Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide a complete response. The format of this plan - (recommendations to your clients, Jonathan and Jenny Spears) should be in a simple narrative format

Provide a complete response.

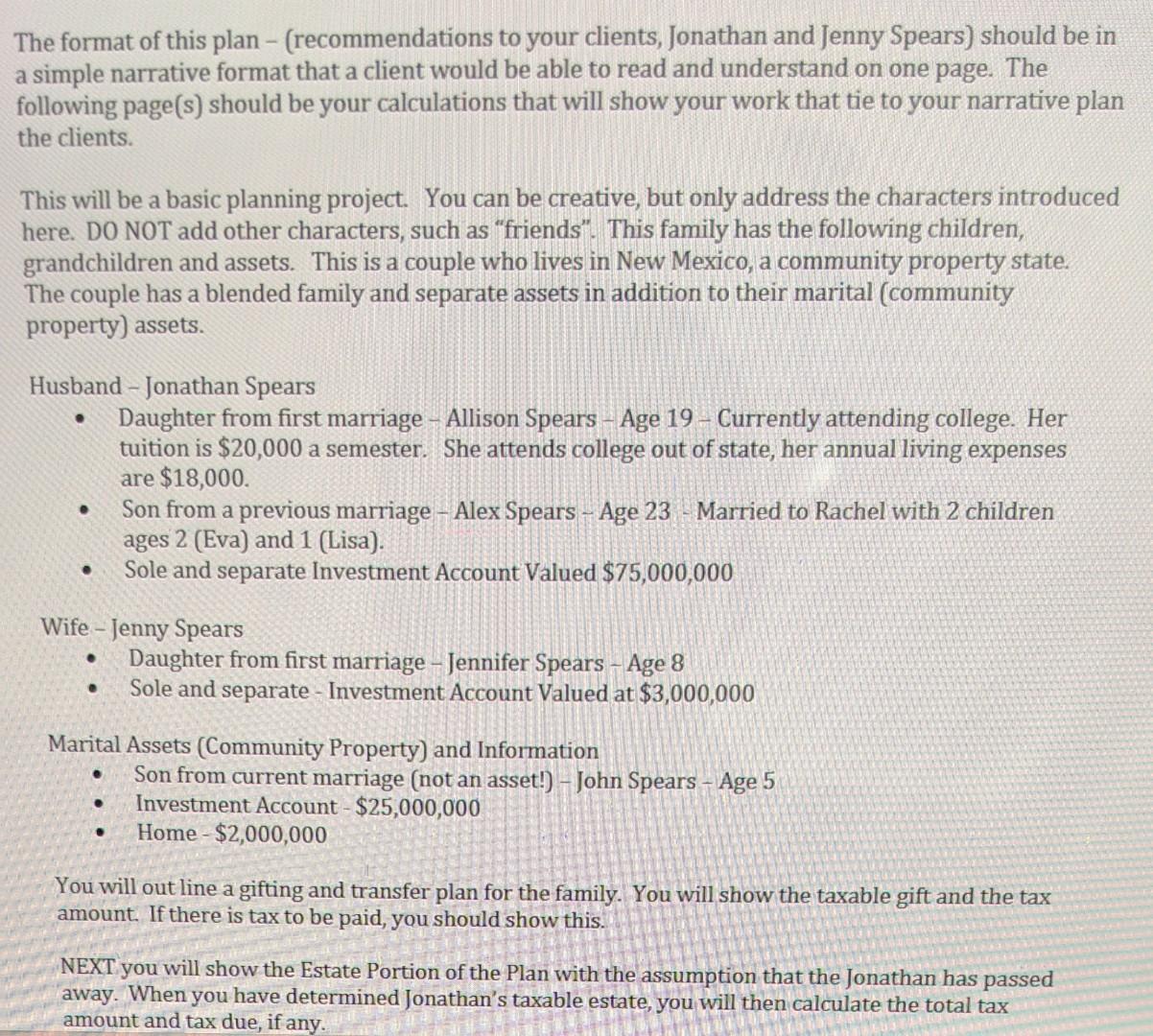

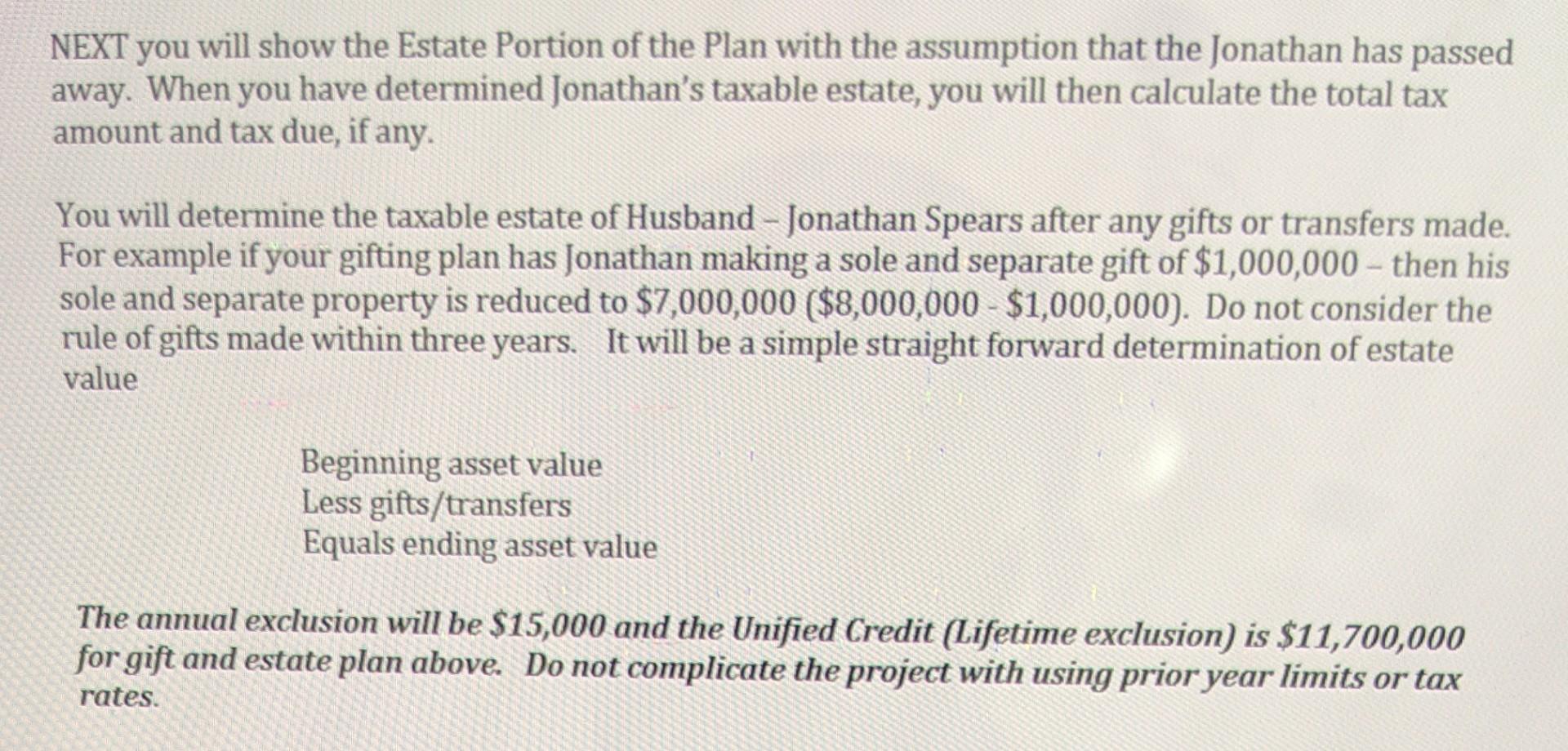

The format of this plan - (recommendations to your clients, Jonathan and Jenny Spears) should be in a simple narrative format that a client would be able to read and understand on one page. The following page(s) should be your calculations that will show your work that tie to your narrative plan the clients. This will be a basic planning project. You can be creative, but only address the characters introduced here. DO NOT add other characters, such as "friends". This family has the following children, grandchildren and assets. This is a couple who lives in New Mexico, a community property state. The couple has a blended family and separate assets in addition to their marital (community property) assets. Husband - Jonathan Spears - Daughter from first marriage - Allison Spears - Age 19 - Currently attending college. Her tuition is $20,000 a semester. She attends college out of state, her annual living expenses are $18,000. - Son from a previous marriage - Alex Spears - Age 23 - Married to Rachel with 2 children ages 2 (Eva) and 1 (Lisa). - Sole and separate Investment Account Valued \$75,000,000 Wife - Jenny Spears - Daughter from first marriage - Jennifer Spears - Age 8 - Sole and separate - Investment Account Valued at $3,000,000 Marital Assets (Community Property) and Information - Son from current marriage (not an asset!) - John Spears - Age 5 - Investment Account $25,000,000 - Home $2,000,000 You will out line a gifting and transfer plan for the family. You will show the taxable gift and the tax amount. If there is tax to be paid, you should show this. NEXT you