Answered step by step

Verified Expert Solution

Question

1 Approved Answer

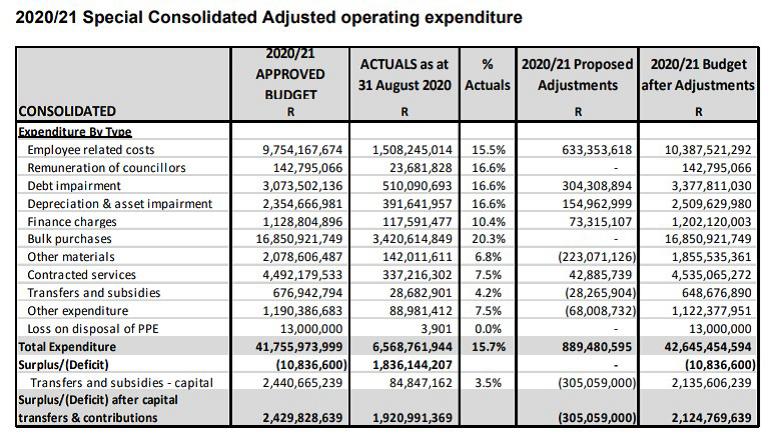

Provide a critical discussion of the adjustments to the 2020/21 operational expenditure, including the major considerations for these adjustments? Evaluate the impact of the adjustment

Provide a critical discussion of the adjustments to the 2020/21 operational expenditure, including the major

considerations for these adjustments?

Evaluate the impact of the adjustment budget on service delivery.

2020/21 Special Consolidated Adjusted operating expenditure 2020/21 APPROVED BUDGET R CONSOLIDATED Expenditure By Type Employee related costs Remuneration of councillors Debt impairment Depreciation & asset impairment Finance charges Bulk purchases Other materials Contracted services Transfers and subsidies Other expenditure Loss on disposal of PPE Total Expenditure Surplus/(Deficit) Transfers and subsidies - capital Surplus/(Deficit) after capital transfers & contributions 9,754,167,674 142,795,066 3,073,502,136 2,354,666,981 1,128,804,896 16,850,921,749 2,078,606,487 4,492,179,533 676,942,794 1,190,386,683 13,000,000 ACTUALS as at % 31 August 2020 Actuals R 2,429,828,639 1,508,245,014 15.5% 23,681,828 16.6% 510,090,693 16.6% 391,641,957 16.6% 117,591,477 10.4% 3,420,614,849 20.3% 142,011,611 6.8% 337,216,302 7.5% 28,682,901 4.2% 88,981,412 7.5% 3,901 0.0% 41,755,973,999 6,568,761,944 15.7% (10,836,600) 1,836,144,207 2,440,665,239 84,847,162 3.5% 1,920,991,369 2020/21 Proposed 2020/21 Budget Adjustments after Adjustments R R 633,353,618 304,308,894 154,962,999 73,315,107 (223,071,126) 42,885,739 (28,265,904) (68,008,732) 10,387,521,292 142,795,066 3,377,811,030 2,509,629,980 1,202,120,003 16,850,921,749 1,855,535,361 4,535,065,272 648,676,890 1,122,377,951 13,000,000 889,480,595 42,645,454,594 (10,836,600) (305,059,000) 2,135,606,239 (305,059,000) 2,124,769,639

Step by Step Solution

★★★★★

3.37 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

The adjustments to the 202021 operational expenditure are significant and have a number of major considerations The increase in employment costs The i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started