Answered step by step

Verified Expert Solution

Question

1 Approved Answer

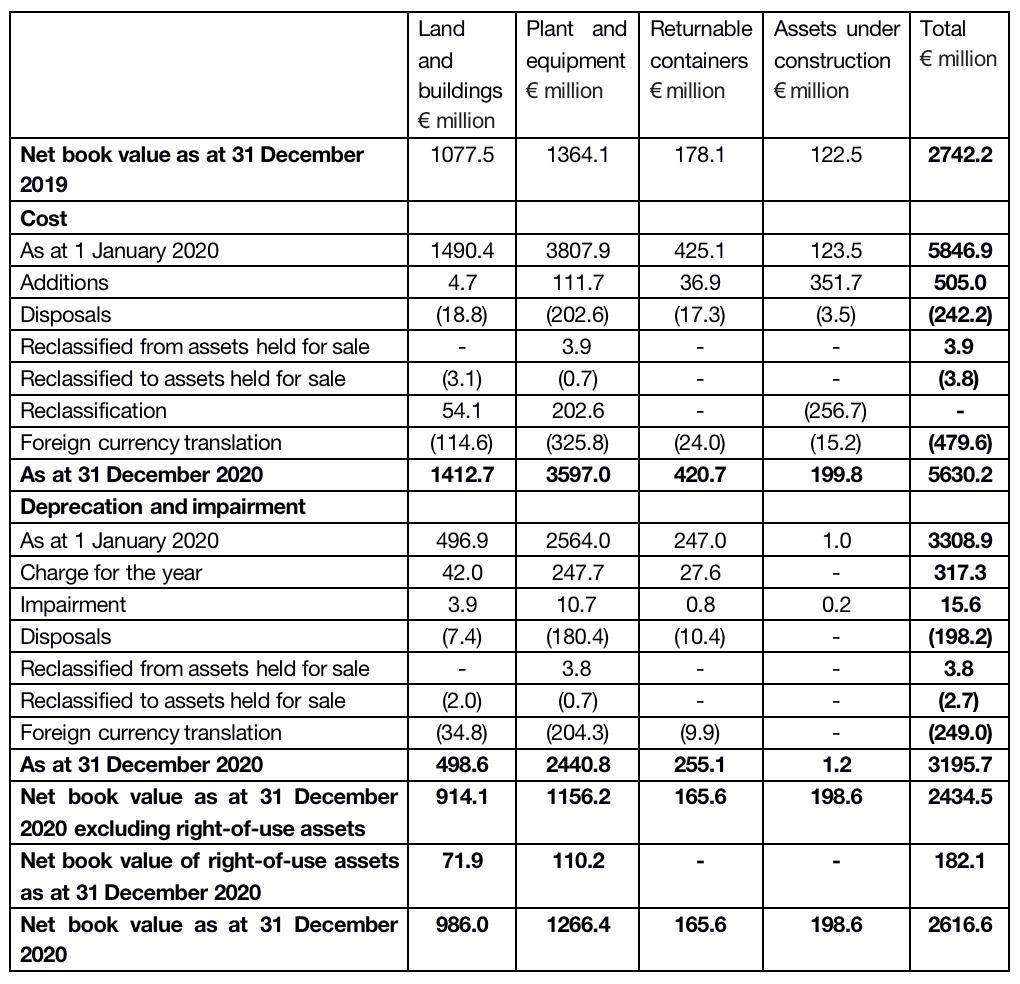

Property, Plant, and Equipment Analyze the changes that happened to PPE over the past 12-month period. Include an analysis of the important changes (additions, disposal,

Property, Plant, and Equipment

Analyze the changes that happened to PPE over the past 12-month period.

Include an analysis of the important changes (additions, disposal, foreign currency translation, charge for the year, depreciation and impairment, etc.)

Plant and Returnable Assets under Total million Land equipment containers million and construction buildings million million million Net book value as at 31 December 1077.5 1364.1 178.1 122.5 2742.2 2019 Cost As at 1 January 2020 1490.4 3807.9 425.1 123.5 5846.9 Additions 4.7 111.7 36.9 351.7 505.0 Disposals (18.8) (202.6) (17.3) (3.5) (242.2) Reclassified from assets held for sale 3.9 3.9 Reclassified to assets held for sale (3.1) (0.7) (3.8) Reclassification 54.1 202.6 (256.7) Foreign currency translation (114.6) (325.8) (24.0) (15.2) (479.6) As at 31 December 2020 1412.7 3597.0 420.7 199.8 5630.2 Deprecation and impairment As at 1 January 2020 Charge for the year 496.9 2564.0 247.0 1.0 3308.9 42.0 247.7 27.6 317.3 Impairment 3.9 10.7 0.8 0.2 15.6 Disposals (7.4) (180.4) (10.4) (198.2) Reclassified from assets held for sale 3.8 3.8 Reclassified to assets held for sale (2.0) (0.7) (204.3) (2.7) Foreign currency translation (34.8) (9.9) (249.0) As at 31 December 2020 498.6 2440.8 255.1 1.2 3195.7 Net book value as at 31 December 914.1 1156.2 165.6 198.6 2434.5 2020 excluding right-of-use assets Net book value of right-of-use assets 71.9 110.2 182.1 as at 31 December 2020 Net book value as at 31 December 986.0 1266.4 165.6 198.6 2616.6 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started