will show the Estate Portion of the Plan with the assumption that the Jonathan has passed away. When you have determined Jonathan's taxable estate, you will then calculate the total tax NEXT you will show the Estate Portion of the Plan with the assumption that the Jonathan has passed away. When you have determined Jonathan's taxable estate, you will then calculate the total tax amount and tax due, if any. You will determine the taxable estate of Husband - Jonathan Spears after any gifts or transfers made. For example if your gifting plan has Jonathan making a sole and separate gift of $1,000,000 - then his sole and separate property is reduced to $7,000,000($8,000,000$1,000,000). Do not consider the rule of gifts made within three years. It will be a simple straight forward determination of estate value Beginning asset value Less gifts/transfers Equals ending asset value The annual exclusion will be $15,000 and the Unified Credit (Lifetime exclusion) is $11,700,000 for gift and estate plan above. Do not complicate the project with using prior year limits or tax rates. The format of this plan - (recommendations to your clients, Jonathan and Jenny Spears) should be in a simple narrative format that a client would be able to read and understand on one page. The following page(s) should be your calculations that will show your work that tie to your narrative plan the clients. This will be a basic planning project. You can be creative, but only address the characters introduced here. DO NOT add other characters, such as "friends". This family has the following children, grandchildren and assets. This is a couple who lives in New Mexico, a community property state. The couple has a blended family and separate assets in addition to their marital (community property) assets. Husband - Jonathan Spears - Daughter from first marriage - Allison Spears - Age 19 - Currently attending college. Her