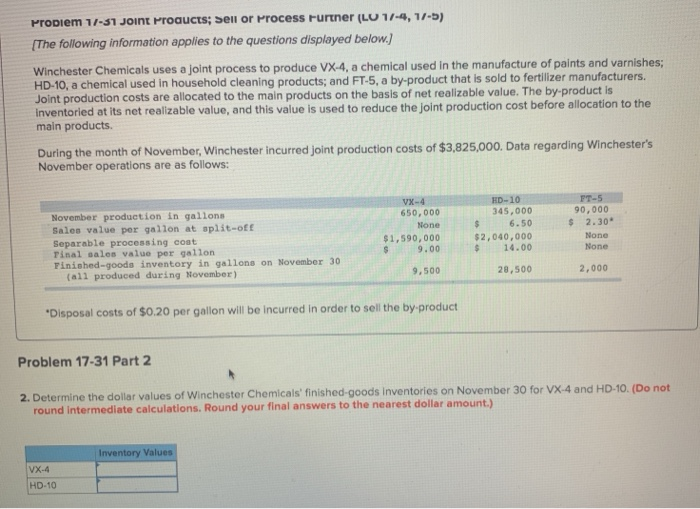

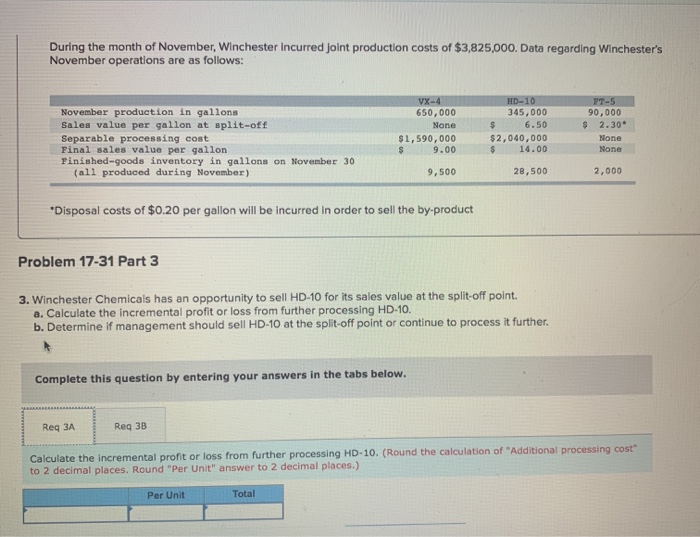

Propiem 1/-31 Joint Products; sell or Process Furtner (LU 1/-4,1/-5) [The following information applies to the questions displayed below.) Winchester Chemicals uses a joint process to produce VX-4, a chemical used in the manufacture of paints and varnishes; HD-10, a chemical used in household cleaning products; and FT-5, a by-product that is sold to fertilizer manufacturers. Joint production costs are allocated to the main products on the basis of net realizable value. The by-product is inventoried at its net realizable value, and this value is used to reduce the joint production cost before allocation to the main products. During the month of November, Winchester incurred joint production costs of $3,825,000. Data regarding Winchester's November operations are as follows: VX-4 650,000 None $1,590,000 $ 9.00 November production in gallons Sales value per gallon at split-oft Separable processing coat Tinal sales value per gallon Tinished-goods inventory in gallons on November 30 (all produced during November) HD-10 345,000 $ 6.50 $2,040,000 $ 14.00 $ FT-5 90,000 2.30 None None 9.500 28,500 2,000 "Disposal costs of $0.20 per gallon will be incurred in order to sell the by-product Problem 17-31 Part 2 2. Determine the dollar values of Winchester Chemicals' finished goods inventories on November 30 for VX-4 and HD-10. (Do not round Intermediate calculations. Round your final answers to the nearest dollar amount.) Inventory Values VX-4 HD-10 During the month of November, Winchester Incurred joint production costs of $3,825,000. Data regarding Winchester's November operations are as follows: November production in gallons Sales value per gallon at split-off Separable processing cost Final sales value per gallon Finished-goods inventory in gallons on November 30 (all produced during November) VX-4 650,000 None $1,590,000 $ 9.00 HD-10 345,000 $ 6.50 $2,040,000 $ 14.00 PT-5 90,000 $ 2.30* None None 9,500 28,500 2,000 *Disposal costs of $0.20 per gallon will be incurred in order to sell the by-product Problem 17-31 Part 3 3. Winchester Chemicals has an opportunity to sell HD-10 for its sales value at the split-off point a. Calculate the incremental profit or loss from further processing HD-10. b. Determine if management should sell HD-10 at the split-off point or continue to process it further. Complete this question by entering your answers in the tabs below. Reg 3A Reg 3B Calculate the incremental profit or loss from further processing HD-10. (Round the calculation of "Additional processing cost" to 2 decimal places. Round "Per Unit" answer to 2 decimal places.) Per Unit Total Propiem 1/-31 Joint Products; sell or Process Furtner (LU 1/-4,1/-5) [The following information applies to the questions displayed below.) Winchester Chemicals uses a joint process to produce VX-4, a chemical used in the manufacture of paints and varnishes; HD-10, a chemical used in household cleaning products; and FT-5, a by-product that is sold to fertilizer manufacturers. Joint production costs are allocated to the main products on the basis of net realizable value. The by-product is inventoried at its net realizable value, and this value is used to reduce the joint production cost before allocation to the main products. During the month of November, Winchester incurred joint production costs of $3,825,000. Data regarding Winchester's November operations are as follows: VX-4 650,000 None $1,590,000 $ 9.00 November production in gallons Sales value per gallon at split-oft Separable processing coat Tinal sales value per gallon Tinished-goods inventory in gallons on November 30 (all produced during November) HD-10 345,000 $ 6.50 $2,040,000 $ 14.00 $ FT-5 90,000 2.30 None None 9.500 28,500 2,000 "Disposal costs of $0.20 per gallon will be incurred in order to sell the by-product Problem 17-31 Part 2 2. Determine the dollar values of Winchester Chemicals' finished goods inventories on November 30 for VX-4 and HD-10. (Do not round Intermediate calculations. Round your final answers to the nearest dollar amount.) Inventory Values VX-4 HD-10 During the month of November, Winchester Incurred joint production costs of $3,825,000. Data regarding Winchester's November operations are as follows: November production in gallons Sales value per gallon at split-off Separable processing cost Final sales value per gallon Finished-goods inventory in gallons on November 30 (all produced during November) VX-4 650,000 None $1,590,000 $ 9.00 HD-10 345,000 $ 6.50 $2,040,000 $ 14.00 PT-5 90,000 $ 2.30* None None 9,500 28,500 2,000 *Disposal costs of $0.20 per gallon will be incurred in order to sell the by-product Problem 17-31 Part 3 3. Winchester Chemicals has an opportunity to sell HD-10 for its sales value at the split-off point a. Calculate the incremental profit or loss from further processing HD-10. b. Determine if management should sell HD-10 at the split-off point or continue to process it further. Complete this question by entering your answers in the tabs below. Reg 3A Reg 3B Calculate the incremental profit or loss from further processing HD-10. (Round the calculation of "Additional processing cost" to 2 decimal places. Round "Per Unit" answer to 2 decimal places.) Per Unit Total