Prove your answer with deep explanation thankyou

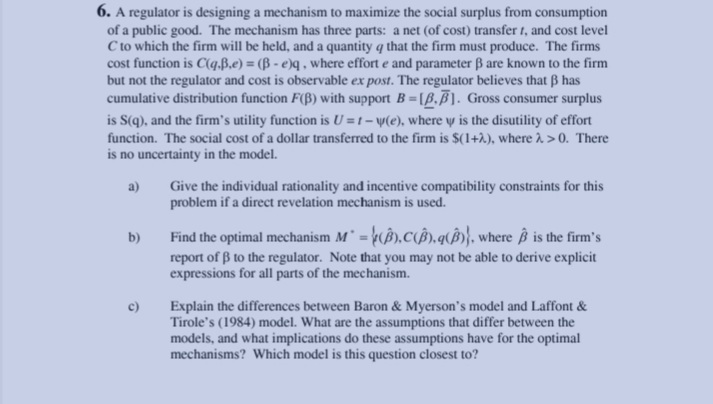

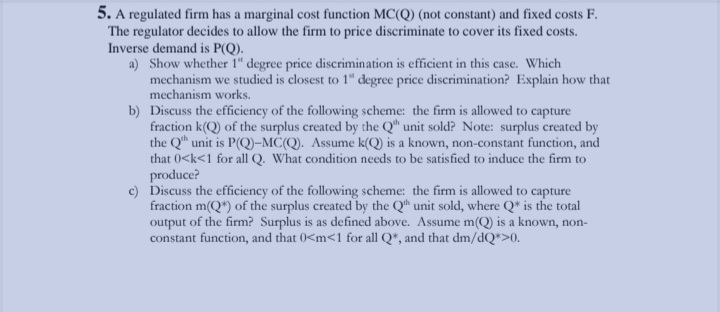

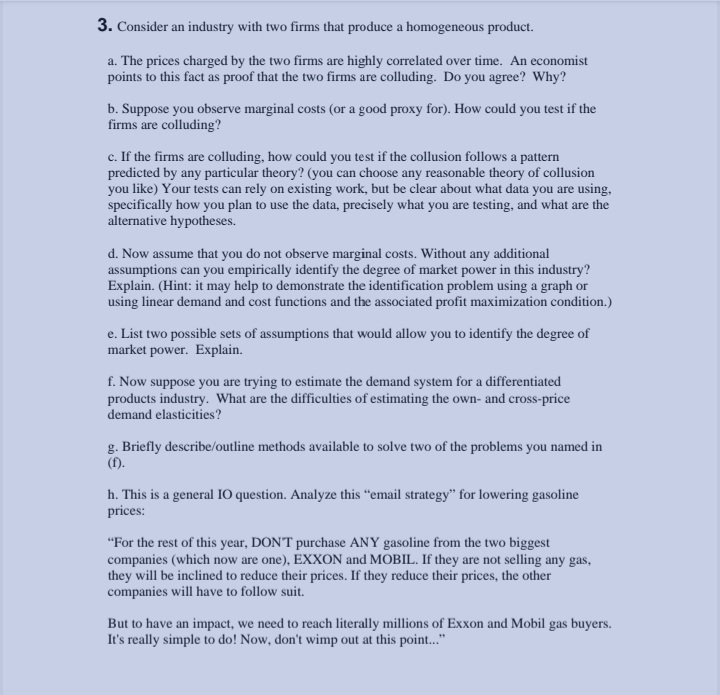

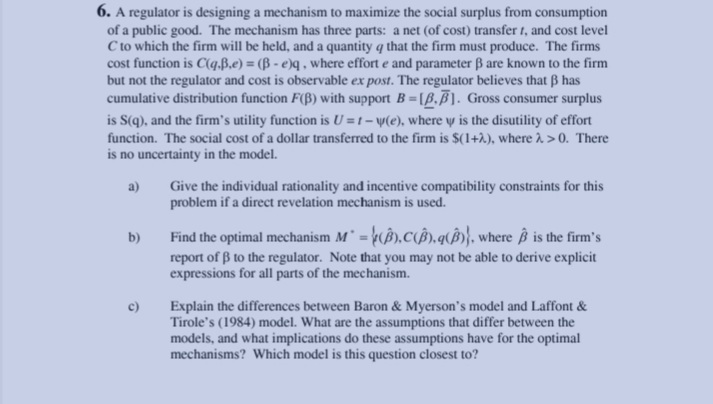

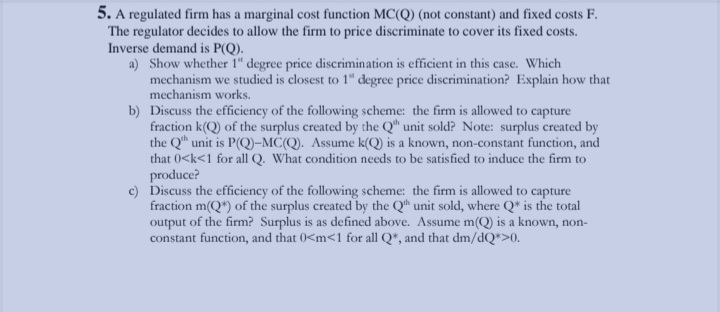

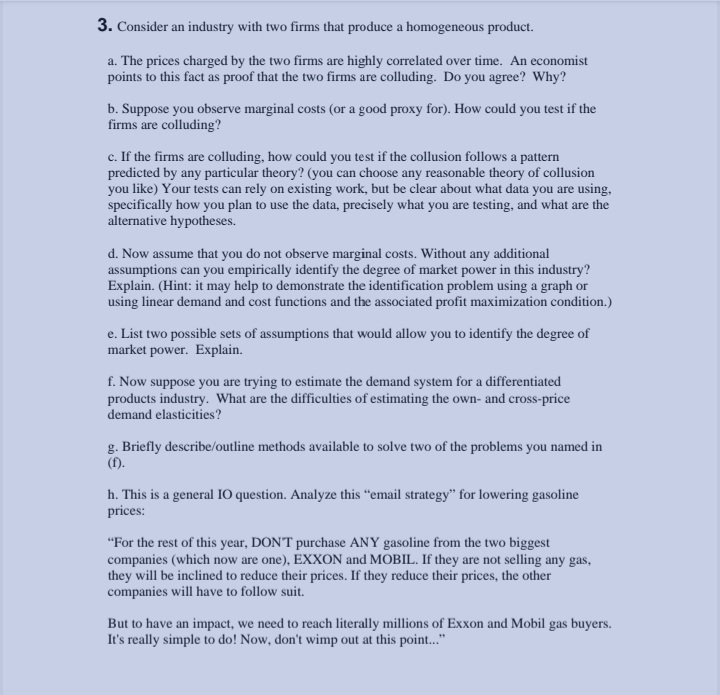

6. A regulator is designing a mechanism to maximize the social surplus from consumption of a public good. The mechanism has three parts: a net (of cost) transfer f, and cost level C to which the firm will be held, and a quantity q that the firm must produce. The firms cost function is C(q.B.e) = (B - e)q . where effort e and parameter B are known to the firm but not the regulator and cost is observable ex post. The regulator believes that B has cumulative distribution function F(B) with support B = [S. #]. Gross consumer surplus is S(q), and the firm's utility function is U = r - w(e), where w is the disutility of effort function. The social cost of a dollar transferred to the firm is $(1+2.), where 2. > 0. There is no uncertainty in the model. a) Give the individual rationality and incentive compatibility constraints for this problem if a direct revelation mechanism is used. b) Find the optimal mechanism M * = "().c().q(/)). where & is the firm's report of B to the regulator. Note that you may not be able to derive explicit expressions for all parts of the mechanism. c) Explain the differences between Baron & Myerson's model and Laffont & Tirole's (1984) model. What are the assumptions that differ between the models, and what implications do these assumptions have for the optimal mechanisms? Which model is this question closest to?5. A regulated firm has a marginal cost function MC(Q) (not constant) and fixed costs F. The regulator decides to allow the firm to price discriminate to cover its fixed costs. Inverse demand is P(Q). a) Show whether 1" degree price discrimination is efficient in this case. Which mechanism we studied is closest to 1" degree price discrimination? Explain how that mechanism works. b) Discuss the efficiency of the following scheme: the firm is allowed to capture fraction k(Q) of the surplus created by the Q" unit sold? Note: surplus created by the Q" unit is P(Q)-MC(Q). Assume k(Q) is a known, non-constant function, and that Ock0).4. This question deals with Ellison (Rand '84) and Borenstein