Answered step by step

Verified Expert Solution

Question

1 Approved Answer

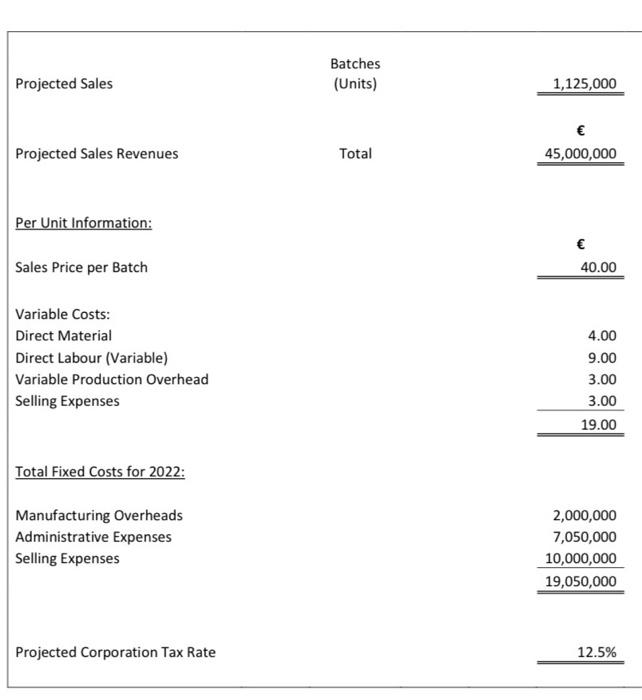

Projected Sales Projected Sales Revenues Per Unit Information: Sales Price per Batch Variable Costs: Direct Material Direct Labour (Variable) Variable Production Overhead Selling Expenses

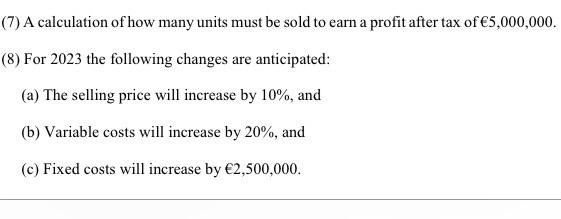

Projected Sales Projected Sales Revenues Per Unit Information: Sales Price per Batch Variable Costs: Direct Material Direct Labour (Variable) Variable Production Overhead Selling Expenses Total Fixed Costs for 2022: Manufacturing Overheads Administrative Expenses Selling Expenses Projected Corporation Tax Rate Batches (Units) Total 1,125,000 45,000,000 40.00 4.00 9.00 3.00 3.00 19.00 2,000,000 7,050,000 10,000,000 19,050,000 12.5% (7) A calculation of how many units must be sold to earn a profit after tax of 5,000,000. (8) For 2023 the following changes are anticipated: (a) The selling price will increase by 10%, and (b) Variable costs will increase by 20%, and (c) Fixed costs will increase by 2,500,000.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

7 Let No of units sold X Sales Variable cost Fixed Cost1125 Profit after ta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started