Answered step by step

Verified Expert Solution

Question

1 Approved Answer

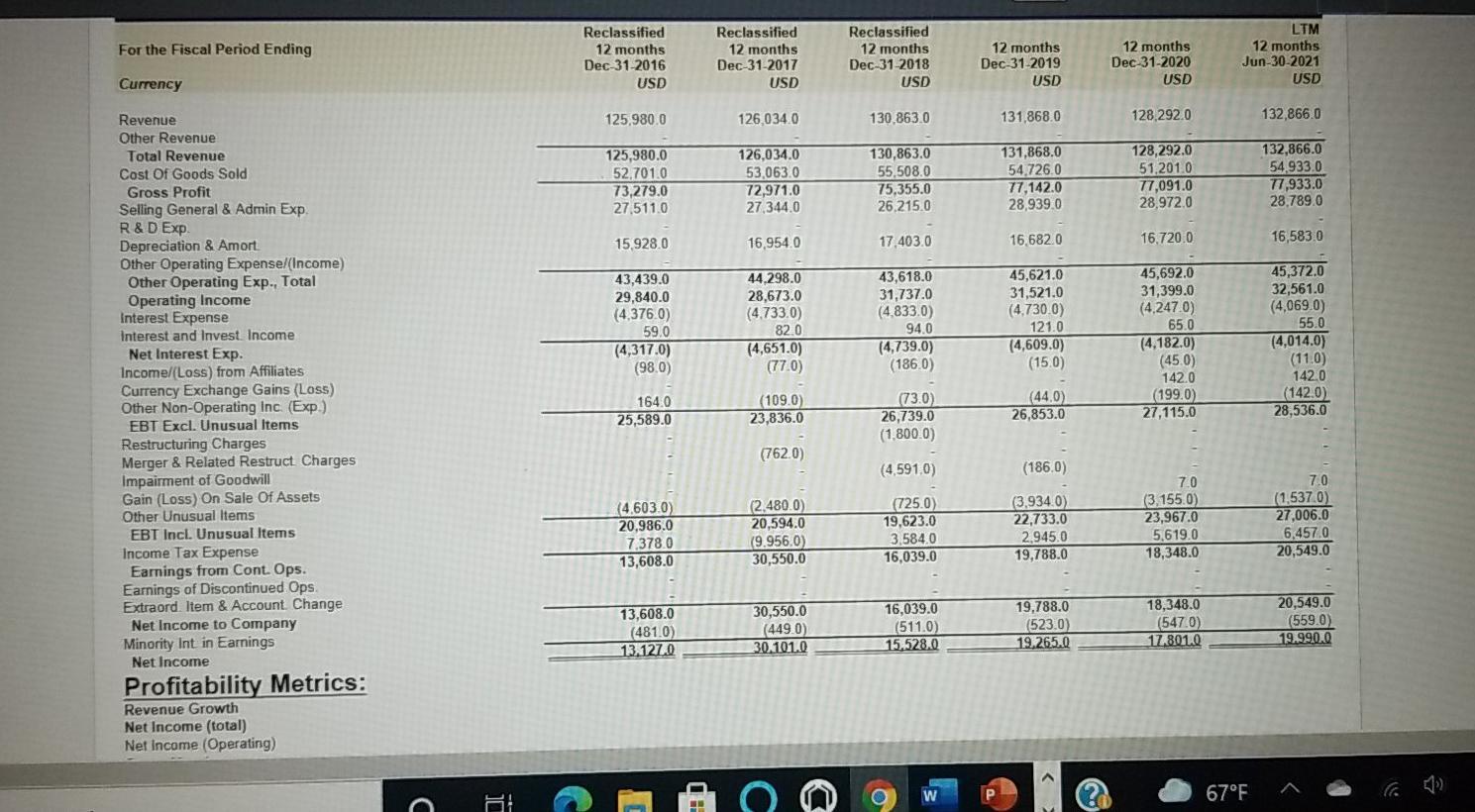

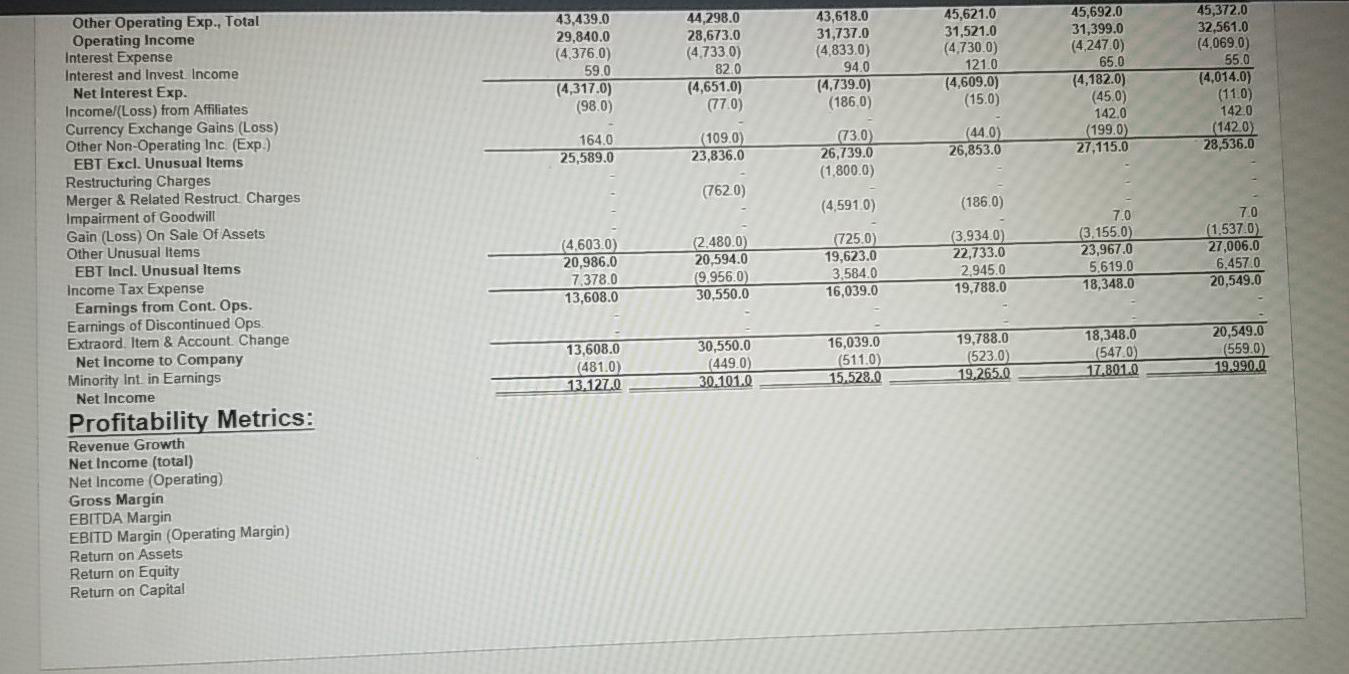

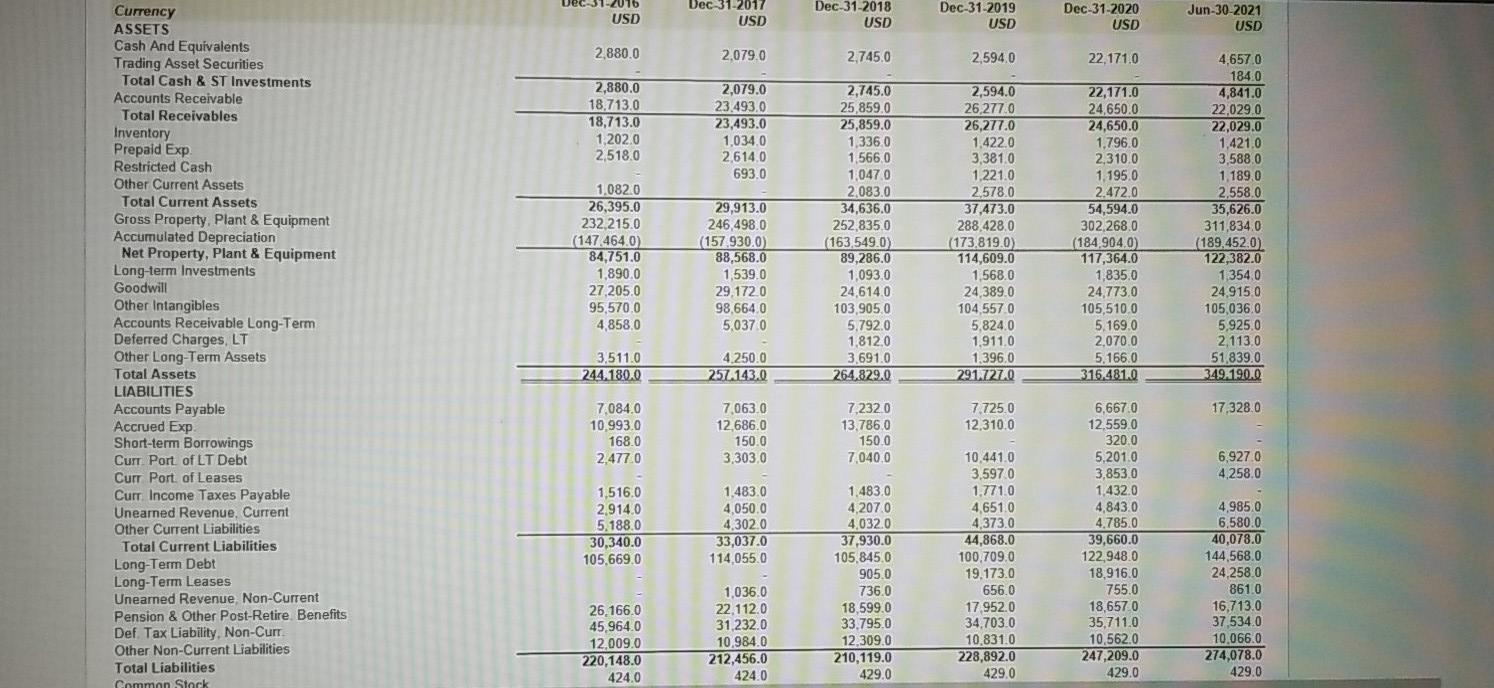

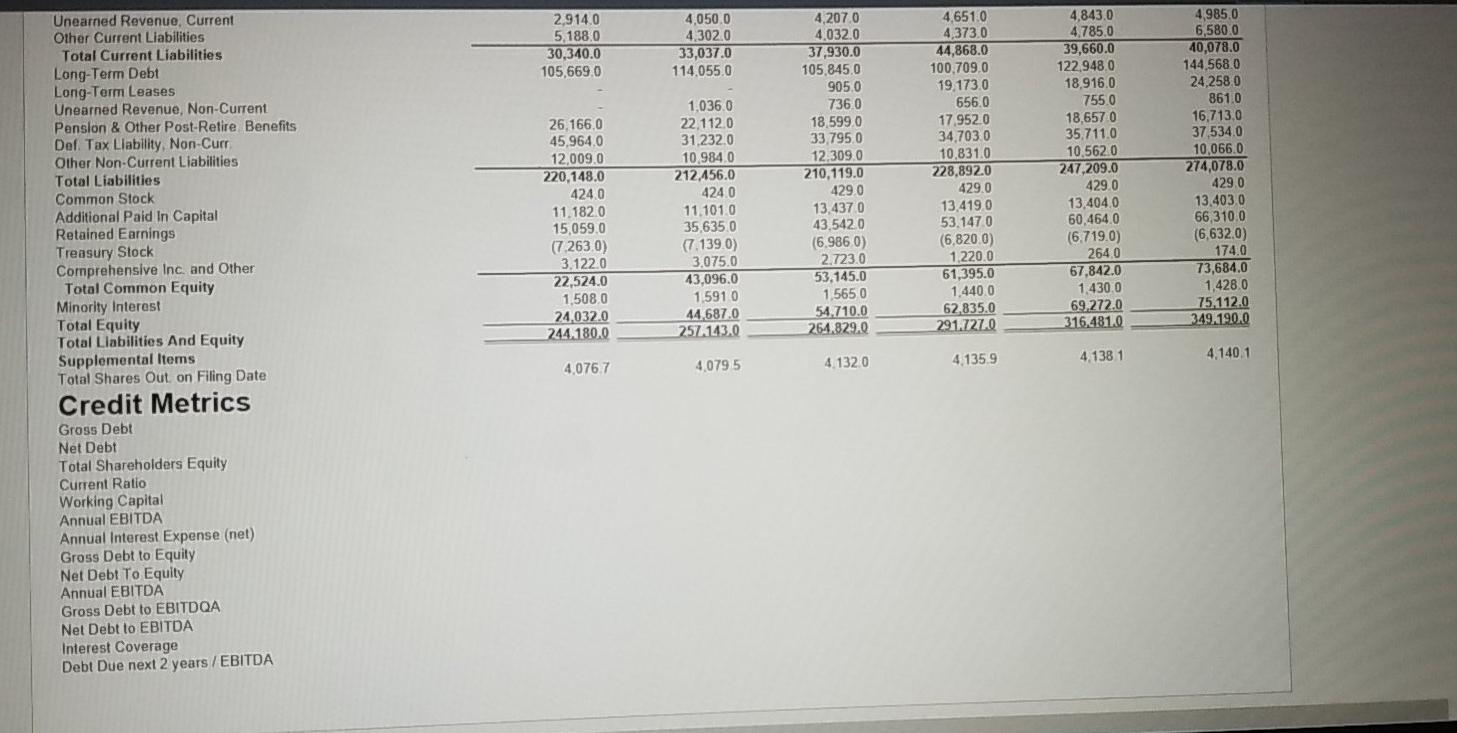

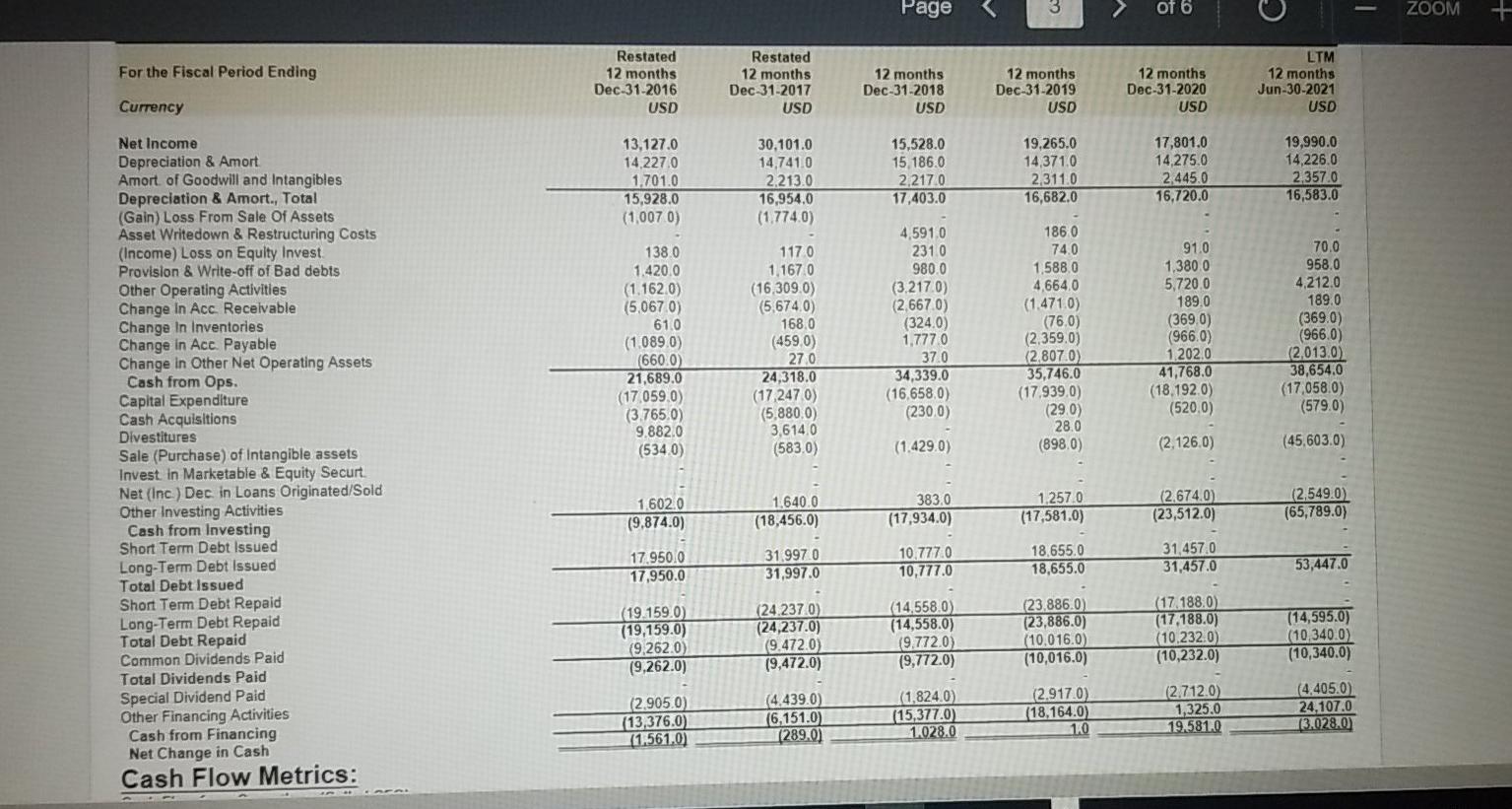

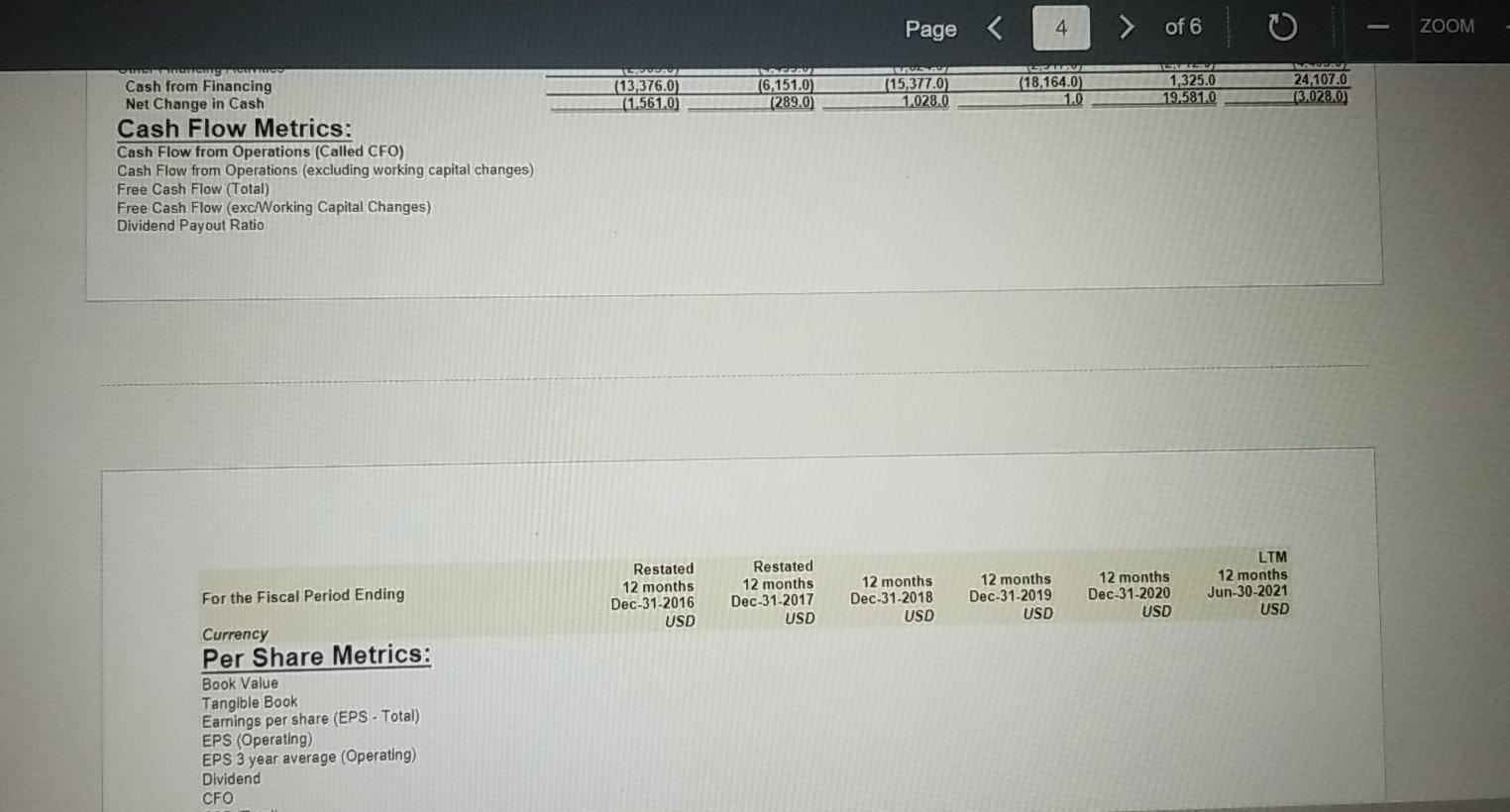

calculate profitability metrics, credit metrics, cash flow metrics, per share metrics Reclassified 12 months Dec-31-2017 USD Reclassified 12 months Dec-31-2018 USD LTM 12 months Jun-30-2021

