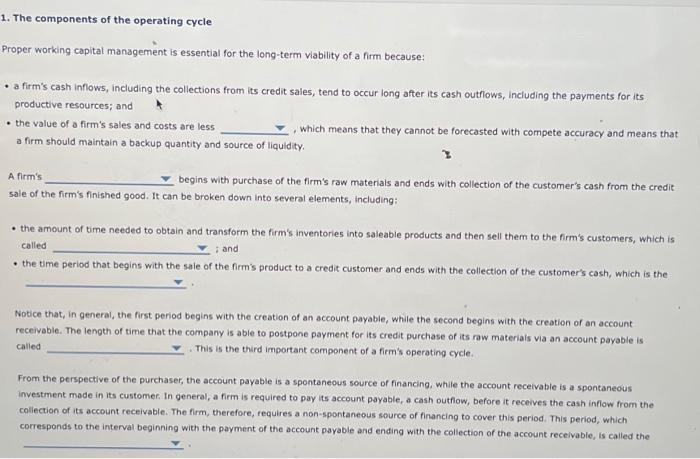

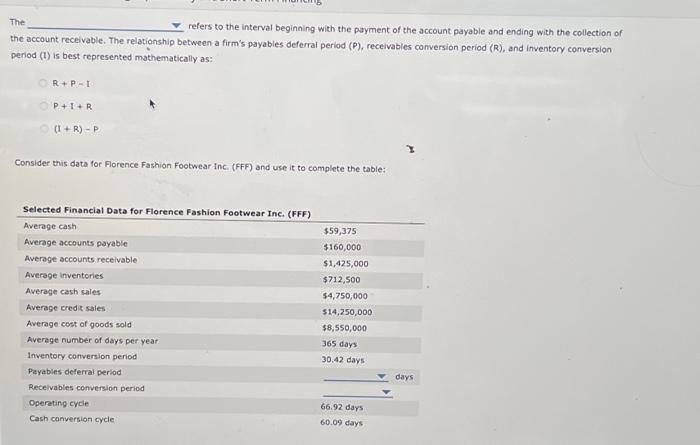

Proper working capital management is essential for the long-term viability of a firm because: - a firm's cash inflows, including the collections from its credit sales, tend to occur long after its cash outflows, including the payments for its productive resources; and - the value of a firm's sales and costs are less - Which means that they cannot be forecasted with compete accuracy and means that a firm should maintain a backup quantity and source of liquidity. z A firm's begins with purchase of the firm's raw materiais and ends with collection of the customer's cash from the credit sale of the firm's finished good. It can be broken down into several elements, including: - the amount of time needed to obtain and transform the firm's inventories into saleable products and then sell them to the firm's customers, which is called ; and - the time period that begins with the sale of the firm's product to a credit customer and ends with the collection of the customer's cash, which is the Notice that, in general, the first period begins with the creation of an account payable, while the second begins with the creation of an account receivable. The length of time that the company is able to postpone payment for ifs credit purchase of its raw materiais via an account payable is called . This is the third important component of a firm's eperating cycle. From the perspective of the purchaser, the account payable is a spontaneous source of financing, while the account receivable is a spontaneous investment mode in its customer. In general, a firm is required to pay its account payable, a cash outhow, before it receives the cash inflow from the collection of its account receivable. The firm, therefore, requires a non-spontaneous source of financing to cover this period, This period, which corresponds to the interval beginning with the payment of the account payable and ending with the collection of the account recelvable, is called the The refers to the interval beginning with the payment of the account payable and ending with the collection of the account receivable. The relationship between a firm's payables deferral period (P), recelvables conversion period ( R ), and inventory conversion period (t) is best represented mathematically as: R+P=tP+I+R (I+R)P Consider this data for Forence Fashion Footwear Inc. (FFF) and use it to complete the table