and Shepard (Rand 96). Both of these papers empirically test the validity of certain theoretical models of collusion. Set up a. Briefly describe the Rotemberg-Saloner and Green and Porter models of tacit collusion. Pay particular attention to what is known by the firms and the behavior of demand. Also, characterize the movements of price in the market. b. Discuss the main differences between the RS/ HH and GP models. Is the nature of "price wars" the same in the two classes of models? If not. how do price wars differ and what within the theoretical models generates this difference? c. Closely related to the Rotemberg and Saloner model is the Haltiwanger and Harrington model. Briefly discuss how the Haltiwanger and Harrington model differs from the Rotemberg and Saloner model. Borenstein and Shepard d. What empirical prediction of the RS/ HH models do Borenstein and Shepard test? Explain why this prediction is inconsistent with a model of pricing with switching costs. e. Describe the context of the paper: What is the industry? What are the data?' Is this a good setting to test the RS/HH model? f. How do the authors propose to test the theory? Describe the empirical model. Is the model structural or reduced form? What is the dependent variable? What is are the main independent variables of interest? g. What econometric difficulties are implied by the prediction that current margins should be correlated with expected future prices and quantities? How do the authors deal with these problems? Be as detailed as possible. Ellison h. What empirical predictions of the RS/ HH and the GP models does Ellison test? i. Describe the context of the paper: What is the industry? What are the data? What characterizes equilibrium prices in this industry? A priori, which theory seems to be most consistent with the industry and the data (and why )? j. How does the author propose to test the two theories." Is the model structural or reduced form? What is(are ) the dependent variable(s). Are all of the dependent variables observed? k. What alternative explanation does Ellison have to deal with? Can be completely rule this out? 10 Field Prelim June 2006 I. This is a general 10 question. Analyze this "email strategy" for lowering gasoline prices (answer only once): "For the rest of this year. DON'T purchase ANY gasoline from the two