calculate profitability metrics, credit metrics, cash flow metrics, per share metrics

Reclassified 12 months Dec-31-2017 USD Reclassified 12 months Dec-31-2018 USD LTM 12 months Jun-30-2021 Reclassified For the Fiscal Period Ending 12 months Dec 31-2020 USD 12 months 12 months Dec-31-2016 Dec-31-2019 Currency USD USD USD 131,868.0 128,292.0 132,866.0 Revenue Other Revenue 125,980.0 126,034.0 130,863.0 132,866.0 54,933.0 77,933.0 28,789.0 131.868.0 128.292.0 130,863.0 55,508.0 125,980.0 126,034.0 53,063.0 Total Revenue 52,701.0 73,279.0 27,511.0 54,726.0 77,142.0 28,939.0 51.201.0 77,091.0 28,972.0 Cost Of Goods Sold Gross Profit Selling General & Admin Exp. R&DExp. Depreciation & Amort Other Operating Expense/(Income) Other Operating Exp., Total Operating Income Interest Expense Interest and Invest. Income Net Interest Exp. Income/(Loss) from Affiliates Currency Exchange Gains (Loss) Other Non-Operating Inc. (Exp.) EBT Excl. Unusual Items 75,355.0 72,971.0 27,344.0 26,215.0 15,928.0 16,954.0 17,403.0 16,682.0 16,720.0 16,583.0 45,372.0 45,692.0 31,399.0 (4,247.0) 65.0 45,621.0 43,618.0 31,737.0 (4,833.0) 94.0 44,298.0 43,439.0 29,840.0 (4,376.0) 59.0 (4,317.0) (98.0) 31,521.0 (4,730.0) 121.0 (4,609.0) (15.0) 32,561.0 (4,069.0) 55.0 (4,014.0) (11.0) 142.0 (142.0) 28,536.0 28,673.0 (4,733.0) 82.0 (4,651.0) (77.0) (4,739.0) (186.0) (4,182.0) (45.0) 142.0 (109.0) 23,836.0 (73.0) 26,739.0 (44.0) 26,853.0 (199.0) 27,115.0 164.0 25,589.0 (1,800.0) Restructuring Charges Merger & Related Restruct Charges Impairment of Goodwill Gain (Loss) On Sale Of Assets Other Unusual Items EBT Incl. Unusual Items Income Tax Expense Earnings from Cont. Ops. Earnings of Discontinued Ops. Extraord. Item & Account. Change Net Income to Company Minority Int in Earnings (762.0) (4,591.0) (186.0) 7.0 7.0 (1,537.0) 27,006.0 (4.603.0) 20.986.0 7,378.0 (2,480.0) 20,594.0 (9.956.0) 30,550.0 (725.0) 19,623.0 3,584.0 16,039.0 (3,934.0) 22,733.0 2,945.0 19,788.0 (3,155.0) 23,967.0 5.619.0 18,348.0 6,457.0 20,549.0 13,608.0 13,608.0 (481.0) 13.127.0 30,550.0 (449.0) 30.101.0 16,039.0 (511.0) 15.528.0 19,788.0 (523.0) 19.265.0 18,348.0 (547.0) 17.801.0 20,549.0 (559.0) 19.990.0 Net Income Profitability Metrics: Revenue Growth Net Income (total) Net income (Operating) 67F

Step by Step Solution

★★★★★

3.49 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started