Question: Adjusting Journal Entries (Appendix A)(instruction): Proper journal entries are prepared for all items on the trial balance that require adjustment. Required entries are properly formatted

Adjusting Journal Entries (Appendix A)(instruction): Proper journal entries are prepared for all items on the trial balance that require adjustment. Required entries are properly formatted with a date, the correct accounts and debit/credit amounts. The explanation includes the reason that an entry was or was not required and all supporting calculations. Explanations are free from abbreviations, slang, spelling, grammar and incorrect word usage errors.

Appendix A - Additional Information, year ended December 31, 2020

Based on discussions with Vera Topham

1. The buildings consist of greenhouses, storage sheds and a storefront. All buildings were constructed five years ago and have expected useful lives of fifty years.

2. The equipment was purchased five years ago and has an expected useful life of 10 years.

3. A physical count indicated that there were $300 of supplies on hand at the end of the year.

4. The prepaid expenses relate to a one-year insurance policy purchased July 01, 2020.

5. Deferred revenue relates to a deposit received from a customer for a special order of herbs to be delivered May 31, 2021.

6. 6% interest has accrued on the year-end mortgage balance and is payable on January 01,2021.

7. 10% interest has accrued on the year-end loan balance and is payable on January 01, 2021.

8. 5,000 common shares were issued in June 2020 to Vera's sister Hazel in exchange for $50,000 cash.

9. $25,000 in dividends were declared and paid in 2020.

10. The effective income tax rate is 25%.

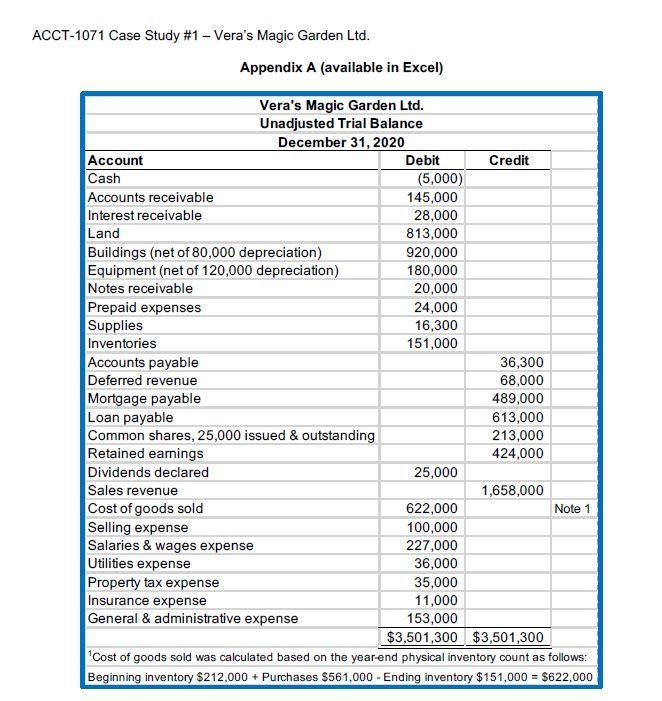

ACCT-1071 Case Study #1 - Vera's Magic Garden Ltd. Account Cash Accounts receivable Interest receivable Land Prepaid expenses Supplies Inventories Buildings (net of 80,000 depreciation) Equipment (net of 120,000 depreciation) Notes receivable Accounts payable Deferred revenue Mortgage payable Appendix A (available in Excel) Sales revenue Cost of goods sold Vera's Magic Garden Ltd. Unadjusted Trial Balance December 31, 2020 Loan payable Common shares, 25,000 issued & outstanding Retained earnings Dividends declared Selling expense Salaries & wages expense Utilities expense Property tax expense Insurance expense General & administrative expense Debit (5,000) 145,000 28,000 813,000 920,000 180,000 20,000 24,000 16,300 151,000 25,000 622,000 100,000 227,000 36,000 35,000 11,000 153,000 Credit 36,300 68,000 489,000 613,000 213,000 424,000 1,658,000 Note 1 $3,501,300 $3,501,300 'Cost of goods sold was calculated based on the year-end physical inventory count as follows: Beginning inventory $212,000+ Purchases $561,000 - Ending inventory $151,000 = $622,000

Step by Step Solution

There are 3 Steps involved in it

Adjusting Journal Entries for Veras Magic Garden Ltd for December 31 2020 1 Depreciation Expense Buildings Date December 31 2020 Accounts Depreciation Expense Buildings Buildings Debit Depreciation Ex... View full answer

Get step-by-step solutions from verified subject matter experts