Answered step by step

Verified Expert Solution

Question

1 Approved Answer

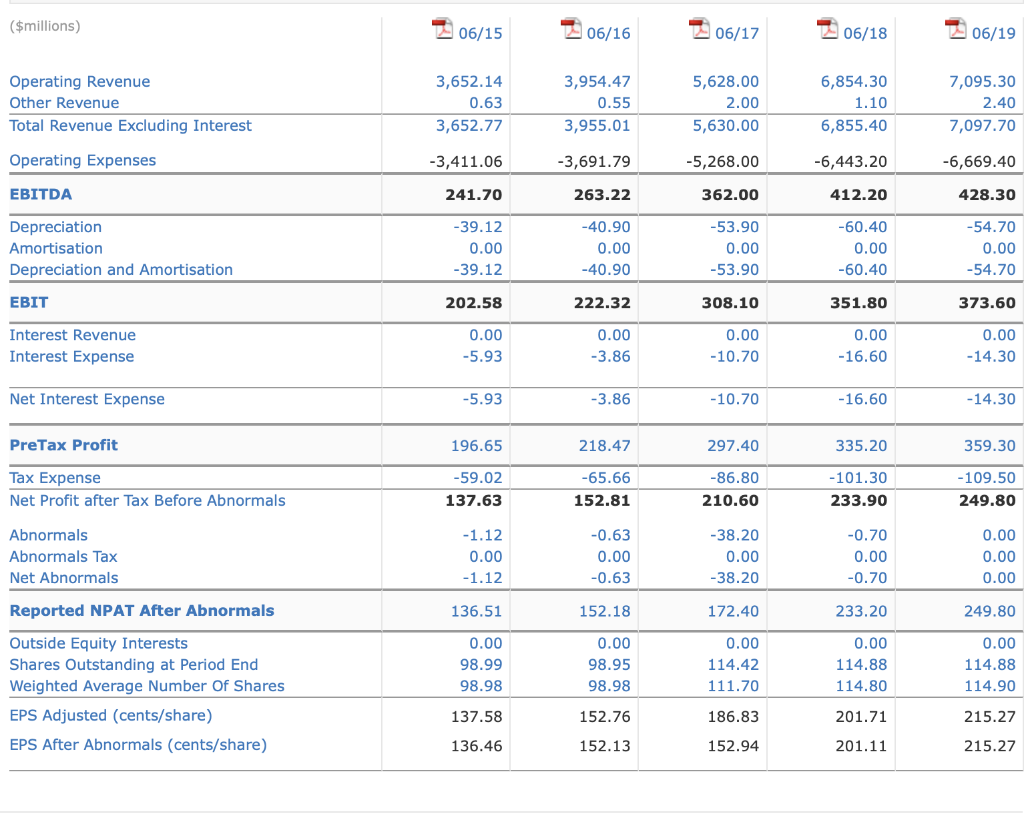

Provide a trend analysis for the previous 5 years for key profit and cash flow figures of JBH. In addition provide a discussion of any

Provide a trend analysis for the previous 5 years for key profit and cash flow figures of JBH. In addition provide a discussion of any noticeable trends or outliers.

($millions) Operating Cash Flow Receipts from customers Payments to Suppliers and Employees Dividends Received Interest Received Interest Paid Tax Paid Other Operating Cash Flow Net Operating Cash Flow Investing Cash Flow Payment for Purchase of PPE Proceeds from Sale of PPE Investments Purchased Proceeds from Sale of Investments Payments for Purchase of Subsidiaries Proceeds from Sale of Subsidiaries Loans Granted Loans Repaid Other Investing Cash Flow Net Investing Cash Flow Financing Cash Flow Proceeds from Issues Proceeds from Borrowings Repayment of Borrowings Dividends Paid Other Financing Cash Flow Net Financing Cash Flow Net Increase in Cash Cash at Beginning of Period Exchange Rate Adj Cash at End of Period 06/15 4,012.13 -3,767.21 0.00 0.55 -5.69 -59.89 0.00 179.90 -42.47 0.50 0.00 0.00 -2.40 0.00 0.00 0.00 0.00 -44.37 3.12 0.00 -40.11 -87.17 -5.48 -129.64 5.89 43.44 -0.20 49.13 06/16 4,355.75 -4,101.23 0.00 0.52 -3.66 -66.25 0.00 185.14 -52.34 0.34 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -52.00 5.96 0.00 -30.00 -93.20 -13.32 -130.56 2.57 49.13 0.18 51.88 06/17 6,205.50 -5,908.80 0.00 1.70 -9.30 -98.50 0.00 190.60 -49.10 0.20 0.00 0.00 -836.60 0.00 0.00 0.00 0.00 -885.50 395.90 450.00 0.00 -119.10 -10.90 715.90 21.00 51.90 -0.10 72.80 06/18 7,551.90 -7,130.50 0.00 0.50 -15.00 -114.80 0.00 292.10 -54.40 0.40 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -54.00 3.00 -89.70 0.00 -151.60 -0.80 -239.10 -1.00 72.80 0.20 72.00 06/19 7,804.90 -7,373.80 0.00 0.70 -13.80 -116.40 0.00 301.60 -59.30 0.20 0.00 0.00 0.00 0.00 0.00 0.00 0.00 -59.10 1.90 -30.50 0.00 -157.40 -9.40 -195.40 47.10 72.00 0.10 119.20 ($millions) Operating Revenue Other Revenue Total Revenue Excluding Interest Operating Expenses EBITDA Depreciation Amortisation Depreciation and Amortisation EBIT Interest Revenue Interest Expense Net Interest Expense PreTax Profit Tax Expense Net Profit after Tax Before Abnormals Abnormals Abnormals Tax Net Abnormals Reported NPAT After Abnormals Outside Equity Interests Shares Outstanding at Period End Weighted Average Number Of Shares EPS Adjusted (cents/share) EPS After Abnormals (cents/share) 06/15 3,652.14 0.63 3,652.77 -3,411.06 241.70 -39.12 0.00 -39.12 202.58 0.00 -5.93 -5.93 196.65 -59.02 137.63 -1.12 0.00 -1.12 136.51 0.00 98.99 98.98 137.58 136.46 06/16 3,954.47 0.55 3,955.01 -3,691.79 263.22 -40.90 0.00 -40.90 222.32 0.00 -3.86 -3.86 218.47 -65.66 152.81 -0.63 0.00 -0.63 152.18 0.00 98.95 98.98 152.76 152.13 06/17 5,628.00 2.00 5,630.00 -5,268.00 362.00 -53.90 0.00 -53.90 308.10 0.00 -10.70 -10.70 297.40 -86.80 210.60 -38.20 0.00 -38.20 172.40 0.00 114.42 111.70 186.83 152.94 06/18 6,854.30 1.10 6,855.40 -6,443.20 412.20 -60.40 0.00 -60.40 351.80 0.00 -16.60 -16.60 335.20 -101.30 233.90 -0.70 0.00 -0.70 233.20 0.00 114.88 114.80 201.71 201.11 06/19 7,095.30 2.40 7,097.70 -6,669.40 428.30 -54.70 0.00 -54.70 373.60 0.00 -14.30 -14.30 359.30 -109.50 249.80 0.00 0.00 0.00 249.80 0.00 114.88 114.90 215.27 215.27

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Key Profit figures Year EBITDA Change in NPAT Change in Operating Cash Flow Change in Investing Cash ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started