Answered step by step

Verified Expert Solution

Question

1 Approved Answer

provide detailed solutions to both questions this is regarding part 2 of the question Question or (a) Assume that the Tanzanian Machine Tools Company Ltd

provide detailed solutions to both questions

this is regarding part 2 of the question

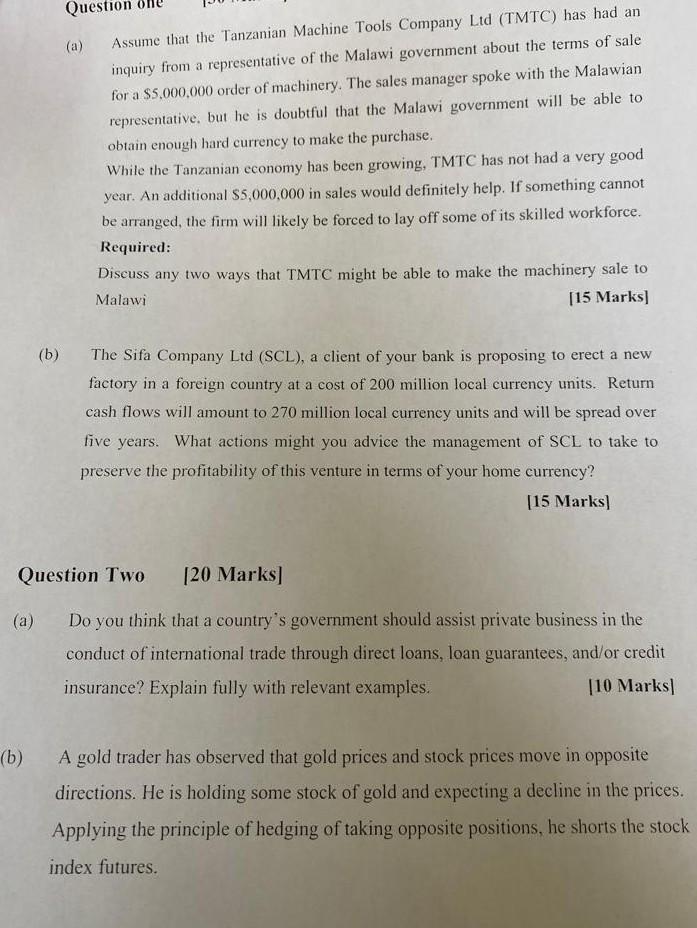

Question or (a) Assume that the Tanzanian Machine Tools Company Ltd (TMTC) has had an inquiry from a representative of the Malawi government about the terms of sale for a $5,000,000 order of machinery. The sales manager spoke with the Malawian representative, but he is doubtful that the Malawi government will be able to obtain enough hard currency to make the purchase. While the Tanzanian economy has been growing, TMTC has not had a very good year. An additional $5,000,000 in sales would definitely help. If something cannot be arranged, the firm will likely be forced to lay off some of its skilled workforce. Required: Discuss any two ways that TMTC might be able to make the machinery sale to Malawi [15 Marks] (b) The Sifa Company Ltd (SCL), a client of your bank is proposing to erect a new factory in a foreign country at a cost of 200 million local currency units. Return cash flows will amount to 270 million local currency units and will be spread over five years. What actions might you advice the management of SCL to take to preserve the profitability of this venture in terms of your home currency? [15 Marks) Question Two [20 Marks] (a) a Do you think that a country's government should assist private business in the conduct of international trade through direct loans, loan guarantees, and/or credit insurance? Explain fully with relevant examples. [10 Marks) (b) A gold trader has observed that gold prices and stock prices move in opposite directions. He is holding some stock of gold and expecting a decline in the prices. Applying the principle of hedging of taking opposite positions, he shorts the stock index futures. Required: Is he hedging or is it an inadvertent speculation? Discuss. 110 Marks Question or (a) Assume that the Tanzanian Machine Tools Company Ltd (TMTC) has had an inquiry from a representative of the Malawi government about the terms of sale for a $5,000,000 order of machinery. The sales manager spoke with the Malawian representative, but he is doubtful that the Malawi government will be able to obtain enough hard currency to make the purchase. While the Tanzanian economy has been growing, TMTC has not had a very good year. An additional $5,000,000 in sales would definitely help. If something cannot be arranged, the firm will likely be forced to lay off some of its skilled workforce. Required: Discuss any two ways that TMTC might be able to make the machinery sale to Malawi [15 Marks] (b) The Sifa Company Ltd (SCL), a client of your bank is proposing to erect a new factory in a foreign country at a cost of 200 million local currency units. Return cash flows will amount to 270 million local currency units and will be spread over five years. What actions might you advice the management of SCL to take to preserve the profitability of this venture in terms of your home currency? [15 Marks) Question Two [20 Marks] (a) a Do you think that a country's government should assist private business in the conduct of international trade through direct loans, loan guarantees, and/or credit insurance? Explain fully with relevant examples. [10 Marks) (b) A gold trader has observed that gold prices and stock prices move in opposite directions. He is holding some stock of gold and expecting a decline in the prices. Applying the principle of hedging of taking opposite positions, he shorts the stock index futures. Required: Is he hedging or is it an inadvertent speculation? Discuss. 110 MarksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started