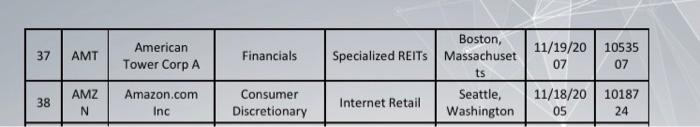

PROJECT SUMMARY (SCENARIO) Managers should try to maximize the intrinsic value of a firm, which is determined by cash flows as revealed in financial statements, you as a financial Manager or financial analyst, should periodically evaluate your company and particularly its financial statements and stock to help in making substantial financial decisions so the following should take place: A. Company and the Importance of Ratios analysis Description of the selected companies in order to assist investors know the business, its industry, its motivation and any edge it might have over its competitors Why are ratios useful? What are the five major categories of ratios? Calculate the company's 2019 and 2020 current and quick ratios based on the latest available financial statements? What can you say about the company's liquidity position in 2019, 2020? B. Ratio analysis Calculate the 2019 and 2020 inventory turnover, day's sales outstanding, fixed assets turnover, and the total assets turnover? How does your company utilization of assets stack up against the other firm in your group companies? Calculate the 2019 and 2020 debt-to-assets and time-interest-earned ratio. How does your company compare with your group with respect to financial leverage? What can you conclude from these ratios? Calculate the 2019 and 2020 ratios of profitability. Explain your answers. Calculate the 2019 and 2020 market ratios. Explain your answers. 37 AMT American Tower Corp A Financials 11/19/2010535 07 07 Boston, Specialized REITS Massachuset ts Seattle, Internet Retail Washington 38 AMZ N Amazon.com Inc Consumer Discretionary 11/18/2010187 05 24 PROJECT SUMMARY (SCENARIO) Managers should try to maximize the intrinsic value of a firm, which is determined by cash flows as revealed in financial statements, you as a financial Manager or financial analyst, should periodically evaluate your company and particularly its financial statements and stock to help in making substantial financial decisions so the following should take place: A. Company and the Importance of Ratios analysis Description of the selected companies in order to assist investors know the business, its industry, its motivation and any edge it might have over its competitors Why are ratios useful? What are the five major categories of ratios? Calculate the company's 2019 and 2020 current and quick ratios based on the latest available financial statements? What can you say about the company's liquidity position in 2019, 2020? B. Ratio analysis Calculate the 2019 and 2020 inventory turnover, day's sales outstanding, fixed assets turnover, and the total assets turnover? How does your company utilization of assets stack up against the other firm in your group companies? Calculate the 2019 and 2020 debt-to-assets and time-interest-earned ratio. How does your company compare with your group with respect to financial leverage? What can you conclude from these ratios? Calculate the 2019 and 2020 ratios of profitability. Explain your answers. Calculate the 2019 and 2020 market ratios. Explain your answers. 37 AMT American Tower Corp A Financials 11/19/2010535 07 07 Boston, Specialized REITS Massachuset ts Seattle, Internet Retail Washington 38 AMZ N Amazon.com Inc Consumer Discretionary 11/18/2010187 05 24