Provide detailed calculations

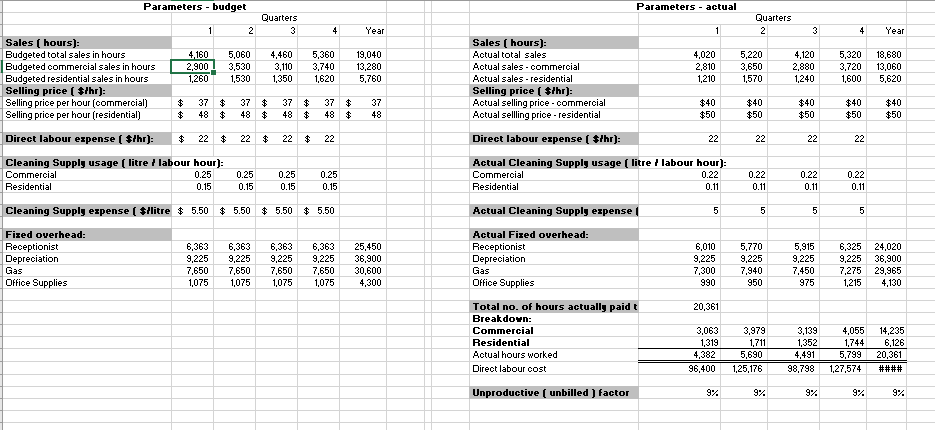

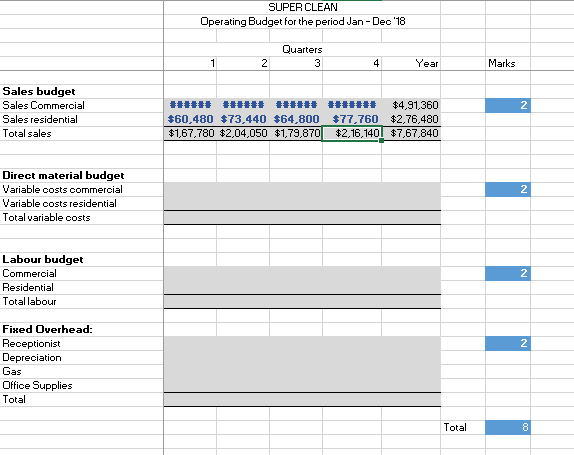

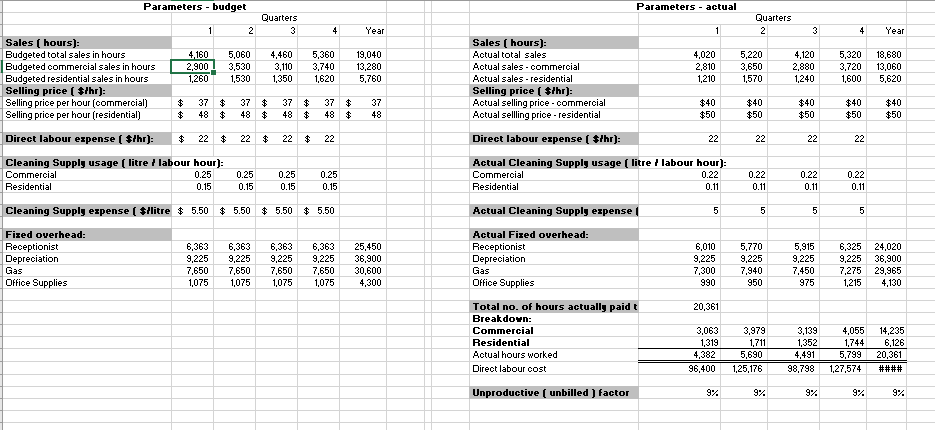

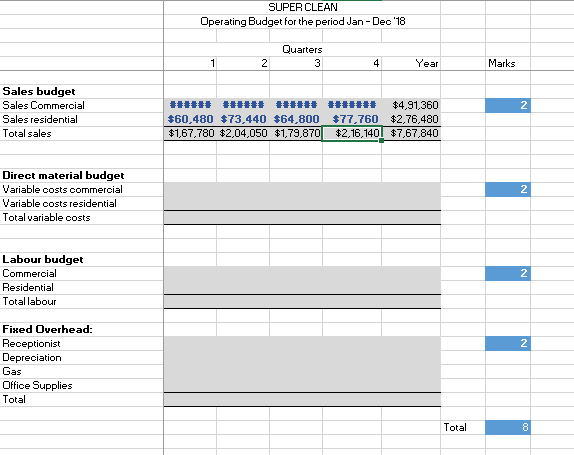

Parameters - budget Parameters - actual Quarters 3 Quarters 2 1 2 4 Year 1 3 4 Year Sales ( hours): Budgeted total sales in hours Budgeted commercial sales in hours Budgeted residential sales in hours Selling price ( $/hr): Selling price per hour (commercial) Selling price per hour (residential) 4,160 2,900 1,260 5,060 3,530 1,530 4,460 3,110 1350 5,360 3,740 1,620 19,040 13,280 5,760 Sales ( hours): Actualtotal sales Actual sales -commercial Actual sales - residential Selling price ( $lhr): Actual selling price-commercial Actual selling price - residential 4,020 2,810 1,210 5,220 3,650 1,570 4,120 2,880 1,240 5,320 3,720 1,600 18,680 13,060 5,620 $ 37 $ 37 37 $ 48 $ $ 37 $ 48 $ 37 48 $40 $50 $40 $50 $40 $50 $40 $50 $40 $50 Direct labour expense ( $/hr): $ 22 $ 22 $ 22 $ 22 Direct labour expense { $/hr): 22 22 22 22 Cleaning Supply usage ( litre / labour hour): Commercial 0.25 Residential 0.15 0.25 0.15 0.25 0.15 0.25 0.15 Actual Cleaning Supply usage ( litre / labour hour): Commercial 0.22 Residential 0.11 0.22 0.11 0.22 0.11 0.22 0.11 Cleaning Supply expense ( Silitre $ 5.50 $ 5.50 $ 5.50 $ 5.50 Actual Cleaning Supply expense 5 5 5 5 Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,363 9.225 7,650 1,075 6,363 9,225 7,650 1,075 6,363 9.225 7,650 1,075 6.363 9.225 7,650 1,075 25,450 36,900 30,600 4,300 Actual Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,010 9,225 7.300 990 5,770 9,225 7,940 950 5,915 9.225 7,450 975 6,325 9.225 7.275 1.215 24,020 36,900 29,965 4,130 20,361 Total no. of hours actually paid t Breakdown: Commercial Residential Actual hours worked Direct labour cost 3,063 1,319 4,382 96,400 3,979 1,711 5,690 1,25,176 3,139 1,352 4,491 98,798 4,055 1,744 5,799 1,27,574 14,235 6,126 20,361 #### Unproductive ( unbilled ) factor 9% 9% 9% SUPER CLEAN Operating Budget for the period Jan-Dec '18 Quarters 3 1 2 4 Year Marks 2 Sales budget Sales Commercial Sales residential Total sales ##### ###### $4,91,360 $60,480 $73,440 $64,800 $77,760 $2,76,480 $1,67,780 $2,04,050 $1,79,870 $2,16,1401 $7,67,840 2 Direct material budget Variable costs commercial Variable costs residential Total variable costs 2 Labour budget Commercial Residential