provide references.

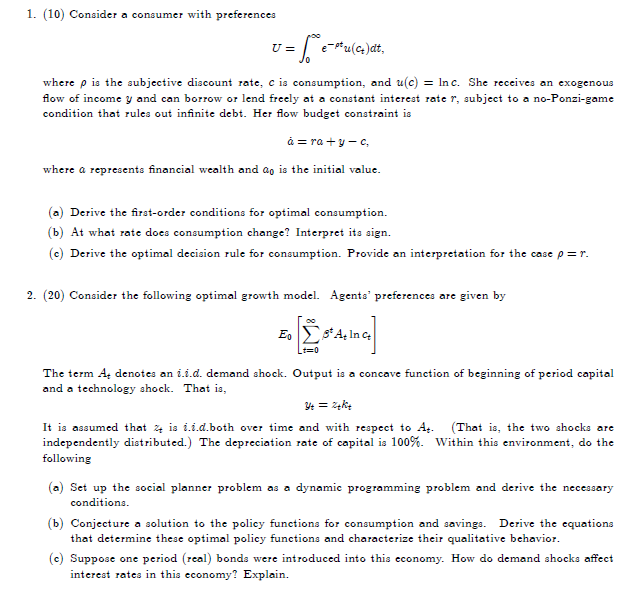

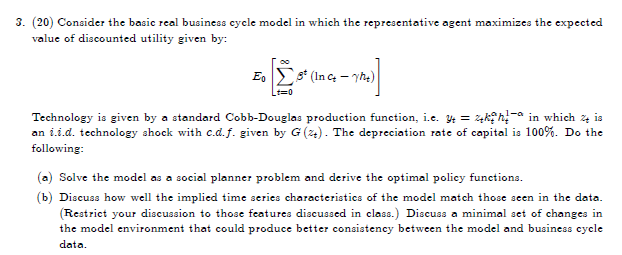

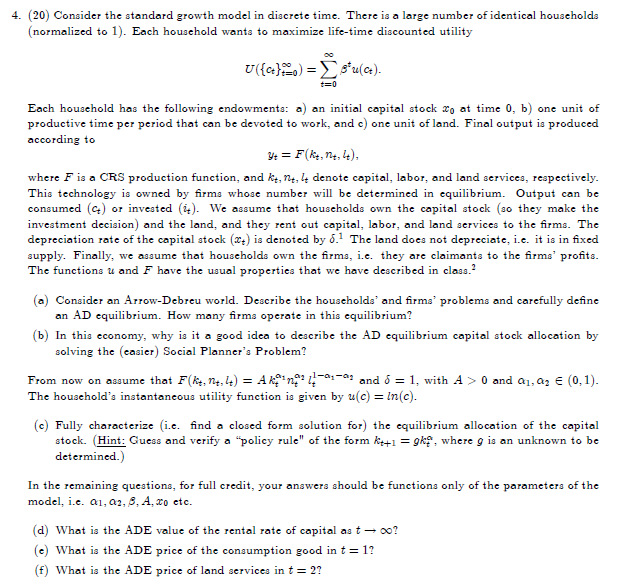

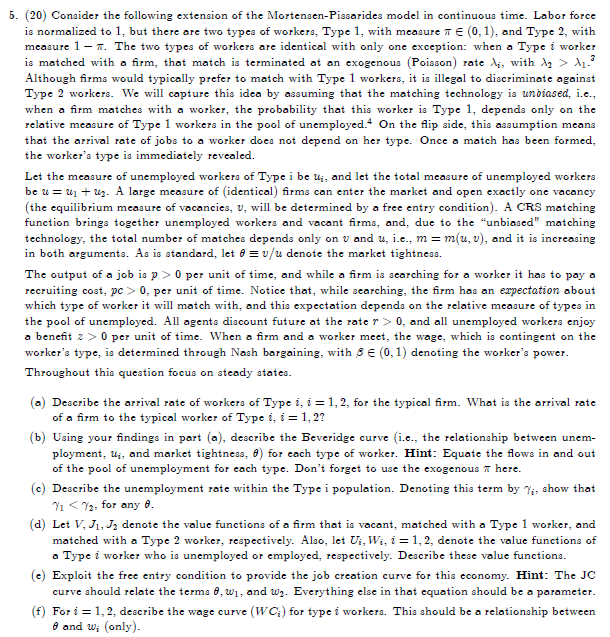

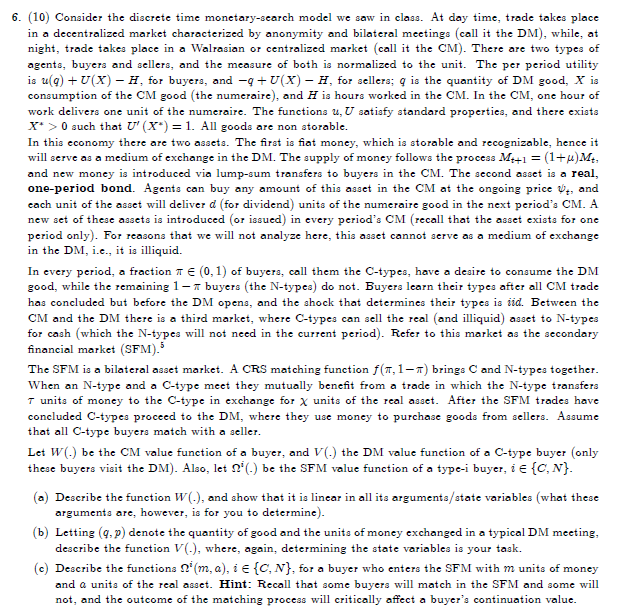

l. [ltlll Consider a consumer with preferences U= Ire\"TIME, 1Where p is the subjective discount rate__ at: is consumption, and EEC} = lnc. She receives an exogenous ow of income If and can borrow or lend til-eel].r at a constant interest rate 1", subject to a noPon'sigame condition that rules out innite debt. Her ow budget constraint is ri=rs+yc 1Where 0: represents nancial 1wealth and an is the initial value. {a} Derive the rstorder conditions for optimal consumption. {b} At what rate does consumption change? Interpret its sign. {c} Derive the optimal decision rule for consumption. Provide an interpretation for the case p = f. 2. [2(1) Consider the following optimal growth model. Agents1 preferences are given by E0 [in Inc] The term Ag denotes an Lid. demand shock. Output is a concave function of beginning of period capital and a technology shock. That is, HZEHH It is assumed that 3.; is i_i_d.both over time and with respect to 11*. {That is1 the two shocks are independently distributed] The depreciation rate of capital is 100%. \"'ithin this environment__ do the followrng {a} Set up the social planner problem as a dynamic programming problem and derive the necessary conditions. {b} Conjecture a solution to the policy functions for consumption and savings. Derive the equations that determine these optimal policj.r functions and characterize their qualitative behavior. [ell Suppose one period {real} bonds were introduced into this economy. How do demand shocks a'Eect interest rates in this economy"!I Explain. \f4. [2(1) ISonsider the standard growth model in discrete time. There is a large number ofidentical households [normalized to 1}. Each household wants to maximize life-time discounted utility mass.) = 2 sum). Each household has the following endowments: a} an initial capital stock In at time D, b} one unit of productive time per period that can be devoted to work, and c} one unit of land. Final output is produced according to r: = Flo, H1, 1:11 where F is a CR3 production function1 and t, 11, 1* denote capital.1 labor, and land services, respectively. This technology is owned by rms whose number will be determined in equilibrium. Output can be consumed [q] or invested [11]. \"Fe assume that households own the capital stock [so they make the investment decision] and the land. and they rent out carpital1 labor1 and land services to the rms. The depreciation rate of the capital storlr. [IQ is denoted by [5.1 The land does not depreciate, i.e. it is in xed supply. Finally, we assume that households own the rms, i.e. they are claimants to the rms' prots. The functions 1.: and F have the usual properties that we have described in class.2 {a} Consider an ArrowDebreu world. Describe the households" and rms" problems and carefully dene an AD equilibrium. How many rms operate in this equilibrium? {b} In this economy, why is it a good idea to describe the All] equilibrium capital stock allocation by solving the [easier] Social Planner's Problem'l' From now on assume that Fi: \"hf-t] = Akf'ft? li'a'll and :5 = l, with A \"I? ll and 111,113 E {0,1}. The household's instantaneous utility function is given by 11115} = tnEE}. c Fully characterize i.e. nd a closed form solution for the uilibriurn