. Provide detailed explanations to the attachments.

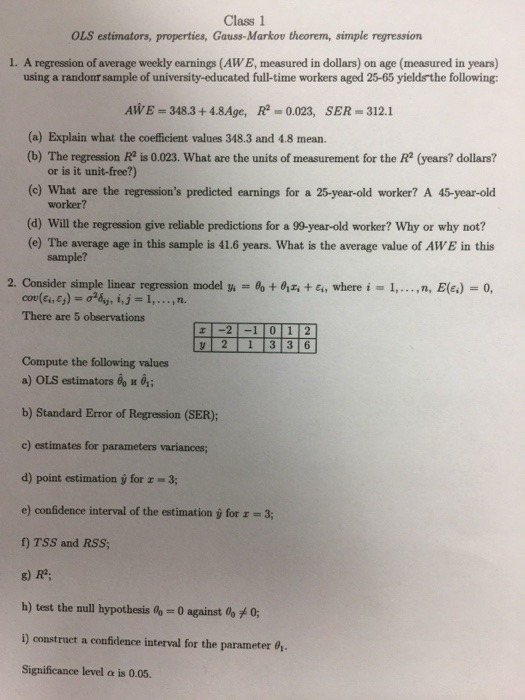

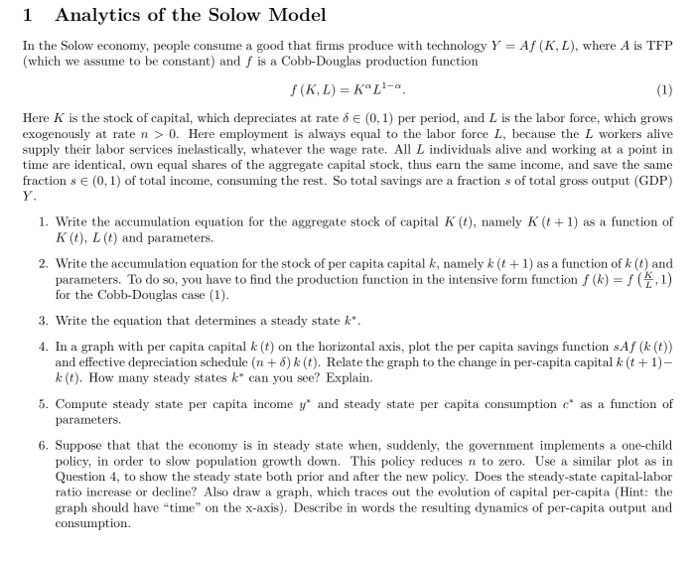

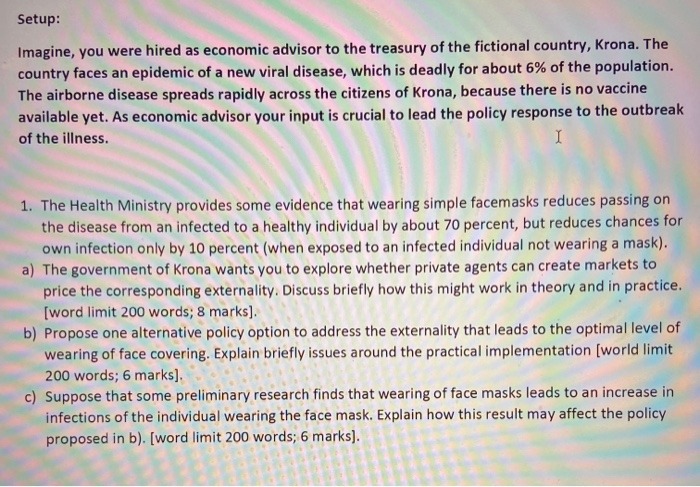

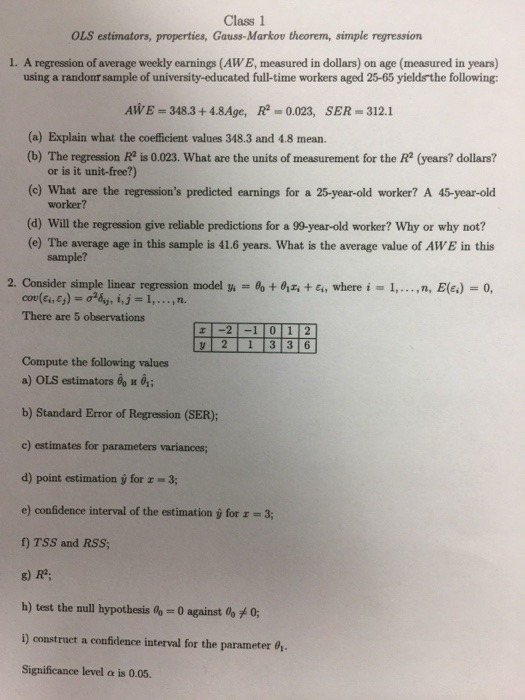

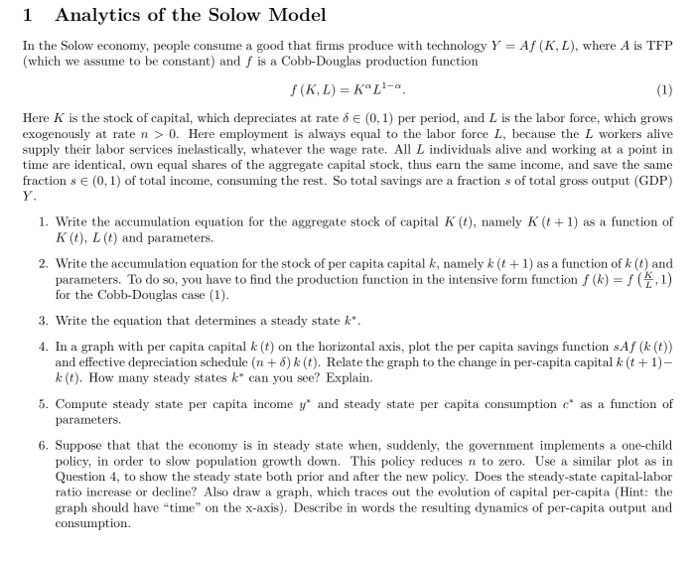

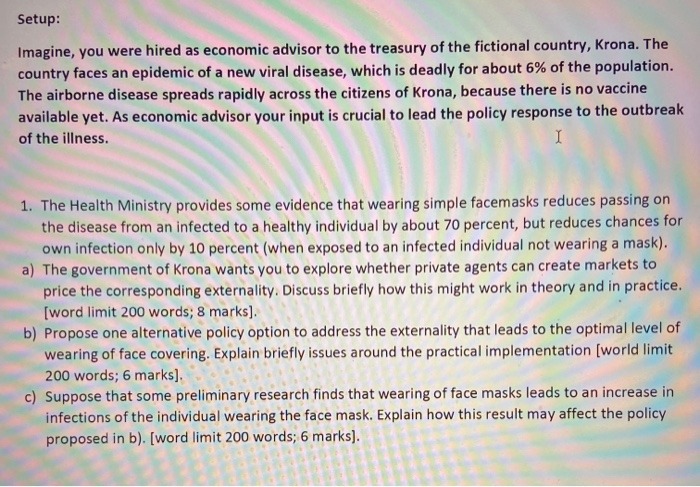

Class 1 OLS estimators, properties, Gauss-Markov theorem, simple regression 1. A regression of average weekly earnings (AW E, measured in dollars) on age (measured in years) using a randon sample of university-educated full-time workers aged 25-65 yields the following: AWE = 348.3 + 4.8Age, R' - 0.023, SER = 312.1 (a) Explain what the coefficient values 348.3 and 4.8 mean. (b) The regression R" is 0.023. What are the units of measurement for the R? (years? dollars? or is it unit-free?) (c) What are the regression's predicted earnings for a 25-year-old worker? A 45-year-old worker? (d) Will the regression give reliable predictions for a 99-year-old worker? Why or why not? (e) The average age in this sample is 41.6 years. What is the average value of AWE in this sample? 2. Consider simple linear regression model y = 6 + 65, + 6,, where i = 1,..., n, E(e.) = 0, cou(, Es ) = 0'dy, i, j = 1,...,n. There are 5 observations -2 -101 2 y 2 1 3 3 6 Compute the following values a) OLS estimators do # 61; b) Standard Error of Regression (SER); c) estimates for parameters variances; d) point estimation y for r = 3; e) confidence interval of the estimation y for = = 3; [) TSS and RSS; g) R'; h) test the null hypothesis 60 = 0 against 4 / 0; i) construct a confidence interval for the parameter . Significance level a is 0.05.2 A More General Ramsey Model In this and the next three sections, we extend the basic Ramsey model along a number of dimensions. In this section we include elastic labor supply and a more general production technology. We also present a more detailed derivation of our results. To allow for elastic labor supply, we use a form of preferences over consump- tion and labor proposed by King, Plosser, and Rebelo (1988). King-Plosser- Rebelo preferences have the property that the uncompensated elasticity of labor supply is zero. This feature has the appealing implication that long-run growth caused by technological progress does not lead to a trend in hours worked. The compensated (constant-consumption) elasticity of labor supply need not be zero, however. This parameter, which we will call o, will have a significant role in some of our results. 