Answered step by step

Verified Expert Solution

Question

1 Approved Answer

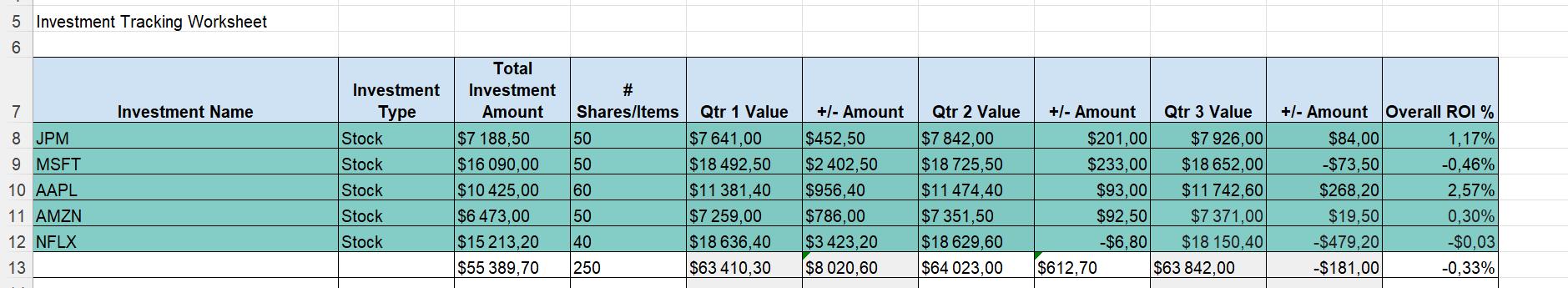

Provide a sufficient explanation of what transpired over this period (starting from initial investment to quarter 1, quarter 2, and quarter 3) for each company

Provide a sufficient explanation of what transpired over this period (starting from initial investment to quarter 1, quarter 2, and quarter 3) for each company and then for the overall portfolio, how the investments are doing, and what changes you would suggest (if any). please explain your rationale as well.

The companies are JP Morgan & Chase, Microsoft, Apple, Amazon, and Netflix

56 5 Investment Tracking Worksheet 7 8 JPM 9 MSFT 10 AAPL 11 AMZN 12 NFLX 13 Investment Name Total Investment Investment # Type Amount Shares/Items Stock $7 188,50 50 $7 641,00 Stock $16 090,00 50 $18 492,50 Stock $10 425,00 60 $11381,40 Stock $6 473,00 50 $7 259.00 Qtr 1 Value +/- Amount $452,50 $2 402,50 $956,40 $786,00 Qtr 2 Value $7 842,00 $18 725,50 $11474,40 $7 351,50 +/- Amount Qtr 3 Value +/- Amount Overall ROI % $201,00 $7 926,00 $84,00 1,17% $233,00 $18 652,00 -$73,50 -0,46% $93,00 $11742,60 $268,20 2,57% $92,50 $7 371,00 $19,50 0,30% Stock $15 213,20 40 $18 636,40 $3 423,20 $55 389,70 250 $63 410,30 $8 020,60 $18 629,60 $64 023,00 -$6,80 $18 150,40 -$479,20 -$0,03 $612,70 $63 842,00 -$181,00 -0,33%

Step by Step Solution

★★★★★

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Heres a detailed explanation of the performance of each company and the overall portfolio over the three quarters along with suggested changes 1 JP Morgan Chase JPM Initial Investment 718850 Qtr 1 Inc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started