Answered step by step

Verified Expert Solution

Question

1 Approved Answer

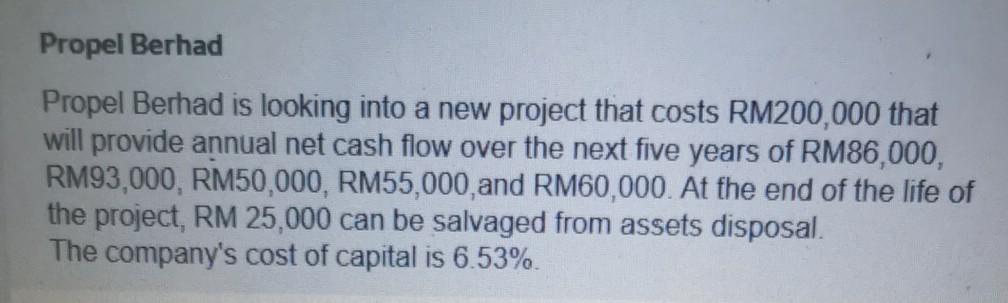

Propel Berhad Propel Berhad is looking into a new project that costs RM200,000 that will provide annual net cash flow over the next five years

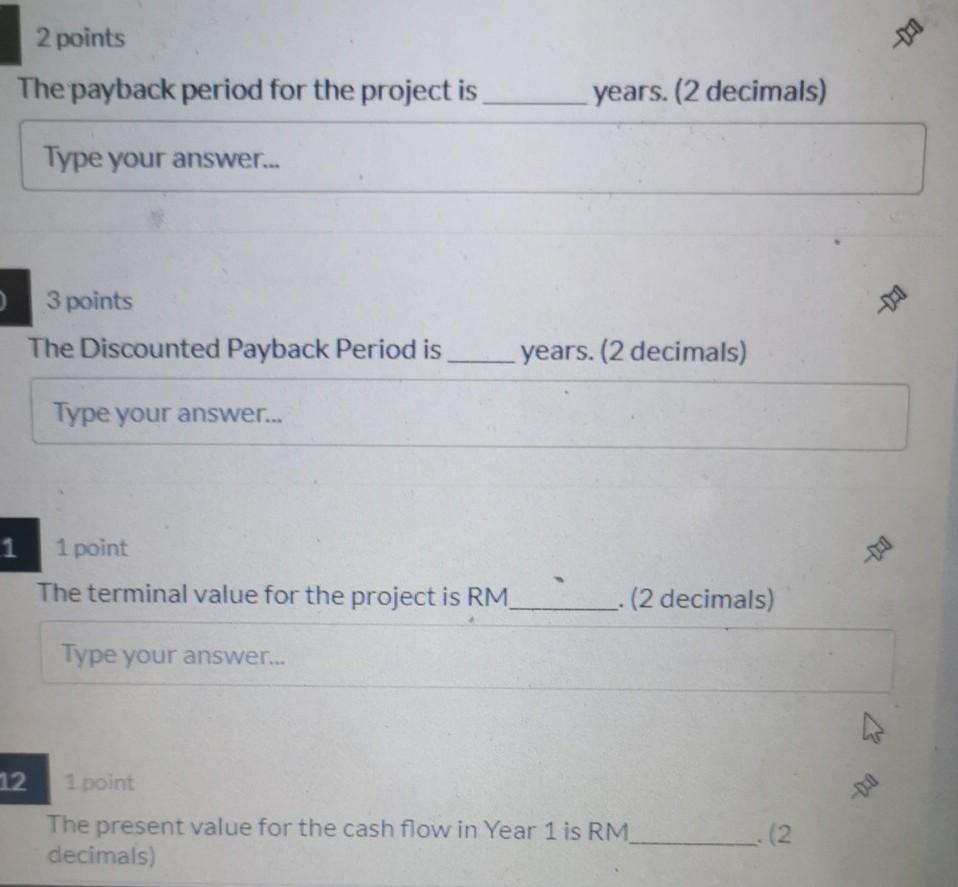

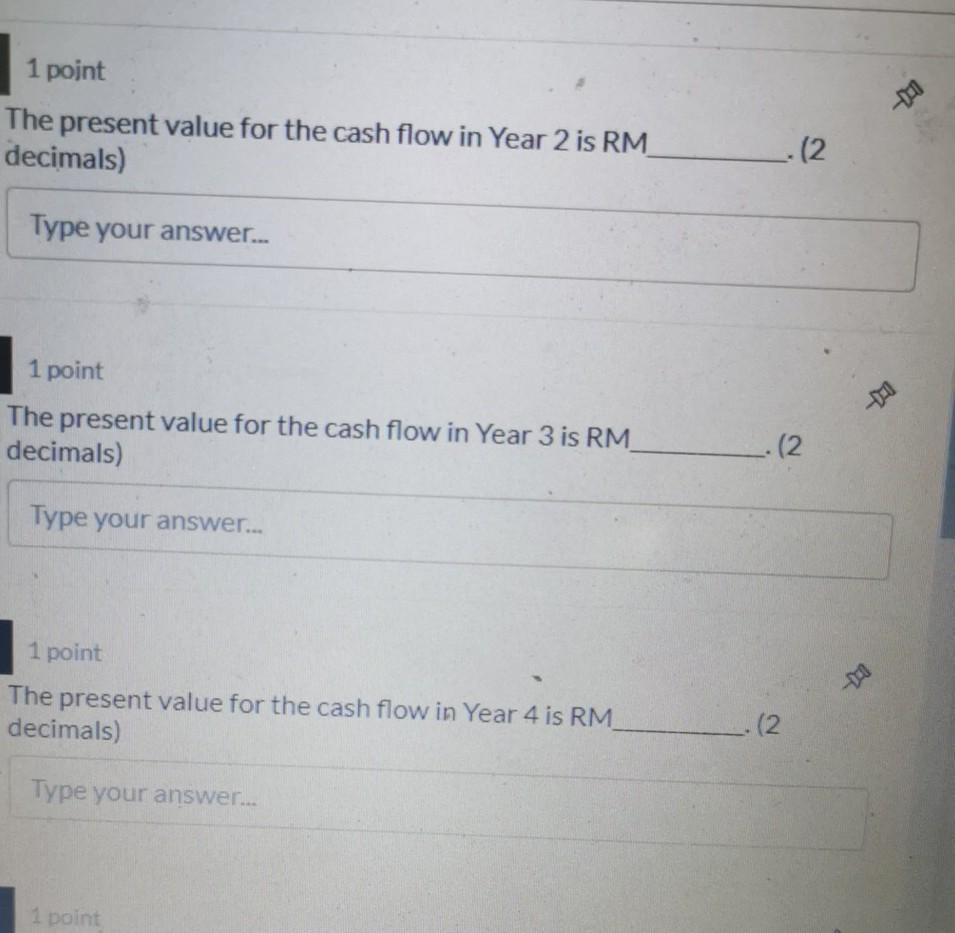

Propel Berhad Propel Berhad is looking into a new project that costs RM200,000 that will provide annual net cash flow over the next five years of RM86,000, RM93,000, RM50,000, RM55,000, and RM60,000. At the end of the life of the project, RM 25,000 can be salvaged from assets disposal. The company's cost of capital is 6.53% 2 points The payback period for the project is years. (2 decimals) Type your answer... 3 points The Discounted Payback Period is years. (2 decimals) Type your answer... 1 1 point The terminal value for the project is RM (2 decimals) Type your answer... 12 1 point The present value for the cash flow in Year 1 is RM decimals) 2 1 point The present value for the cash flow in Year 2 is RM decimals) (2 Type your answer... 1 point The present value for the cash flow in Year 3 is RM decimals) ..12 Type your answer... 1 point The present value for the cash flow in Year 4 is RM decimals) (2 Type your answer... 1 point 1 point The present value for the cash flow in Year 5 is RM decimals) . (2 Type your answer... 1 point Total Present Value for the cash flow is RM (2 decimals) Type your answer... 1 point The Net Present Value (NPV) of the project is RM decimals) (2 Type your answer... 1 point The Internal Rate of Return of the project is %6. (2 decimals) 1 point The future value of the cash flow in Year 1 is RM (2 decimals) Type your answer... 1 point The present value for the cash flow in Year 2 is RM decimals) . (2 Type your answer... 1 point The present value for the cash flow in Year 3 is RM decimals) . (2 Type your answer.... The present value for the cash flow in Year 4 is RM 2:40 PM 0 ENG 1 point The present value for the cash flow in Year 4 is RM decimals) . 12 Type your answer... 1 point The present value for the cash flow in Year 5 is RM decimals) (2 Type your answer... 1 point The Modified Internal Rate of Return (MIRR) of the project is (2 decimals) % Type your answer... 2 points The Profitability Index (PI) of the project is (2 decimals) 2:41 PM ENG Type your answer... 1 point The Modified Internal Rate of Return (MIRR) of the project is (2 decimals) %. Type your answer... 2 points The Profitability Index (PI) of the project is (2 decimals) Type your answer... 2 points Based on your assessment, the project is to be O ACCEPTED O REJECTED O Not enough analysis to decide accept or reject

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started