2.1 Firms We begin with production. Assume there are many identical firms in competi- tive input and output markets, producing output with constant returns to scale technology according to the production function Y = F(K, N), The feedback depends critically on the tax rate. If the capital tax rate were 0.40 instead of 0.15, and all other parameter values are the some, the feedback from a capital tax cut would be 75 percent rether than 50 percent. The literature on taxation in the United States suggests that our choice of 7% = 7 = 0.25 is within the range of plausible estimates, although perhaps a bit conservative. Mendoza, Romin, and Tesar (1994) estimate a 40.7 percent capital tax rate (applied to corporate and non-corporate capital) for the United States in 1986, the last year of their series. This is above the estimate given by Gravelle (2004), who reports a rate of 37 percent for all capital in that year. Gravelle extends her estimates through 2003, by which point the capital tax rate had fallen to 17 percent. Mendoza et al. estimate a labor tax rate of 28.5 percent in 1980, together with a consumption tax of about 5 percent; these tax rates would combine to be equivalent to a tax on labor of about 31 percent.1 Analytics of the Solow Model In the Solow economy, people consume a good that firms produce with technology Y = Af (K, L), where A is TFP (which we assume to be constant) and f is a Cobb-Douglas production function f ( K, L) = KOL-a. (1) Here K is the stock of capital, which depreciates at rate o e (0, 1) per period, and L is the labor force, which grows exogenously at rate n > 0. Here employment is always equal to the labor force L, because the L workers alive supply their labor services inelastically, whatever the wage rate. All L individuals alive and working at a point in time are identical, own equal shares of the aggregate capital stock, thus earn the same income, and save the same fraction s E (0, 1) of total income, consuming the rest. So total savings are a fraction s of total gross output (GDP) Y. 1. Write the accumulation equation for the aggregate stock of capital K (), namely K (t + 1) as a function of K (t), L (t) and parameters. 2. Write the accumulation equation for the stock of per capita capital k, namely k (t + 1) as a function of k (t) and parameters. To do so, you have to find the production function in the intensive form function / (#) = f (7,1) for the Cobb-Douglas case (1). 3. Write the equation that determines a steady state &*. 4. In a graph with per capita capital & (t) on the horizontal axis, plot the per capita savings function sAf (k ()) and effective depreciation schedule (n + 6) k (). Relate the graph to the change in per-capita capital k (t + 1)- k (t). How many steady states k* can you see? Explain. 5. Compute steady state per capita income y" and steady state per capita consumption c* as a function of parameters. 