Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Proposal A Proposal B Initial Investment $6,000 ,000 $3,000,000 Cash inflow $1,500,000 $1,000,000 Period of project 8 years 4 years Internal Rate of Return 10%

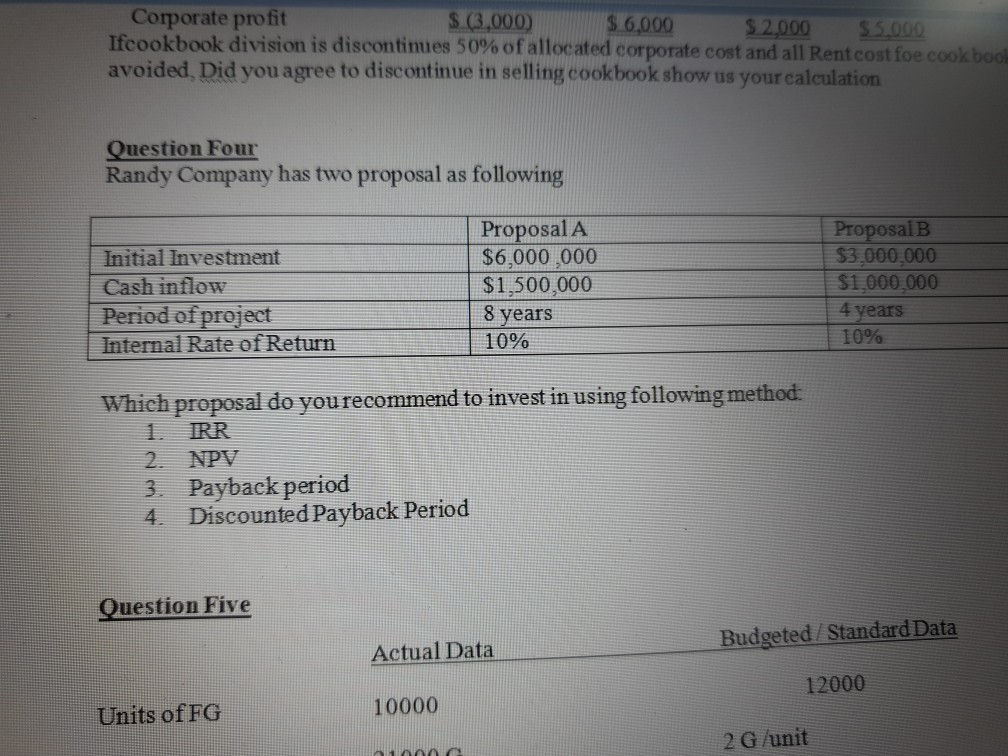

Proposal A Proposal B Initial Investment $6,000 ,000 $3,000,000 Cash inflow $1,500,000 $1,000,000 Period of project 8 years 4 years Internal Rate of Return 10% 10% Which proposal do you recommend to invest in using following method: 1. IRR 2. NPV 3. Payback period 4. Discounted Payback Period

Corporate profit $.(3.000) $ 6,000 $2.000 $ 5.000 Ifcookbook division is discontinues 50% of allocated corporate cost and all Rentcost foe cookbook avoided. Did you agree to discontinue in selling cookbook show us your calculation Question Four Randy Company has two proposal as following Proposal A $6,000,000 $1,500,000 Initial Investment Cash inflow Period of project Internal Rate of Return Proposal B $3,000,000 $1.000.000 4 years 10% 8 years 10% Which proposal do yourecommend to invest in using following method: TRR NPV 3. Payback period 4. Discounted Payback Period Question Five Budgeted / Standard Data Actual Data 12000 Units of FG 10000 2 G unit 100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started