allocation of the ca ital E] P stoclc. lHint: Guess and 1verify a \"policy rul.eII of the form kb+I 2 94:5\El. [2111} Consider the following extension ofthe MortensenPissarides model in continuous time. Labor force is normalized to l, but there are two types of workers, Type 1, with measure it E {I}, l}, and Type 2, with measure 1 ET. The two types of workers are identical with only one exception: when a Type i worker is matched with a rm, that match is terminated at an exogenous [Poisson] rate 35-, with A; 2:- 3.1.: Although rms would typically prefer to match with IType 1. workers, it is illegal to discriminate against Type 2 workers. \"5e will capture this idea by assuming that the matching technology is animal, i.e., when a rm matches with a worker, the probability that this worker is Type 1, depends only on the relative measure of Type 1 workers in the pool ofunemployed." On the ip side, this assumption means that the arrival rate of jobs to a worker does not depend on her type. Once a match has been formed, the worker's type is immediately revealed. Let the measure of unemployed workers of Type i be In, and let the total measure of unemployed workers be u = 111+ 113. A large measure of {identical} rms can enter the market and open exactly one vacancy [the equilibrium measure of vacancies, 13, will be determined by a free entry condition]. A C115 matching function brings together unemployed workers and vacant rms, and, due to the \"'I:I.I:Lbiased"I matching technology, the total number of matches depends only on 1.? and 1t, i.e., m. 2 tabs, 13], and it is increasing in both arguments. 21s is standard, let 5 E 13,311. denote the market tightness. The output ofa job is p Z:- {I per unit oftime, and while a rm is searching for a worker it has to pay a recruiting cost, 11!: 1':- D, per unit of time. Notice that, while searching, the rm has an expectation about which type of worker it will match with, and this expectation depends on the relative measure of types in the pool of unemployed .F'Lll agents discount future at the rate 1" 1':- , and all unemployed workers enjoy a benet 2 1':- per unit of time. t-Vhen a rm and a worker meet, the wage, which is contingent on the worker's type, is determined through Nash bargaining, with _S E {0,1} denoting the worker's power. Throughout this question focus on steady states. [all Describe the arrival rate of workers of Type E, t = l, 2, for the typical rnn. t-Vhat is the arrival rate o'fa rn: to the typical worker onype i, i: 1, 2'! {b} Using your ndings in part {a}, describe the Bevesidge curve {i.e., the relationship between unem ployment, LI", and market tightness, a} for each type of worker. EEIII: Equate the ows in and out of the pool ofunemployment for each type. Don't forget to use the exogenous 1T here. [ell Describe the unemployment rate within the Type i population. Denoting this term by '"r',-, show that \"TI '5: T3, To! any E. {d} Let V, J1,J3 denote the value functions ofa rm that is vacant, matched with a Type 1 worker, and matched with a Type 2 worker, respectively. Mso, let Hi, \"If, t = l, 2, denote the 1value functions of a Type t worker who is unemployed or employed, respectively. Describe these value functions. [ell Exploit the free entry condition to provide the job creation curve for this economy. I'Iint: The JG curve should relate the terms E, \"El, and my. Everything else in that equation should be a parameter. it} For t = l, 2, describe the wage curve {W'CI-J for type 1 workers. This should be a relationship between E and 1H,- {only}. E. El} Consider the discrete time monetarysearch model we saw in class. At day time, trade takes place in a decentralized market characterized by anonymity and bilateral meetings Ecall it the DM}, while, at night, trade takes place in a 1|nn'Ia-rsllrasian or centralized market {call it the Chi}. There are two types of agents, buyers and sellers, and the measure of both is normalized to the unit. The per period utility is 1|:qu + HEX} H, for buyers, and q+ [TEX] H, for sellers; :1 is the quantity of DIE-I good, I is consumption of the CM good {the numeraire}, and H is hours worked in the Chi. In the Chi, one hour of work delivers one unit ofthe numeraire. The functions u,U satisfy standard properties, and there exists X\" \":1 ll such that U' {in} = 1. All goods are non storable. In this economy there are two assets. The rst is at money, which is storable and recognizable, hence it will serve as a medium ofexchange in the DM. The supply of money follows the process MHI = [l+p}M, and new money is introduced via lump-sum transfers to buyers in the CM. The second asset is a l'lauill1 one-pcriod bond. gents can buy any amount of this asset in the CM at the ongoing price 195'}, and each unit of the asset will deliver til {for dividend} units of the numeraire good in the next period's Chi. FL new set ofthese assets is introduced [or issued} in every period's Cle [recall that the asset exists for one period only}. For reasons that we will not analyze here, this asset cannot serve as a medium of exchange in the DM, i.e., it is illiquid. In every period, a fraction \"IT E Ell, l} of buyers, call them the Ctypes, have a desire to consume the Dhl good, while the remaining 1 ET buyers [the Ntypes} do not. Buyers learn their types after all CM trade has concluded but before the DM opens, and the shock that determines their types is iii Between the Chi and the Dhi there is a third market, where Ctypes can sell the real {and illiquid} asset to Ntypes for cash {which the Ntypes will not need in the current period}. Refer to this market as the secondary nancial market {3m}.i The SFhi is a bilateral asset market. A CRS matching function fE'iT, lrr} brings C and Ntypes together. \"than an Ntype and a Ctype meet they mutually benet from a trade in which the Ntype transfers T units of money to the Cty'pe in exchange for X units of the real asset. After the SFhi trades have concluded Ctypes proceed to the Dhi, where they use money to purchase goods from sellers. Assume that all Cty'pe buyers match with a seller. Let WE.) be the CM value function ofa buyer, and VE.) the Dle value function of a Iiiitype buyer [only these buyers visit the DM}. Also, let 'E.) be the SFhi value function of a type-i buyer, 1: E {(32417}. {a} Describe the function WEJ, and show that it is linear in all its argumentsfstate variables Ewhat these arguments are, however, is for you to determine}. {b} Letting (-3,?) denote the quantity of good and the units ofmoney exchanged in a typical Dhi meeting, describe the function FL}, where, again, determining the state variables is your task. Ec} Describe the functions [211114], i E {6", N}, for a buyer who enters the SFle with m units of money and :1 units of the real asset. Hint: Recall. that some buyers will match in the EFL-I and some will not, and the outcome ofth.e matching process will critically atfect a buyer's continuation value