Answered step by step

Verified Expert Solution

Question

1 Approved Answer

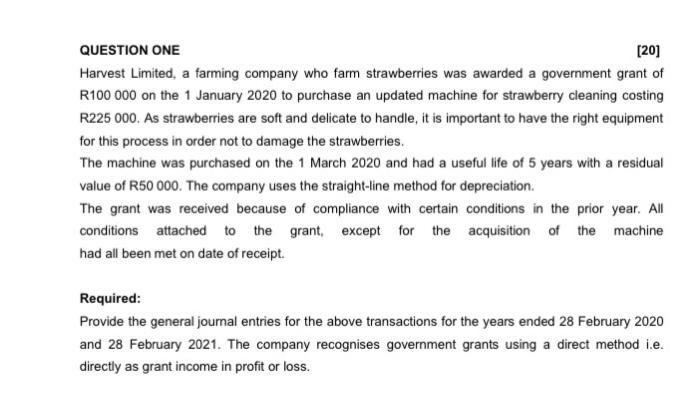

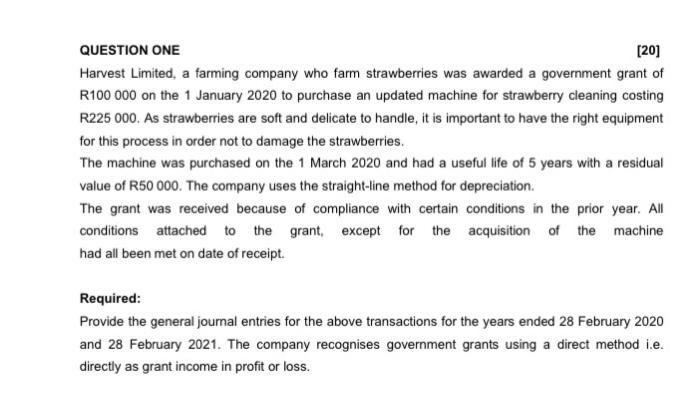

Provide generel journal entries. the government uses Direct method (25 marks) QUESTION ONE [20] Harvest Limited, a farming company who farm strawberries was awarded a

Provide generel journal entries.

QUESTION ONE [20] Harvest Limited, a farming company who farm strawberries was awarded a government grant of R100 000 on the 1 January 2020 to purchase an updated machine for strawberry cleaning costing R225 000. As strawberries are soft and delicate to handle, it is important to have the right equipment for this process in order not to damage the strawberries. The machine was purchased on the 1 March 2020 and had a useful life of 5 years with a residual value of R50 000. The company uses the straight-line method for depreciation. The grant was received because of compliance with certain conditions in the prior year. All conditions attached to the grant, except for the acquisition of the machine had all been met on date of receipt. Required: Provide the general journal entries for the above transactions for the years ended 28 February 2020 and 28 February 2021. The company recognises government grants using a direct method i.e. directly as grant income in profit or loss the government uses Direct method (25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started