Question

Prost paid legal fees for the transfer of assets and liabilities of $17,000. Prost also paid audit fees of $27,000 and listing application fees

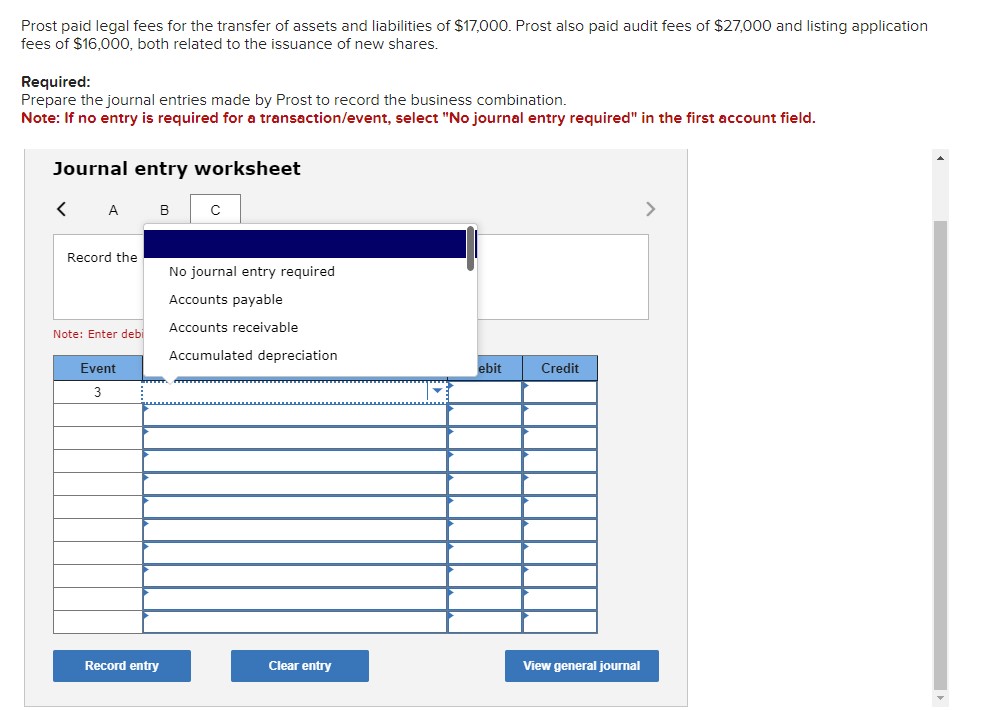

Prost paid legal fees for the transfer of assets and liabilities of $17,000. Prost also paid audit fees of $27,000 and listing application fees of $16,000, both related to the issuance of new shares. Required: Prepare the journal entries made by Prost to record the business combination. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Journal entry worksheet < A B C > Record the No journal entry required Accounts payable Note: Enter debi Accounts receivable Accumulated depreciation Event 3 ebit Credit Record entry Clear entry View general journal

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries for Business Combination are as follows Debit Assets acquired Ac 17000 C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Advanced Financial Accounting

Authors: Theodore E. Christensen, David M. Cottrell, Cassy Budd

13th International Edition

1265042616, 9781265042615

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App