Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide answers for all the parts of the question! 6. Discuss how you would expect the financing choices of the following firms to differ and

Provide answers for all the parts of the question!

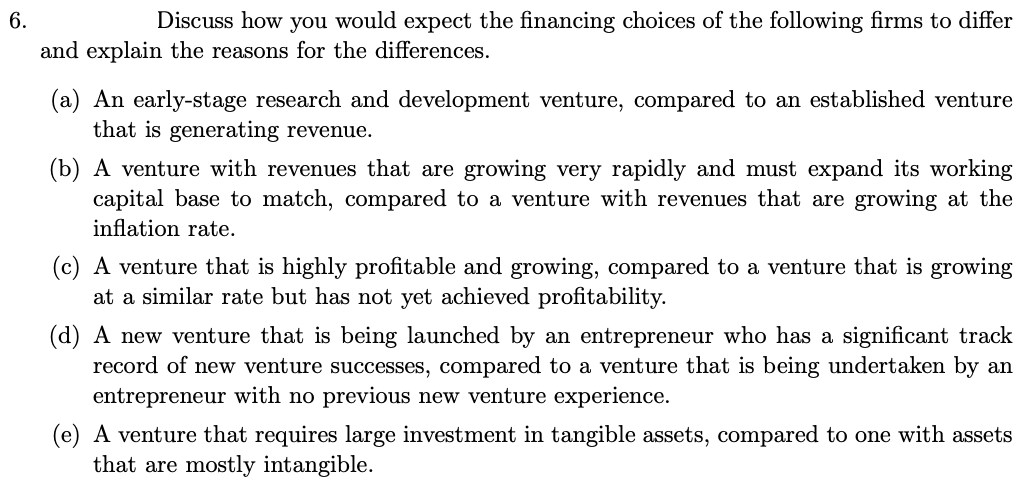

6. Discuss how you would expect the financing choices of the following firms to differ and explain the reasons for the differences. (a) An early-stage research and development venture, compared to an established venture that is generating revenue. (b) A venture with revenues that are growing very rapidly and must expand its working capital base to match, compared to a venture with revenues that are growing at the inflation rate. (c) A venture that is highly profitable and growing, compared to a venture that is growing at a similar rate but has not yet achieved profitability. (d) A new venture that is being launched by an entrepreneur who has a significant track record of new venture successes, compared to a venture that is being undertaken by an entrepreneur with no previous new venture experience. (e) A venture that requires large investment in tangible assets, compared to one with assets that are mostly intangibleStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started