Answered step by step

Verified Expert Solution

Question

1 Approved Answer

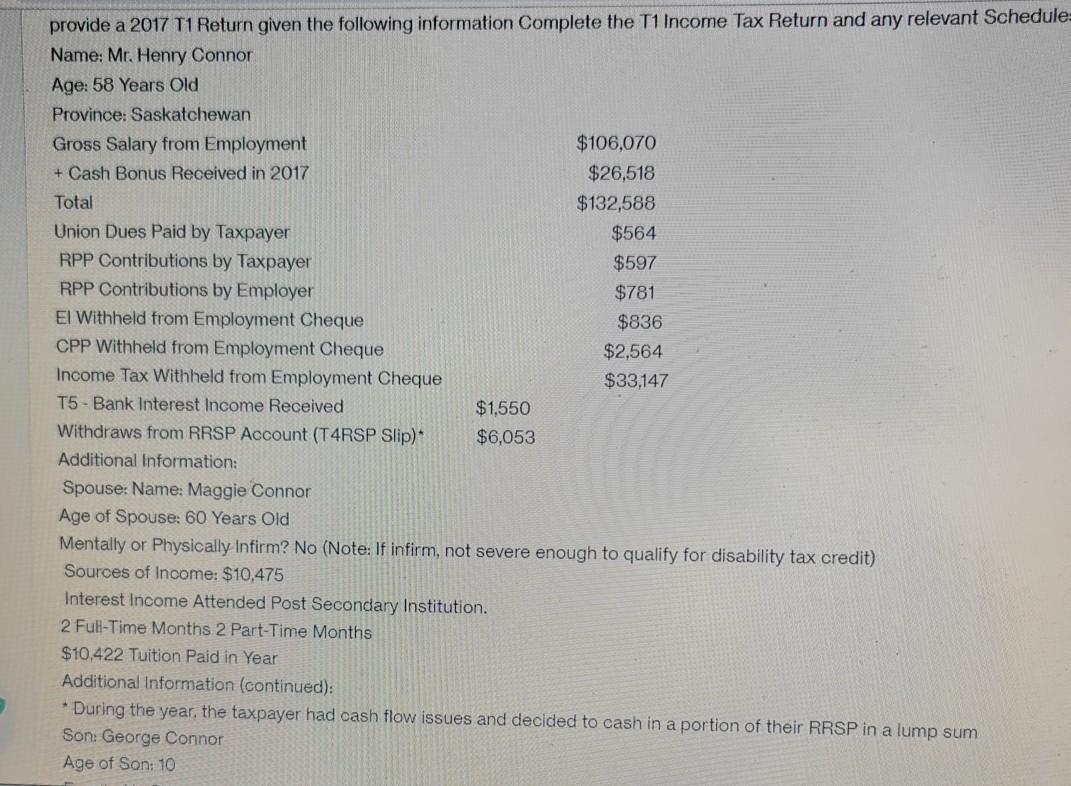

provide a 2017 T1 Return given the following information Complete the T1 Income Tax Return and any relevant Schedule: Name: Mr. Henry Connor Age: 58

