Answered step by step

Verified Expert Solution

Question

1 Approved Answer

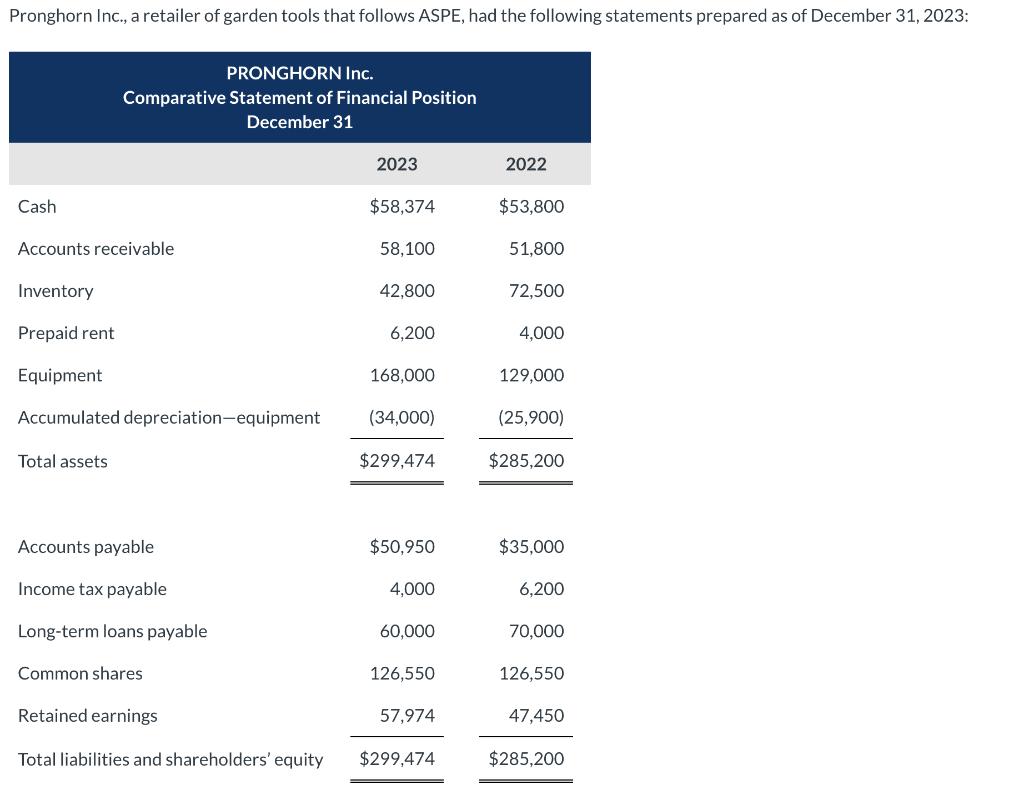

Pronghorn Inc., a retailer of garden tools that follows ASPE, had the following statements prepared as of December 31, 2023: PRONGHORN Inc. Comparative Statement

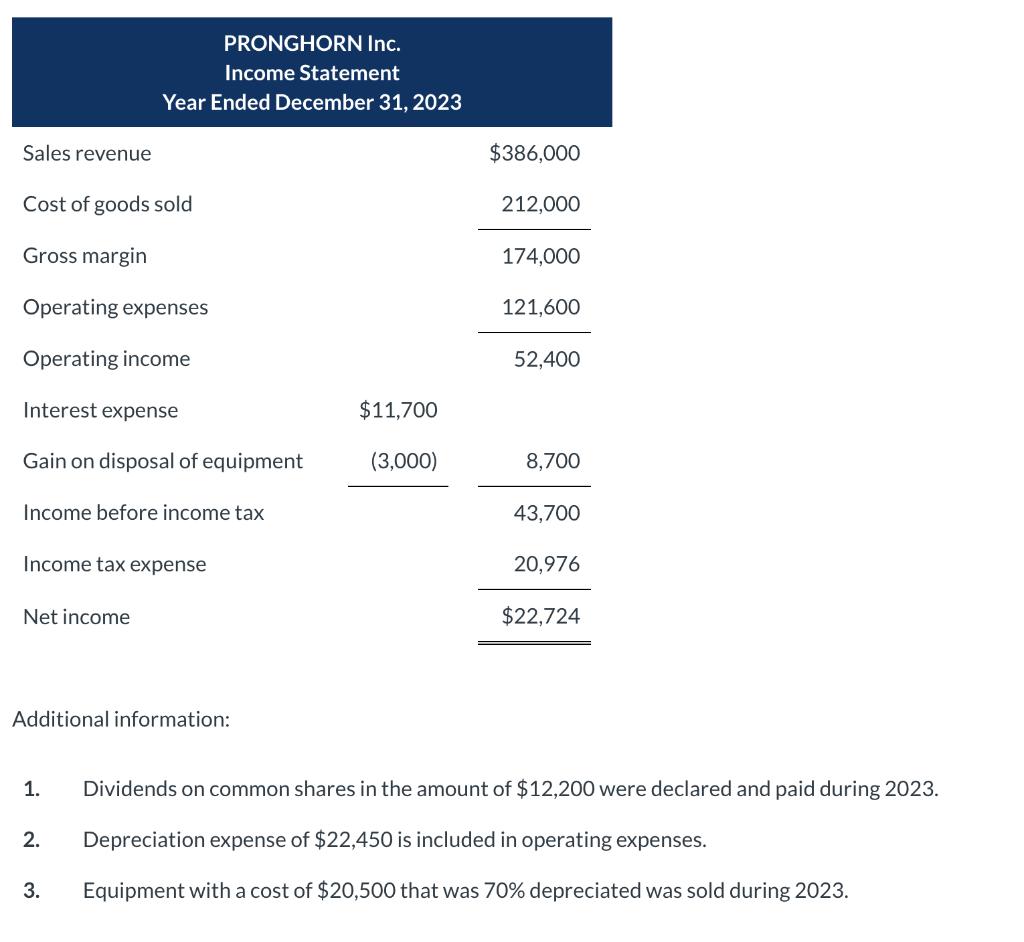

Pronghorn Inc., a retailer of garden tools that follows ASPE, had the following statements prepared as of December 31, 2023: PRONGHORN Inc. Comparative Statement of Financial Position December 31 2023 2022 Cash $58,374 $53,800 Accounts receivable 58,100 51,800 Inventory 42,800 72,500 Prepaid rent 6,200 4,000 Equipment 168,000 129,000 Accumulated depreciation-equipment (34,000) (25,900) Total assets $299,474 $285,200 Accounts payable $50,950 $35,000 Income tax payable 4,000 6,200 Long-term loans payable 60,000 70,000 Common shares 126,550 126,550 Retained earnings 57,974 47,450 Total liabilities and shareholders' equity $299,474 $285,200 PRONGHORN Inc. Income Statement Year Ended December 31, 2023 Sales revenue Cost of goods sold Gross margin $386,000 212,000 174,000 Operating expenses 121,600 Operating income 52,400 Interest expense $11,700 Gain on disposal of equipment (3,000) 8,700 Income before income tax 43,700 Income tax expense 20,976 Net income $22,724 Additional information: 1. Dividends on common shares in the amount of $12,200 were declared and paid during 2023. 2. Depreciation expense of $22,450 is included in operating expenses. 3. Equipment with a cost of $20,500 that was 70% depreciated was sold during 2023. Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) PRONGHORN Inc. Statement of Cash Flows (Indirect Method) Adjustments to reconcile net income to net cash provided by operating activities:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started