have a useful life of years with a replacement cost of 5M. The vehicles have useful life of 4 years and a replacement cost of 5M. You should calculate depreciation of the other assets using appropriate rates and methods of your choice. The residual value for the building is given in the tables of the project proposals under the investment Costs. You must clearly explain the methodology employed and justify any assumptions that you make. In addition to the costs and benefits on the project proposal tables, the following cost and benefits will further be acquired throughout the lifecycle of the project Production - It is estimated that the irrigation plant will produce 500,000 units in the first year of production and will grow at 10% per year for the two subsequent years. Following this there will be no subsequent growth in production. . Sales - The sales price is 200 per unit. Operating Costs - the project will operate and produce irrigation outputs per the years on the costs and benefit table provided for each project. Direct labour costs are approximately 30% of the unit selling price and direct materials are 20% of the unit selling price. Fixed Costs - are 6,000 for all operating years. . Physical Working Capital Costs - should be based on the following assumptions: o Materials - 1.5 month's supply kept in stock o Final goods - 1 month's stock kept on average . Working Capital - should be estimated on the following assumptions: Accounts receivable - 2.5 months credit allowed before payment due O Accounts payable - 1 month's credit given on materials purchased Using this information, you should answer the following questions to determine whether or not this project acceptable. These answers should be presented under financial analysis session. (a) Prepare an annual statement of costs and benefits (pre-financing). Interpret the results with reference to the relevant theoretical literature. (b) Calculate the Trading and Profit and Loss Account (Income Statement) for the project. Profits are taxable at 20% of annual profit and no tax holiday is available, but earlier losses can be offset against subsequent annual profits where applicable. Using appropriate ratios determine whether the level of profit is acceptable for the selected project? What additional information you would need to make a more informed and critical assessment of the profitability of the project