6. Suppose that that the economy is in steady state when, suddenly, the government implements a one-child policy, in order to slow population growth down. This policy reduces n to zero. Use a similar plot as in Question 4, to show the steady state both prior and after the new policy. Does the steady-state capital-labor ratio increase or decline? Also draw a graph, which traces out the evolution of capital per-capita (Hint: the graph should have "time" on the x-axis). Describe in words the resulting dynamics of per-capita output and consumption.Setup: Imagine, you were hired as economic advisor to the treasury of the fictional country, Krona. The country faces an epidemic of a new viral disease, which is deadly for about 6% of the population. The airborne disease spreads rapidly across the citizens of Krona, because there is no vaccine available yet. As economic advisor your input is crucial to lead the policy response to the outbreak of the illness. 1. The Health Ministry provides some evidence that wearing simple facemasks reduces passing on the disease from an infected to a healthy individual by about 70 percent, but reduces chances for own infection only by 10 percent (when exposed to an infected individual not wearing a mask). a) The government of Krona wants you to explore whether private agents can create markets to price the corresponding externality. Discuss briefly how this might work in theory and in practice. [word limit 200 words; 8 marks]. b) Propose one alternative policy option to address the externality that leads to the optimal level of wearing of face covering. Explain briefly issues around the practical implementation [world limit 200 words; 6 marks]. c) Suppose that some preliminary research finds that wearing of face masks leads to an increase in infections of the individual wearing the face mask. Explain how this result may affect the policy proposed in b). [word limit 200 words; 6 marks].Setup: Imagine, you were hired as economic advisor to the treasury of the fictional country, Krona. The country faces an epidemic of a new viral disease, which is deadly for about 6% of the population. The airborne disease spreads rapidly across the citizens of Krona, because there is no vaccine available yet. As economic advisor your input is crucial to lead the policy response to the outbreak of the illness. 1. The Health Ministry provides some evidence that wearing simple facemasks reduces passing on the disease from an infected to a healthy individual by about 70 percent, but reduces chances for own infection only by 10 percent (when exposed to an infected individual not wearing a mask). a) The government of Krona wants you to explore whether private agents can create markets to price the corresponding externality. Discuss briefly how this might work in theory and in practice. [word limit 200 words; 8 marks]. b) Propose one alternative policy option to address the externality that leads to the optimal level of wearing of face covering. Explain briefly issues around the practical implementation [world limit 200 words; 6 marks]. c) Suppose that some preliminary research finds that wearing of face masks leads to an increase in infections of the individual wearing the face mask. Explain how this result may affect the policy proposed in b). [word limit 200 words; 6 marks]