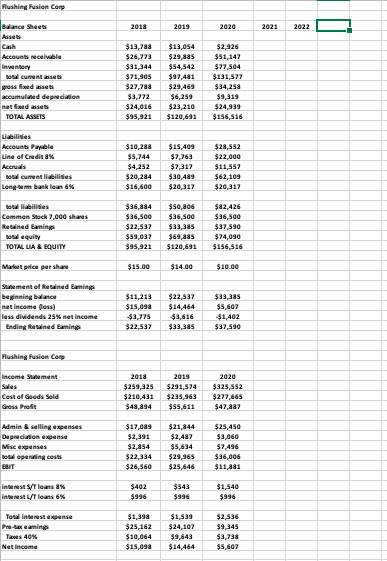

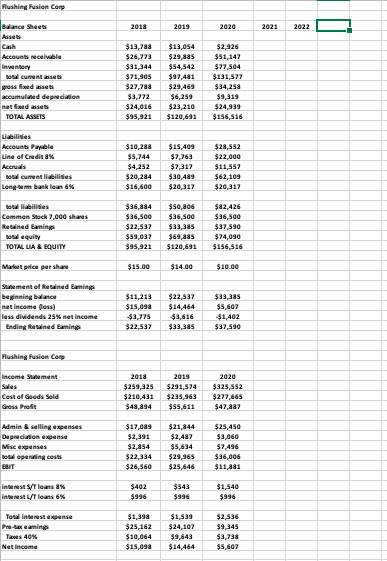

Project the Companys operating statements for 2021 and 2022. Here are the assumptions for your projections:

- Sales growth of 9% for 2021 and 7% in 2022.

- For both years.

- Cost of goods sold 83% of sales

- Administrative and selling expenses 8% of sales

- Miscellaneous expenses 2% of sales

- Depreciation expense (included in cost of goods sold) 10% of gross fixed assets at the end of the year.

- Line of Credit interest rate 8%

- Long-term interest rate 6%

- Bank requires minimum cash balance 5% of sales. Funds in excess of this amount will used to repay the short-term bank loan.

- Accounts receivable - days sales outstanding will be 55 days.

- Inventory use inventory turnover 4 times per year.

- In 2021, plant expansion of $8,000 which the bank will fund with long-term borrowing

- No new fixed assets needed in 2022.

- Accounts payable and accruals increase same as sales each year.

- No additional long-term bank loans or common stock.

- No cash dividends until short-term bank loan is paid in full

- Use line of credit to balance the balance sheet.

Flushing Fusion Corp Balance Sheen 2018 2019 2020 2021 2022 Accounts receivable totalcument es press fixed me accumulated depreciation net fixed assets TOTAL ASSETS $19,788 $26,773 $31,144 $71,905 $27,788 $3,772 $24,016 $95,921 $13,054 $29,88s $54,542 $97,481 $29,469 $6,259 $23,210 $120,691 $2,926 $51,147 $77,504 $131,572 $34,258 $9,319 $24,939 $156,516 Accounts Payable Line of Credit 8% A totalcument liabilities Leng-combank loan 6% $10,288 $5,744 $4,252 $20,284 $16,600 $15,409 $7,763 $7,317 $30,489 $20,317 $28,552 $22,000 $11,557 $62,109 $20,317 Commen Stock 7,000 shares Retained Gaming to quity TOTAL VIA & EQUITY $36,884 $36,500 $22,537 $59,037 $95,921 $50,806 $36,500 $33,385 $69,885 $120,691 $82,426 $36,500 $37,590 $74,090 $156,516 Market price per share $15.00 $14.00 $10.00 Statement of Retained Gaming beginning balance net income foss) less dividends 25% net income Ending Retained in $11, 213 $15,098 $3,775 $22,537 $22,537 $14,464 $3,616 $33,385 $33,385 $5,607 $1,402 $37,590 Flushing Fusion Corp Income Statement 2018 $259,325 $210,431 $48,894 2019 $291,574 $235,963 $55,611 Cest of Goods Sold Gross Profit 2020 $325,552 $277,665 $47,887 Admin & selling expenses Depreciation expense Mise expenses total opening costs EBIT $17,089 $2,391 $2,854 $22,334 $26,560 $21,844 1,487 $5,634 $29,965 $25,646 $25,450 $3,060 $7,496 $36,006 $11,881 interests/T leans ax interest Urleans 6% $402 $996 $543 $996 $1,540 $996 Total intenst expense Pre-eaming Tages 40% Net Income $1,398 $25,162 $10,064 $15,098 $1,539 $24,107 $9,643 $14,464 $2,536 $9,345 $3,738 $5,607 Flushing Fusion Corp Balance Sheen 2018 2019 2020 2021 2022 Accounts receivable totalcument es press fixed me accumulated depreciation net fixed assets TOTAL ASSETS $19,788 $26,773 $31,144 $71,905 $27,788 $3,772 $24,016 $95,921 $13,054 $29,88s $54,542 $97,481 $29,469 $6,259 $23,210 $120,691 $2,926 $51,147 $77,504 $131,572 $34,258 $9,319 $24,939 $156,516 Accounts Payable Line of Credit 8% A totalcument liabilities Leng-combank loan 6% $10,288 $5,744 $4,252 $20,284 $16,600 $15,409 $7,763 $7,317 $30,489 $20,317 $28,552 $22,000 $11,557 $62,109 $20,317 Commen Stock 7,000 shares Retained Gaming to quity TOTAL VIA & EQUITY $36,884 $36,500 $22,537 $59,037 $95,921 $50,806 $36,500 $33,385 $69,885 $120,691 $82,426 $36,500 $37,590 $74,090 $156,516 Market price per share $15.00 $14.00 $10.00 Statement of Retained Gaming beginning balance net income foss) less dividends 25% net income Ending Retained in $11, 213 $15,098 $3,775 $22,537 $22,537 $14,464 $3,616 $33,385 $33,385 $5,607 $1,402 $37,590 Flushing Fusion Corp Income Statement 2018 $259,325 $210,431 $48,894 2019 $291,574 $235,963 $55,611 Cest of Goods Sold Gross Profit 2020 $325,552 $277,665 $47,887 Admin & selling expenses Depreciation expense Mise expenses total opening costs EBIT $17,089 $2,391 $2,854 $22,334 $26,560 $21,844 1,487 $5,634 $29,965 $25,646 $25,450 $3,060 $7,496 $36,006 $11,881 interests/T leans ax interest Urleans 6% $402 $996 $543 $996 $1,540 $996 Total intenst expense Pre-eaming Tages 40% Net Income $1,398 $25,162 $10,064 $15,098 $1,539 $24,107 $9,643 $14,464 $2,536 $9,345 $3,738 $5,607