tuition is $20,000 a semester. She attends college out of state, her annual living expenses are $18,000. - Son from a previous marriage - Alex Spears - Age 23 - Married to Rachel with 2 children ages 2 (Eva) and 1 (Lisa). - Sole and separate Investment Account Valued \$75,000,000 Wife - Jenny Spears - Daughter from first marriage - Jennifer Spears - Age 8 - Sole and separate - Investment Account Valued at $3,000,000 Marital Assets (Community Property) and Information - Son from current marriage (not an asset!) - John Spears - Age 5 - Investment Account $25,000,000 - Home $2,000,000 You will out line a gifting and transfer plan for the family. You will show the taxable gift and the tax amount. If there is tax to be paid, you should show this. NEXT you will show the Estate Portion of the Plan with the assumption that the Jonathan has passed away. When you have determined Jonathan's taxable estate, you will then calculate the total tax NEXT you will show the Estate Portion of the Plan with the assumption that the Jonathan has passed away. When you have determined Jonathan's taxable estate, you will then calculate the total tax amount and tax due, if any. You will determine the taxable estate of Husband - Jonathan Spears after any gifts or transfers made. For example if your gifting plan has Jonathan making a sole and separate gift of $1,000,000 - then his sole and separate property is reduced to $7,000,000($8,000,000$1,000,000). Do not consider the rule of gifts made within three years. It will be a simple straight forward determination of estate value Beginning asset value Less gifts/transfers Equals ending asset value The annual exclusion will be $15,000 and the Unified Credit (Lifetime exclusion) is $11,700,000 for gift and estate plan above. Do not complicate the project with using prior year limits or tax ratesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started