Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide journal entries for the facts for both the modified accrual accounting basis and the accrual accounting basis. CLEARLY LABEL WHICH ENTRIES REPRESENT MODIFIED ACCRUAL

Provide journal entries for the facts for both the modified accrual accounting basis and the accrual accounting basis. CLEARLY LABEL WHICH ENTRIES REPRESENT MODIFIED ACCRUAL ACCOUNTING AND WHICH ENTRIES REPRESENT ACCRUAL ACCOUNTING.Salaries paid in cash during Salaries applicable to due to be paid January $Utility bill applicable to due to be paid January Equipment acquired at the beginning of and having an estimated useful lifeof yearsPayment of principal on longterm debt on December Payment of interest on longterm debt on December

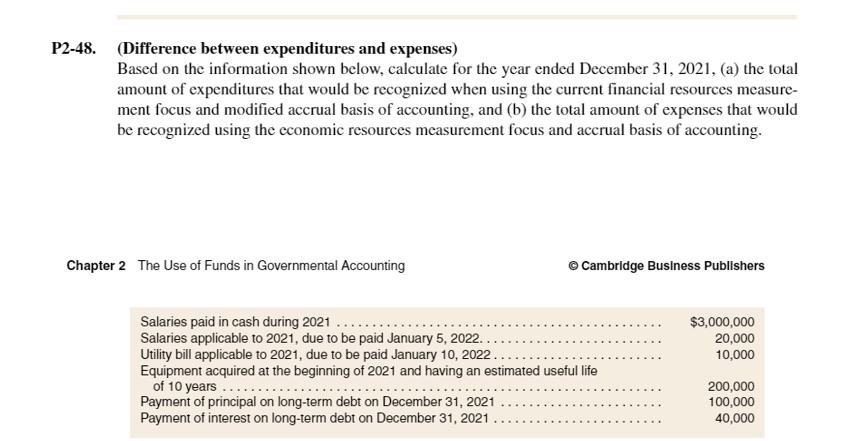

P2-48. (Difference between expenditures and expenses) Based on the information shown below, calculate for the year ended December 31, 2021, (a) the total amount of expenditures that would be recognized when using the current financial resources measure- ment focus and modified accrual basis of accounting, and (b) the total amount of expenses that would be recognized using the economic resources measurement focus and accrual basis of accounting. Chapter 2 The Use of Funds in Governmental Accounting Cambridge Business Publishers Salaries paid in cash during 2021 Salaries applicable to 2021, due to be paid January 5, 2022. Utility bill applicable to 2021, due to be paid January 10, 2022. Equipment acquired at the beginning of 2021 and having an estimated useful life of 10 years Payment of principal on long-term debt on December 31, 2021 Payment of interest on long-term debt on December 31, 2021 $3,000,000 20,000 10,000 200,000 100,000 40,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started