biggest companies (which now are one). EXXON and MOBIL. If they are not selling any gas. they will be inclined to reduce their prices. If they reduce their prices, the other companies will have to follow suit. But to have an impact, we need to reach literally millions of Exxon and Mobil gas buyers. It's really simple to do! Now, don't wimp out at this point..."3. Consider an industry with two firms that produce a homogeneous product. a. The prices charged by the two firms are highly correlated over time. An economist points to this fact as proof that the two firms are colluding. Do you agree? Why? b. Suppose you observe marginal costs (or a good proxy for). How could you test if the firms are colluding? c. If the firms are colluding, how could you test if the collusion follows a pattern predicted by any particular theory? (you can choose any reasonable theory of collusion you like) Your tests can rely on existing work, but be clear about what data you are using, specifically how you plan to use the data, precisely what you are testing, and what are the alternative hypotheses. d. Now assume that you do not observe marginal costs. Without any additional assumptions can you empirically identify the degree of market power in this industry? Explain. (Hint: it may help to demonstrate the identification problem using a graph or using linear demand and cost functions and the associated profit maximization condition.) e. List two possible sets of assumptions that would allow you to identify the degree of market power. Explain. f. Now suppose you are trying to estimate the demand system for a differentiated products industry. What are the difficulties of estimating the own- and cross-price demand elasticities? g. Briefly describe/outline methods available to solve two of the problems you named in (f). h. This is a general IO question. Analyze this "email strategy" for lowering gasoline prices: "For the rest of this year, DON'T purchase ANY gasoline from the two biggest companies (which now are one), EXXON and MOBIL. If they are not selling any gas, they will be inclined to reduce their prices. If they reduce their prices, the other companies will have to follow suit. But to have an impact, we need to reach literally millions of Exxon and Mobil gas buyers. It's really simple to do! Now, don't wimp out at this point..."