Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide a program that projects yearly income, the amount saved towards retirement each year, and total retirement savings. Assume a 3 percent raise on

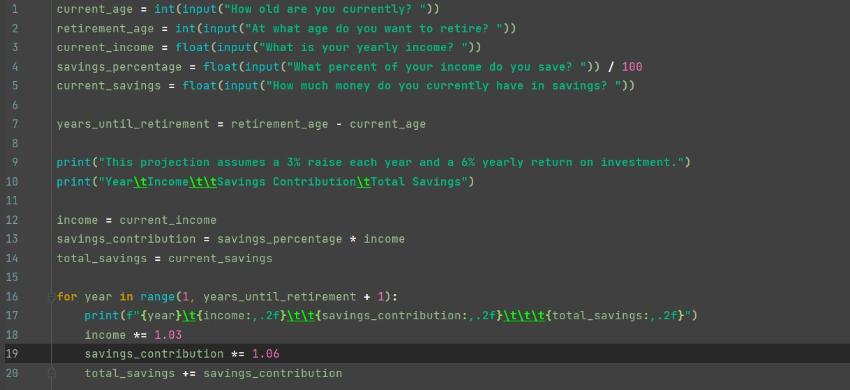

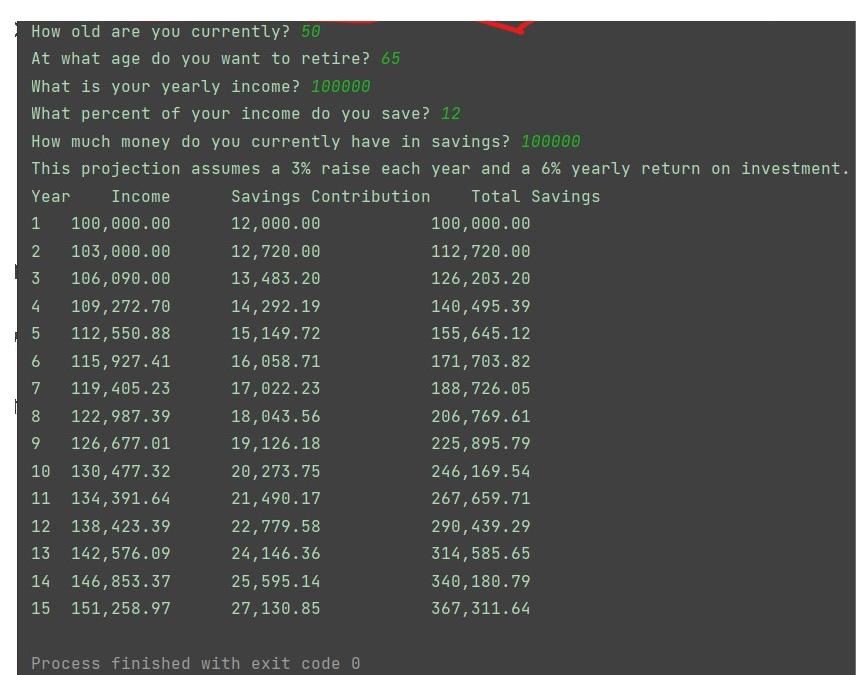

Provide a program that projects yearly income, the amount saved towards retirement each year, and total retirement savings. Assume a 3 percent raise on the starting income each year, and a 6% yearly return on investment. You will need to ask the user their current age, at what age they want to retire, what their current income is, what percent of their income they save each year, and how much they currently have in savings. You will calculate how many years until retirement, and display the projected income, savings contribution, and total savings each year. Hint: Assume they will enter a whole number for the percent of income saved and divide it by 100 (for 8 percent - 8/100 .08). 1 current age = int(input("How old are you currently? ")) 2 3 current income = float(input("What is your yearly income? ")) 4 5 retirement age = int(input("At what age do you want to retire? ")) savings percentage = float(input("What percent of your income do you save? ")) / 100 current savings = float(input("How much money do you currently have in savings? ")) 6 7 years until retirement = retirement age current_age B 9 10 11 12 13 14 15 16 17 18 19 20 print("This projection assumes a 3% raise each year and a 6% yearly return on investment.") print("Year\tIncome\t\tSavings Contribution\tTotal Savings") income = current income savings contribution = savings percentage * income total_savings = current_savings for year in range(1, years until retirement + 1): print("{year}\t{income:, .2f}\t\t{savings_contribution:, .2f}\t\t\t{total_savings:,.2f}") income *= 1.03 savings contribution = 1.06 total_savings += savings contribution How old are you currently? 50 At what age do you want to retire? 65 What is your yearly income? 100000 What percent of your income do you save? 12 How much money do you currently have in savings? 100000 This projection assumes a 3% raise each year and a 6% yearly return on investment. Year Savings Contribution Total Savings Income 1 100,000.00 12,000.00 100,000.00 2 103,000.00 12,720.00 112,720.00 3 106,090.00 13,483.20 126,203.20 4 109,272.70 14,292.19 140,495.39 5 112,550.88 15,149.72 155,645.12 6 115,927.41 16,058.71 171,703.82 7 119,405.23 17,022.23 188,726.05 8 122,987.39 18,043.56 206,769.61 9 126,677.01 19,126.18 225,895.79 10 130,477.32 20,273.75 246,169.54 11 134,391.64 21,490.17 267,659.71 12 138,423.39 22,779.58 290,439.29 13 142,576.09 24,146.36 314,585.65 14 146,853.37 25,595.14 340,180.79 15 151,258.97 27,130.85 367,311.64 Process finished with exit code

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started