Answered step by step

Verified Expert Solution

Question

1 Approved Answer

provide answer with using a financial calculator function please. provide answer with using a financial calculator function please. You just won the state lottery. The

provide answer with using a financial calculator function please.

provide answer with using a financial calculator function please.

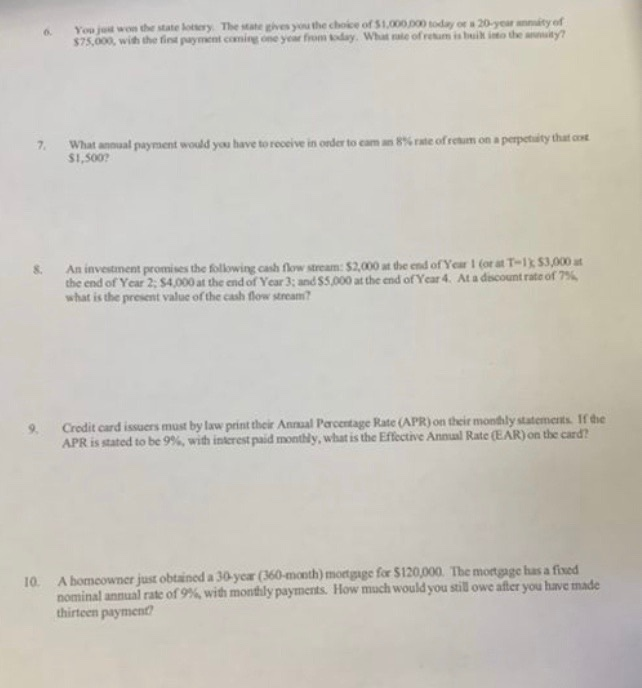

You just won the state lottery. The watehes you the choice of $1.000 D oday or 20 year w ity of $75,000, with the payment coming one year from today. What we ofrem i bukit them ? 7. 8% rate of return on a perpctity that cont What annual payment would you have to receive in order to cam $1,500 An investment promises the following cash flow stream: 52.000 at the end of Year I for at T-153,000 the end of Year 2, S4,000 at the end of Year 3: and 55.000 at the end of Year 4. At a discount rate of 7% what is the present value of the cash flow stream? Credit card issuers must by law print their Annual Percentage Rate (APR) on their monthly statements. If the APR is stated to be 9%, with interest paid monthly, what is the Effective Annual Rate (EAR) on the card? 10. A bomeowner just obtained a 30 year (360-month) mortgage for $120,000. The mortgage has a fixed nominal annual rate of 9%, with monthly payments. How much would you still owe after you have made thirteen payment Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started