. Provide adequate solutions to the following attachments.

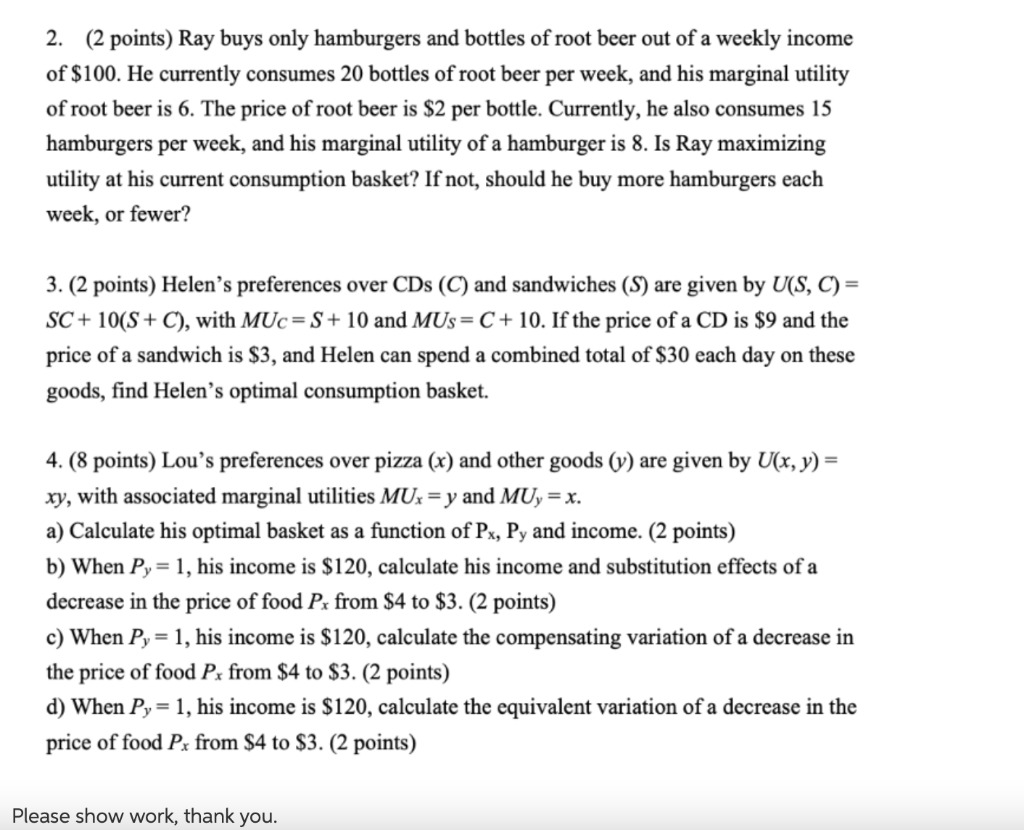

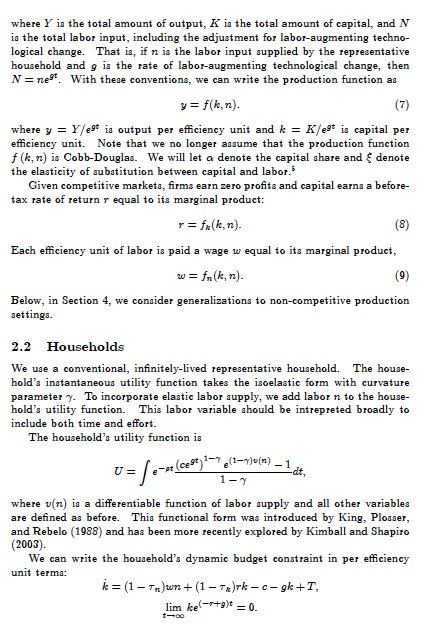

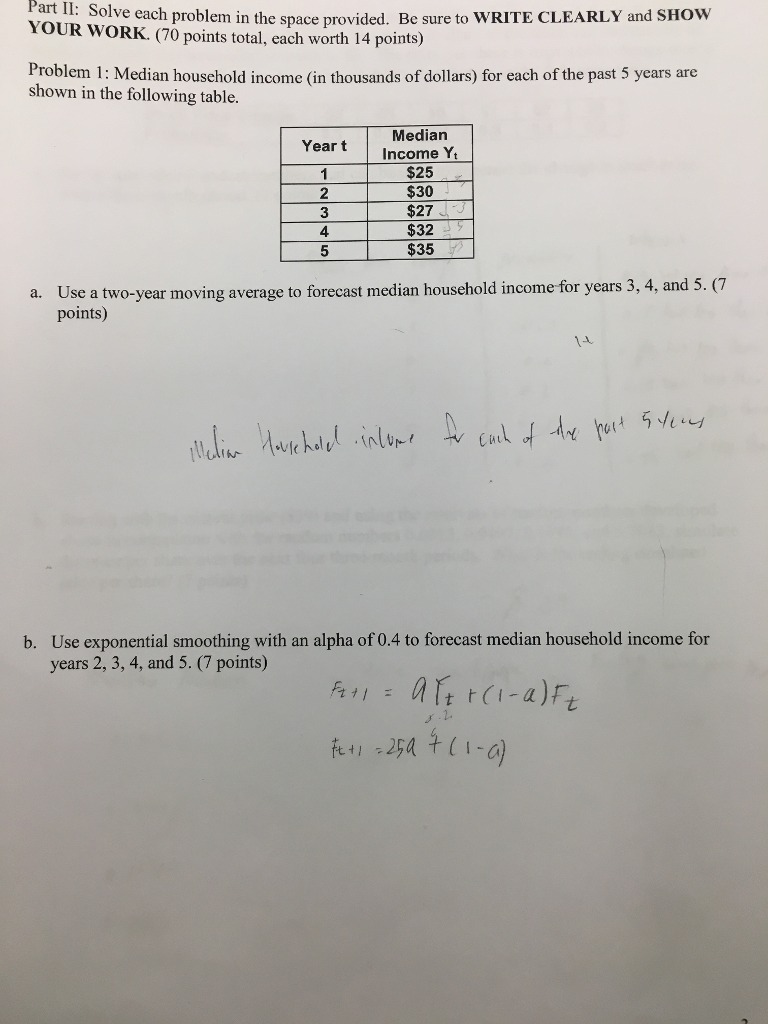

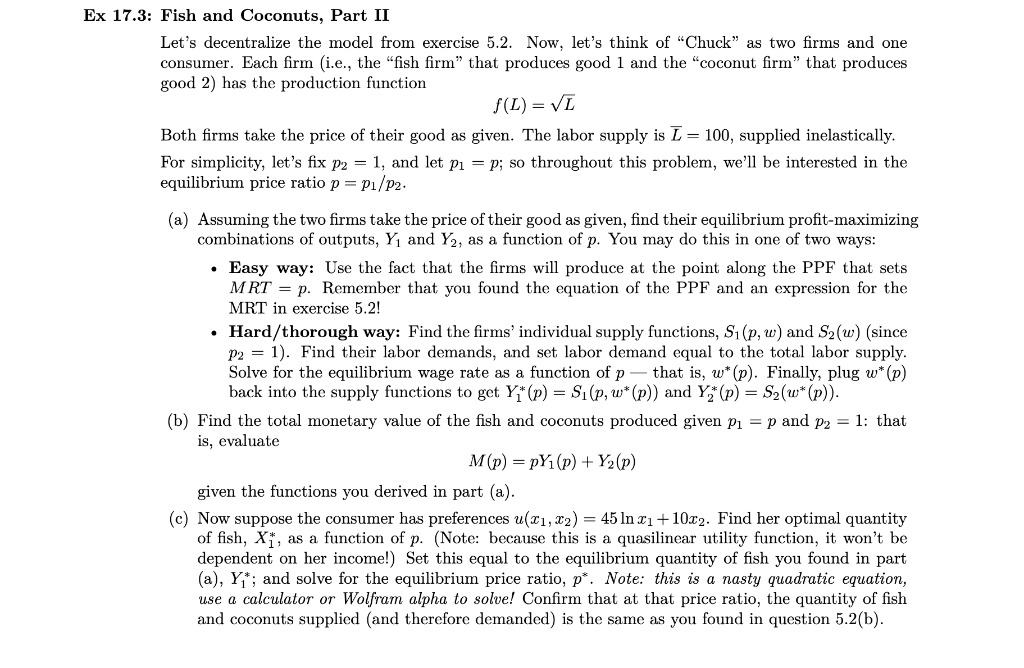

2. (2 points) Rey buys only hamburgers and bottles of root beer out of a weekly income of 5100. He currently consumes 20 bottles of root beer per week, and his marginal utility of root beer is 6. The price of root beer is $2 per bottle. Currently, he also consumes 15 hamburgers per week, and his marginal utility of a hamburger is 8. Is Ray maximizing utility at his current consumption basket? If not, should he buy more hamburgers each week, or fewer? 3. (2 points) Helen's preferences over CDs (C) and sandwiches (S) are given by UIS, C) = SC+10(S+ C), withMUc=S+10 andMUs= (3+ 10. Ifthe price ofaCD is $9 and the price of a sandwich is $3, and Helen can spend a combined total of $30 each day on these goods, nd Helen's optimal consmrtption basket. 4. (8 points) Lou's preferences over pizza (x) and other goods 0;) are given by U(x, y) = xy, with associated marginal utilities MU: = y and m = x. a) Calculate his optimal basket as a function of Pi, Py and income. (2 points) b) When Py = 1, his income is $120, calculate his income and substitution effects of a decrease in the price offood l";r from $4 to $3. (2 points) c) When P, = 1, his incotne is $120, calculate the compensating variation of a decrease in the price of food P; from $4 to $3. (2 points) (1) WhenPy = 1, his income is $120, calculate the equivalent variation ofa decrease in the price of food P: from $4 to $3. (2 points) Please show work, thank you. where Y is the total amount of output, A is the total amount of capital, and N is the total labor input, including the adjustment for labor-augmenting techno- logical change. That is, if n is the labor input supplied by the representative household and g is the rate of labor-augmenting technological change, then N= ne". With these conventions, we can write the production function as y = f(k, n). (7) where y = 1/e" is output per efficiency unit and k = Kest is capital per efficiency unit. Note that we no longer assume that the production function f (k, n) is Cobb-Douglas. We will let a denote the capital share and { denote the elasticity of substitution between capital and labor. Given competitive markets, firms earn zero profits and capital earns a before- tax rate of return r equal to its marginal product: r = f*( k,n). (8) Each efficiency unit of labor is paid a wage w equal to its marginal product, w = fn( k, n). (9) Below, in Section 4, we consider generalizations to non-competitive production settings. 2.2 Households We use a conventional, infinitely-lived representative household. The house- hold's instantaneous utility function takes the isoelastic form with curvature parameter y. To incorporate elastic labor supply, we add labor n to the house- hold's utility function. This labor variable should be intrepreted broadly to include both time and effort. The household's utility function is U= e-m (ce)1-7 (1-)(m) - 1 1-7 where v(n) is a differentiable function of labor supply and all other variables are defined as before. This functional form was introduced by King, Ploaser, and Rebelo (1988) and has been more recently explored by Kimball and Shapiro (2003). We can write the household's dynamic budget constraint in per efficiency unit terms: k= (1 - T)wn+ (1 -Tx)rk - c- gk+I, lim kertalt = 0.Part II: Solve each problem in the space provided. Be sure to WRITE CLEARLY and SHOW YOUR WORK. (70 points total, each worth 14 points) Problem 1: Median household income (in thousands of dollars) for each of the past 5 years are shown in the following table. Year t Median Income Yt 1 $25 $30 AWN $27 $32 $35 a. Use a two-year moving average to forecast median household income for years 3, 4, and 5. (7 points) Median Household income for cack of are part s years b. Use exponential smoothing with an alpha of 0.4 to forecast median household income for years 2, 3, 4, and 5. (7 points) F+ + 1 = ATE TCI - a)FE $1+1 = 250 7 ( 1 -a )Ex 17.3: Fish and Coconuts, Part II Let's decentralize the model from exercise 5.2. Now, let's think of "Chuck" as two firms and one consumer. Each firm (i.e., the "fish firm" that produces good 1 and the "coconut firm" that produces good 2) has the production function f(L) = VI Both firms take the price of their good as given. The labor supply is L = 100, supplied inelastically. For simplicity, let's fix p2 = 1, and let p1 = p; so throughout this problem, we'll be interested in the equilibrium price ratio p = p1/P2. (a) Assuming the two firms take the price of their good as given, find their equilibrium profit-maximizing combinations of outputs, Y, and Y2, as a function of p. You may do this in one of two ways: . Easy way: Use the fact that the firms will produce at the point along the PPF that sets MRT = p. Remember that you found the equation of the PPF and an expression for the MRT in exercise 5.2! . Hard/thorough way: Find the firms' individual supply functions, S1(p, w) and S2(w) (since p2 = 1). Find their labor demands, and set labor demand equal to the total labor supply. Solve for the equilibrium wage rate as a function of p - that is, w*(p). Finally, plug w* (p) back into the supply functions to get Yr (p) = Si(p, w*(p)) and Y,(p) = S2(w* (p)). (b) Find the total monetary value of the fish and coconuts produced given p1 = p and py = 1: that is, evaluate M(p) = pYi(p) + Y2(p) given the functions you derived in part (a). (c) Now suppose the consumer has preferences u($1, 22) = 45 Inc1 + 1012. Find her optimal quantity of fish, X], as a function of p. (Note: because this is a quasilinear utility function, it won't be dependent on her income!) Set this equal to the equilibrium quantity of fish you found in part (a), Y; and solve for the equilibrium price ratio, p*. Note: this is a nasty quadratic equation, use a calculator or Wolfram alpha to solve! Confirm that at that price ratio, the quantity of fish and coconuts supplied (and therefore demanded) is the same as you found in question 5.2(b)