Totallabour 2 Fixed Overhead: Receptionist Depreciation Gas Office Supplies Total Total 8 Parameters - budget Parameters - actual Quarters 3 Quarters 2 1 2 4 Year 1 3 4 Year Sales ( hours): Budgeted total sales in hours Budgeted commercial sales in hours Budgeted residential sales in hours Selling price ( $/hr): Selling price per hour (commercial) Selling price per hour (residential) 4,160 2,900 1,260 5,060 3,530 1,530 4,460 3,110 1350 5,360 3,740 1,620 19,040 13,280 5,760 Sales ( hours): Actualtotal sales Actual sales -commercial Actual sales - residential Selling price ( $lhr): Actual selling price-commercial Actual selling price - residential 4,020 2,810 1,210 5,220 3,650 1,570 4,120 2,880 1,240 5,320 3,720 1,600 18,680 13,060 5,620 $ 37 $ 37 37 $ 48 $ $ 37 $ 48 $ 37 48 $40 $50 $40 $50 $40 $50 $40 $50 $40 $50 Direct labour expense ( $/hr): $ 22 $ 22 $ 22 $ 22 Direct labour expense { $/hr): 22 22 22 22 Cleaning Supply usage ( litre / labour hour): Commercial 0.25 Residential 0.15 0.25 0.15 0.25 0.15 0.25 0.15 Actual Cleaning Supply usage ( litre / labour hour): Commercial 0.22 Residential 0.11 0.22 0.11 0.22 0.11 0.22 0.11 Cleaning Supply expense ( Silitre $ 5.50 $ 5.50 $ 5.50 $ 5.50 Actual Cleaning Supply expense 5 5 5 5 Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,363 9.225 7,650 1,075 6,363 9,225 7,650 1,075 6,363 9.225 7,650 1,075 6.363 9.225 7,650 1,075 25,450 36,900 30,600 4,300 Actual Fixed overhead: Receptionist Depreciation Gas Office Supplies 6,010 9,225 7.300 990 5,770 9,225 7,940 950 5,915 9.225 7,450 975 6,325 9.225 7.275 1.215 24,020 36,900 29,965 4,130 20,361 Total no. of hours actually paid t Breakdown: Commercial Residential Actual hours worked Direct labour cost 3,063 1,319 4,382 96,400 3,979 1,711 5,690 1,25,176 3,139 1,352 4,491 98,798 4,055 1,744 5,799 1,27,574 14,235 6,126 20,361 #### Unproductive ( unbilled ) factor 9% 9% 9% SUPER CLEAN Operating Budget for the period Jan-Dec '18 Quarters 3 1 2 4 Year Marks 2 Sales budget Sales Commercial Sales residential Total sales ##### ###### $4,91,360 $60,480 $73,440 $64,800 $77,760 $2,76,480 $1,67,780 $2,04,050 $1,79,870 $2,16,1401 $7,67,840 2 Direct material budget Variable costs commercial Variable costs residential Total variable costs 2 Labour budget Commercial Residential Totallabour 2 Fixed Overhead: Receptionist Depreciation Gas Office Supplies Total Total 8