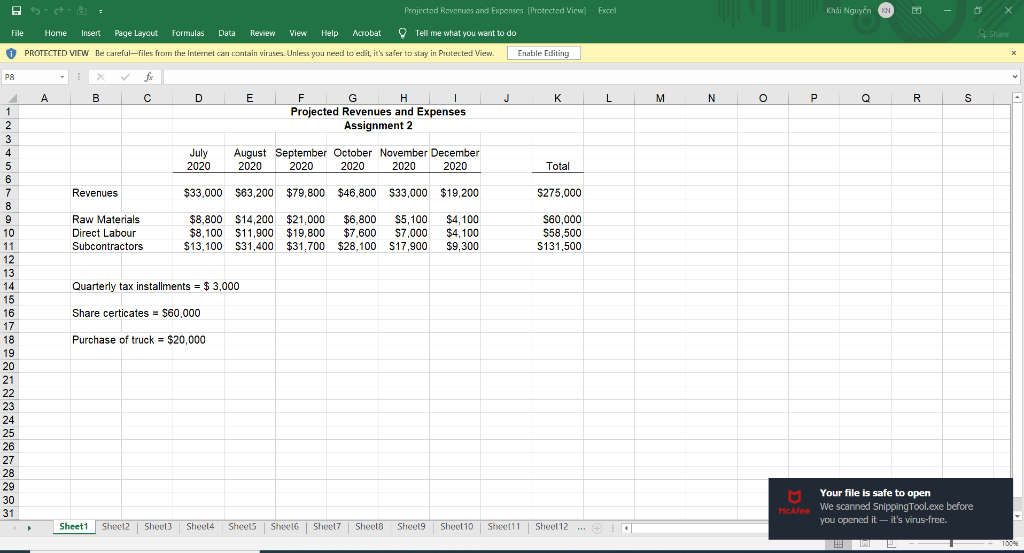

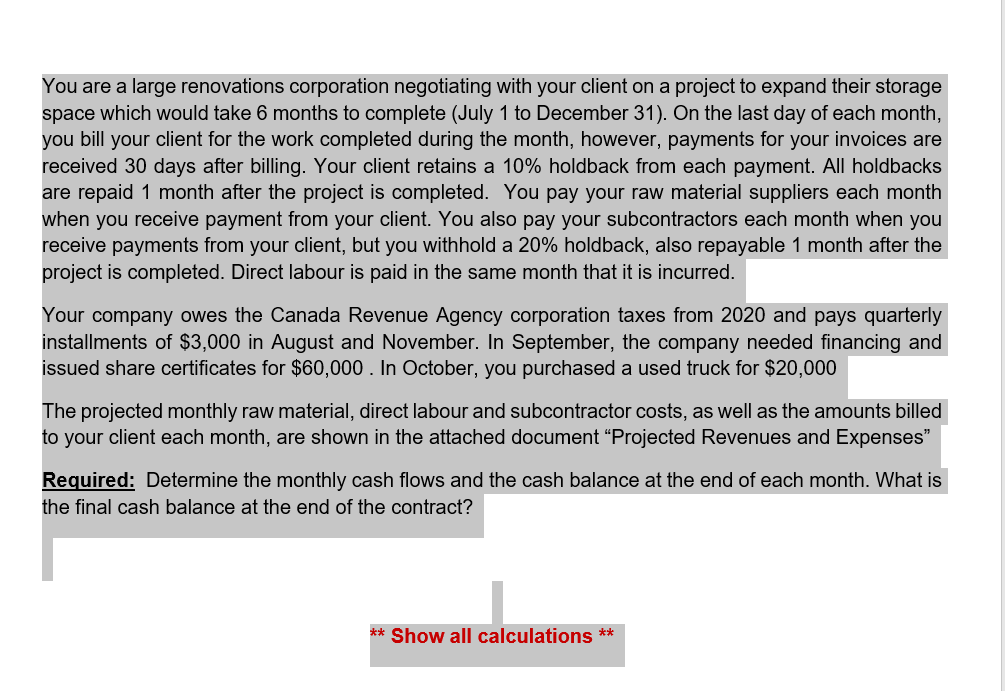

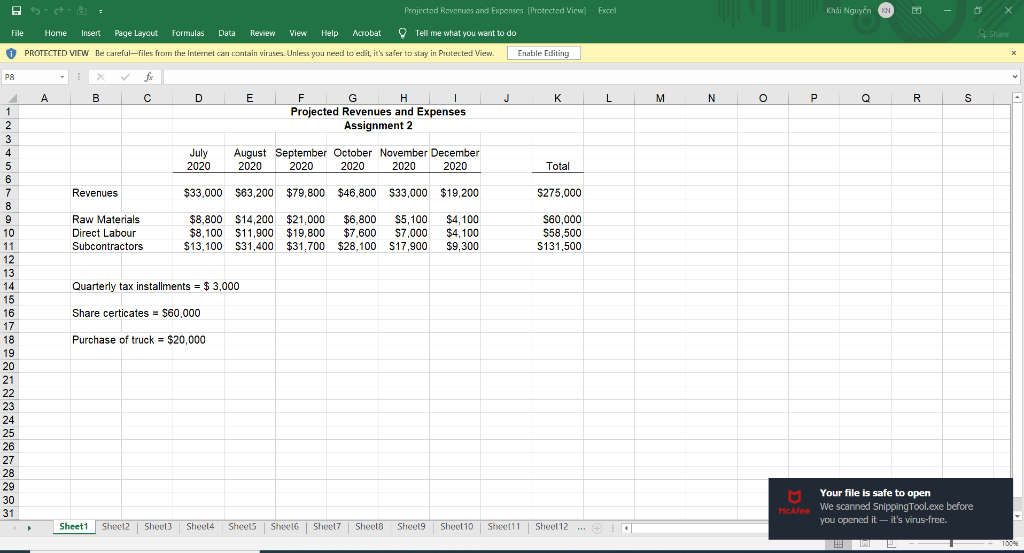

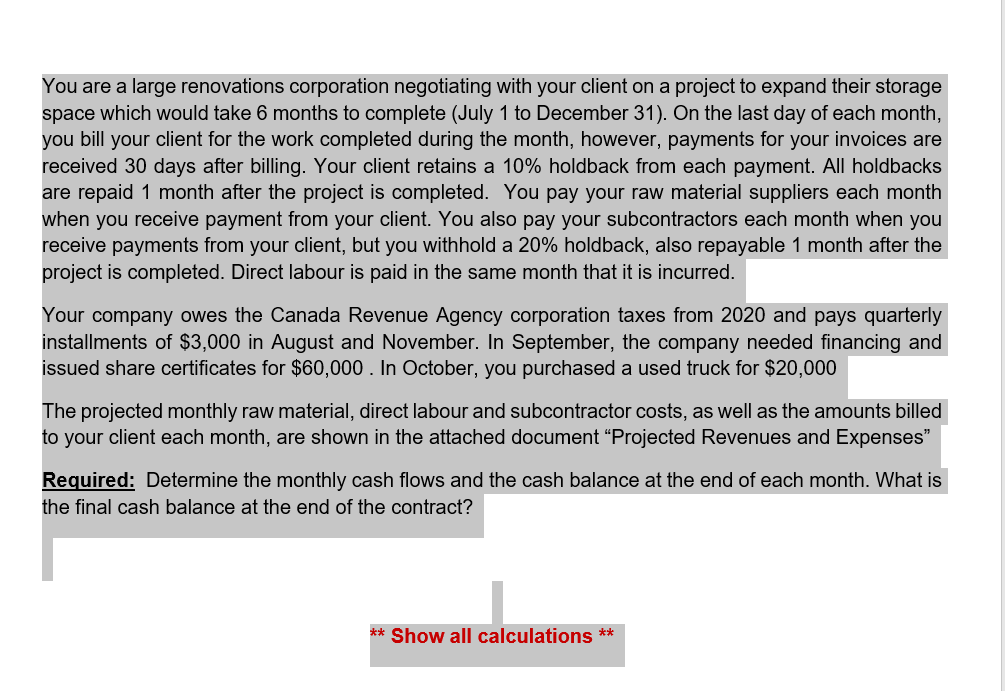

Projected Revenues and Expenses (Protected View) - Excel Khi Nguyn 4 File Home Insert Page Layout Formulas Data Review View Help Acrobat Tell me what you want to do & Share O PROTECTED VIEW Be careful-files from the Internet can contain viruses. Unless you need to edit, it's safer to stay in Protected View Enable Editing 28 B D E K L M N o P P Q R S F I Projected Revenues and Expenses Assignment 2 July 2020 August September October November December 2020 2020 2020 2020 2020 Total Revenues $33,000 $63,200 $79,800 $46,800 $33,000 $19,200 $275,000 Raw Materials Direct Labour Subcontractors $8,800 $14,200 $21,000 $6,800 $5,100 $8,100 $11,900 $19,800 $7,600 $7,000 $13,100 $31,400 $31,700 $28,100 $17,900 $4,100 $4,100 $9,300 S60,000 $58,500 S131,500 Quarterly tax installments = $3,000 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 Share certicates = $60,000 Purchase of truck = $20,000 Your file is safe to open McAfee We scanned SnippingTool.exe before you opened it it's virus-free. Sheet1 Sheet2 Sheet3 Sheet4 Sheets Sheet6 Sheet7 Sheet6 Sheet Sheet10 Sheet11 Sheet12 ... 100% You are a large renovations corporation negotiating with your client on a project to expand their storage space which would take 6 months to complete (July 1 to December 31). On the last day of each month, you bill your client for the work completed during the month, however, payments for your invoices are received 30 days after billing. Your client retains a 10% holdback from each payment. All holdbacks are repaid 1 month after the project is completed. You pay your raw material suppliers each month when you receive payment from your client. You also pay your subcontractors each month when you receive payments from your client, but you withhold a 20% holdback, also repayable 1 month after the project is completed. Direct labour is paid in the same month that it is incurred. Your company owes the Canada Revenue Agency corporation taxes from 2020 and pays quarterly installments of $3,000 in August and November. In September, the company needed financing and issued share certificates for $60,000. In October, you purchased a used truck for $20,000 The projected monthly raw material, direct labour and subcontractor costs, as well as the amounts billed to your client each month, are shown in the attached document Projected Revenues and Expenses Required: Determine the monthly cash flows and the cash balance at the end of each month. What is the final cash balance at the end of the contract? ** Show all calculations **