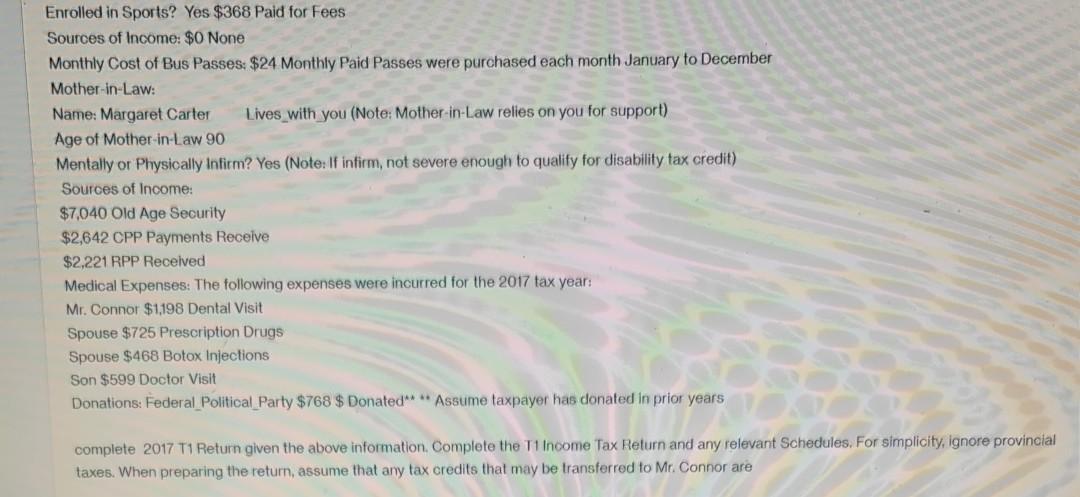

provide a 2017 T1 Return given the following information Complete the T1 Income Tax Return and any relevant Schedule: Name: Mr. Henry Connor Age: 58 Years Old Province: Saskatchewan Gross Salary from Employment $106,070 + Cash Bonus Received in 2017 $26,518 Total $132,588 Union Dues Paid by Taxpayer $564 RPP Contributions by Taxpayer $597 RPP Contributions by Employer $781 El Withheld from Employment Cheque $836 CPP Withheld from Employment Cheque $2,564 Income Tax Withheld from Employment Cheque $33,147 T5 - Bank Interest Income Received $1,550 Withdraws from RRSP Account (T4RSP Slip) $6,053 Additional Information: Spouse: Name: Maggie Connor Age of Spouse: 60 Years Old Mentally or Physically Infirm? No (Note: If infirm, not severe enough to qualify for disability tax credit) Sources of Income: $10,475 Interest Income Attended Post Secondary Institution. 2 Full-Time Months 2 Part-Time Months $10,422 Tuition Paid in Year Additional Information (continued): * During the year, the taxpayer had cash flow issues and decided to cash in a portion of their RRSP in a lump sum Son: George Connor Age of Son: 10 Enrolled in Sports? Yes $368 Paid for Fees Sources of Income: $0 None Monthly Cost of Bus Passes: $24 Monthly Paid Passes were purchased each month January to December Mother-in-Law: Name: Margaret Carter Lives with you (Note: Mother-in-Law relies on you for support) Age of Mother-in-Law 90 Mentally or Physically Infirm? Yes (Note: If infirm, not severe enough to quality for disability tax credit) Sources of income: $7,040 Old Age Security $2,642 CPP Payments Receive $2,221 RPP Received Medical Expenses: The following expenses were incurred for the 2017 tax year: Mr. Connor $1,198 Dental Visit Spouse $725 Prescription Drugs Spouse $468 Botox Injections Son $599 Doctor Visit Donations: Federal Political Party $768 $ Donated"* * Assume taxpayer has donated in prior years complete 2017 T1 Return given the above information Complete the T1 Income Tax Return and any relevant Schedules, For simplicity, ignore provincial taxes. When preparing the return, assume that any tax credits that may be transferred to Mr. Connor are provide a 2017 T1 Return given the following information Complete the T1 Income Tax Return and any relevant Schedule: Name: Mr. Henry Connor Age: 58 Years Old Province: Saskatchewan Gross Salary from Employment $106,070 + Cash Bonus Received in 2017 $26,518 Total $132,588 Union Dues Paid by Taxpayer $564 RPP Contributions by Taxpayer $597 RPP Contributions by Employer $781 El Withheld from Employment Cheque $836 CPP Withheld from Employment Cheque $2,564 Income Tax Withheld from Employment Cheque $33,147 T5 - Bank Interest Income Received $1,550 Withdraws from RRSP Account (T4RSP Slip) $6,053 Additional Information: Spouse: Name: Maggie Connor Age of Spouse: 60 Years Old Mentally or Physically Infirm? No (Note: If infirm, not severe enough to qualify for disability tax credit) Sources of Income: $10,475 Interest Income Attended Post Secondary Institution. 2 Full-Time Months 2 Part-Time Months $10,422 Tuition Paid in Year Additional Information (continued): * During the year, the taxpayer had cash flow issues and decided to cash in a portion of their RRSP in a lump sum Son: George Connor Age of Son: 10 Enrolled in Sports? Yes $368 Paid for Fees Sources of Income: $0 None Monthly Cost of Bus Passes: $24 Monthly Paid Passes were purchased each month January to December Mother-in-Law: Name: Margaret Carter Lives with you (Note: Mother-in-Law relies on you for support) Age of Mother-in-Law 90 Mentally or Physically Infirm? Yes (Note: If infirm, not severe enough to quality for disability tax credit) Sources of income: $7,040 Old Age Security $2,642 CPP Payments Receive $2,221 RPP Received Medical Expenses: The following expenses were incurred for the 2017 tax year: Mr. Connor $1,198 Dental Visit Spouse $725 Prescription Drugs Spouse $468 Botox Injections Son $599 Doctor Visit Donations: Federal Political Party $768 $ Donated"* * Assume taxpayer has donated in prior years complete 2017 T1 Return given the above information Complete the T1 Income Tax Return and any relevant Schedules, For simplicity, ignore provincial taxes. When preparing the return, assume that any tax credits that may be transferred to Mr. Connor are

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started