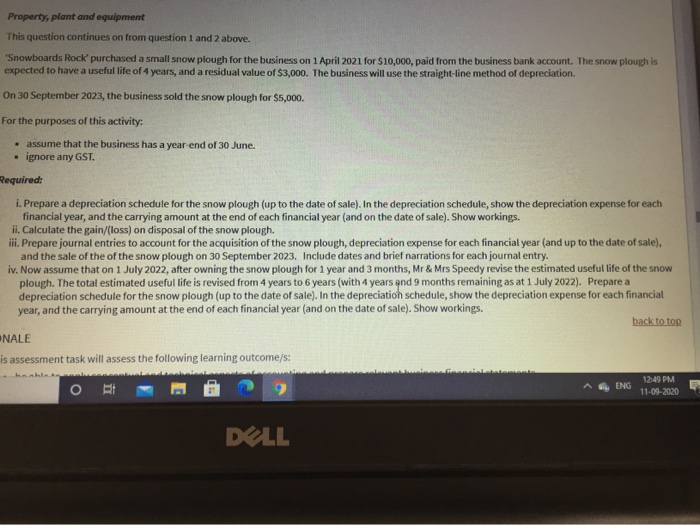

Property, plant and equipment This question continues on from question 1 and 2 above. "Snowboards Rock purchased a small snow plough for the business on 1 April 2021 for $10,000, paid from the business bank account. The snow plough is expected to have a useful life of 4 years, and a residual value of $3,000. The business will use the straight-line method of depreciation. On 30 September 2023, the business sold the snow plough for $5,000. For the purposes of this activity: assume that the business has a year end of 30 June. . ignore any GST. Required: i. Prepare a depreciation schedule for the snow plough (up to the date of sale). In the depreciation schedule, show the depreciation expense for each financial year, and the carrying amount at the end of each financial year (and on the date of sale). Show workings. ii. Calculate the gain/(loss) on disposal of the snow plough. iii. Prepare journal entries to account for the acquisition of the snow plough, depreciation expense for each financial year (and up to the date of sale), and the sale of the of the snow plough on 30 September 2023. Include dates and brief narrations for each journal entry. iv. Now assume that on 1 July 2022, after owning the snow plough for 1 year and 3 months, Mr & Mrs Speedy revise the estimated useful life of the snow plough. The total estimated useful life is revised from 4 years to 6 years (with 4 years and 9 months remaining as at 1 July 2022). Prepare a depreciation schedule for the snow plough (up to the date of sale). In the depreciation schedule, show the depreciation expense for each financial year, and the carrying amount at the end of each financial year (and on the date of sale). Show workings. back to ton NALE is assessment task will assess the following learning outcome/s: haablaag ENG O RI 12:49 PM 11-09-2020 DLL Property, plant and equipment This question continues on from question 1 and 2 above. "Snowboards Rock purchased a small snow plough for the business on 1 April 2021 for $10,000, paid from the business bank account. The snow plough is expected to have a useful life of 4 years, and a residual value of $3,000. The business will use the straight-line method of depreciation. On 30 September 2023, the business sold the snow plough for $5,000. For the purposes of this activity: assume that the business has a year end of 30 June. . ignore any GST. Required: i. Prepare a depreciation schedule for the snow plough (up to the date of sale). In the depreciation schedule, show the depreciation expense for each financial year, and the carrying amount at the end of each financial year (and on the date of sale). Show workings. ii. Calculate the gain/(loss) on disposal of the snow plough. iii. Prepare journal entries to account for the acquisition of the snow plough, depreciation expense for each financial year (and up to the date of sale), and the sale of the of the snow plough on 30 September 2023. Include dates and brief narrations for each journal entry. iv. Now assume that on 1 July 2022, after owning the snow plough for 1 year and 3 months, Mr & Mrs Speedy revise the estimated useful life of the snow plough. The total estimated useful life is revised from 4 years to 6 years (with 4 years and 9 months remaining as at 1 July 2022). Prepare a depreciation schedule for the snow plough (up to the date of sale). In the depreciation schedule, show the depreciation expense for each financial year, and the carrying amount at the end of each financial year (and on the date of sale). Show workings. back to ton NALE is assessment task will assess the following learning outcome/s: haablaag ENG O RI 12:49 PM 11-09-2020 DLL