Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Proud Pooch Pampering is a small business that provides dog exercising and grooming services. The business has an ABN and is registered for GST.

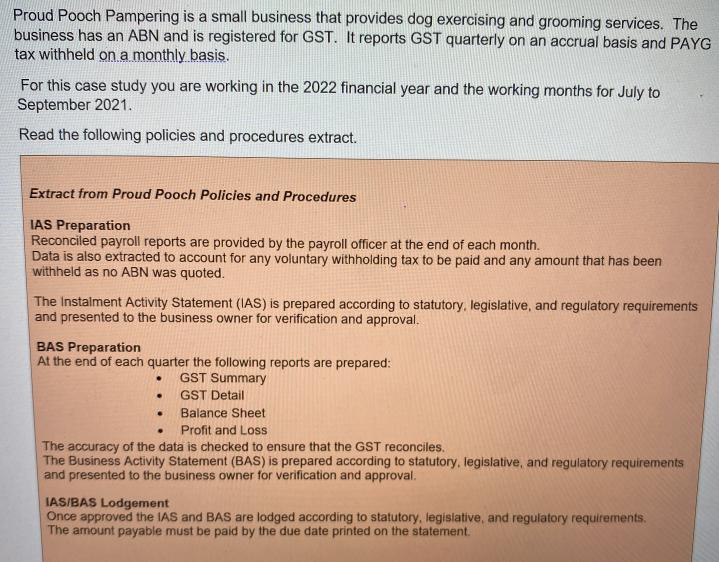

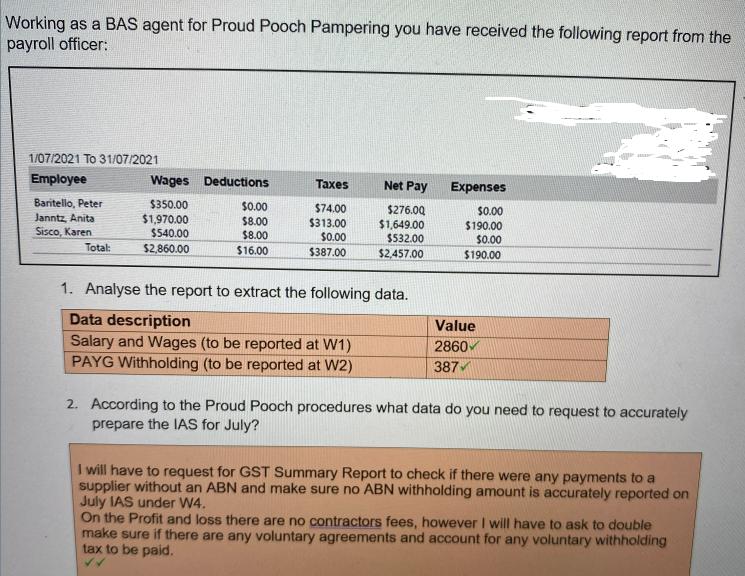

Proud Pooch Pampering is a small business that provides dog exercising and grooming services. The business has an ABN and is registered for GST. It reports GST quarterly on an accrual basis and PAYG tax withheld on a monthly basis. For this case study you are working in the 2022 financial year and the working months for July to September 2021. Read the following policies and procedures extract. Extract from Proud Pooch Policies and Procedures IAS Preparation Reconciled payroll reports are provided by the payroll officer at the end of each month. Data is also extracted to account for any voluntary withholding tax to be paid and any amount that has been withheld as no ABN was quoted. The Instalment Activity Statement (IAS) is prepared according to statutory, legislative, and regulatory requirements and presented to the business owner for verification and approval. BAS Preparation At the end of each quarter the following reports are prepared: GST Summary GST Detail Balance Sheet . Profit and Loss The accuracy of the data is checked to ensure that the GST reconciles. The Business Activity Statement (BAS) is prepared according to statutory, legislative, and regulatory requirements and presented to the business owner for verification and approval. . . IAS/BAS Lodgement Once approved the IAS and BAS are lodged according to statutory, legislative, and regulatory requirements. The amount payable must be paid by the due date printed on the statement. Working as a BAS agent for Proud Pooch Pampering you have received the following report from the payroll officer: 1/07/2021 To 31/07/2021 Employee Baritello, Peter Janntz, Anita Sisco, Karen Total: Wages $350.00 $1,970.00 $540.00 $2,860.00 Deductions $0.00 $8.00 $8.00 $16.00 Taxes $74.00 $313.00 $0.00 $387.00 Net Pay $276.00 $1,649.00 $532.00 $2,457.00 1. Analyse the report to extract the following data. Data description Salary and Wages (to be reported at W1) PAYG Withholding (to be reported at W2) Expenses $0.00 $190.00 $0.00 $190.00 Value 2860 387 2. According to the Proud Pooch procedures what data do you need to request to accurately prepare the IAS for July? I will have to request for GST Summary Report to check if there were any payments to a supplier without an ABN and make sure no ABN withholding amount is accurately reported on July IAS under W4. On the Profit and loss there are no contractors fees, however I will have to ask to double make sure if there are any voluntary agreements and account for any voluntary withholding tax to be paid.

Step by Step Solution

★★★★★

3.41 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Your analysis of the report and the data extraction is correct You have identified the relevant ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started