Answered step by step

Verified Expert Solution

Question

1 Approved Answer

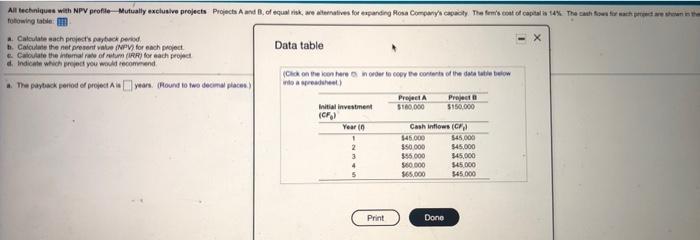

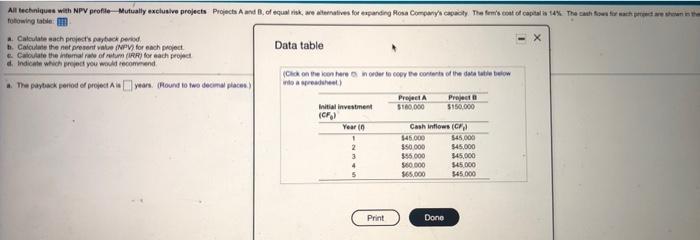

Projects A and B, of equal risk, are alternatives for expanding Ross Company's capacity. The firms cost of capital is 14%. The cash flows for

Projects A and B, of equal risk, are alternatives for expanding Ross Company's capacity. The firms cost of capital is 14%. The cash flows for each project are shown in the table.

All techniques with NPV profile Mutually exclusive projects Projects A and B. of equal risk, we turnativer for expanding Home Company cachy The few's con el capital in 14%. The main for these in the folowrote: R. Calculate each project's payback per h. Calculate the net presentate NPV) for each project Data table Carotate the intamal rate ofreu (Rfor each pro d. Indicate which you would recommend (Click on the conference to copy to content of the water below The payback period of project war. (Round to we decimal place inter) Project A Pro Initial investment $160,000 5150.000 (CF) Year to Cash inflows 1 $45.000 $45,000 2 350 000 545.000 3 395.000 345,000 4 560.000 545.000 5 365.000 345.000 Print Done A. calculate each projects payback period

B. calculate the net present value for each period.

c. calculate the internal rate of return for each project

D. indicate which project you would recommend

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started