Provide step by step solutions.

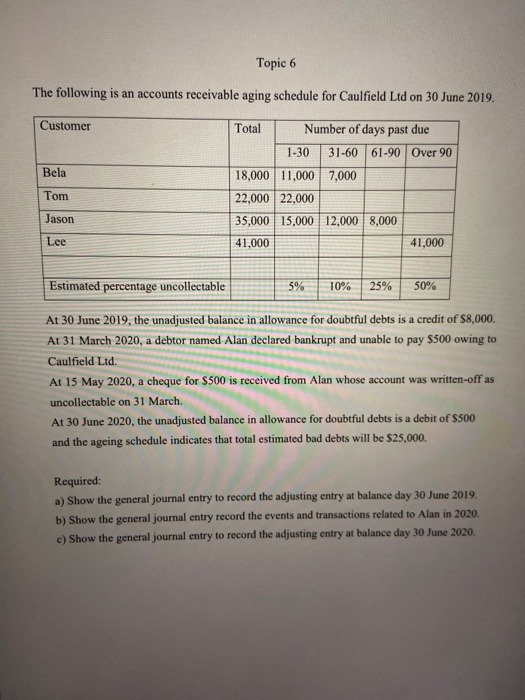

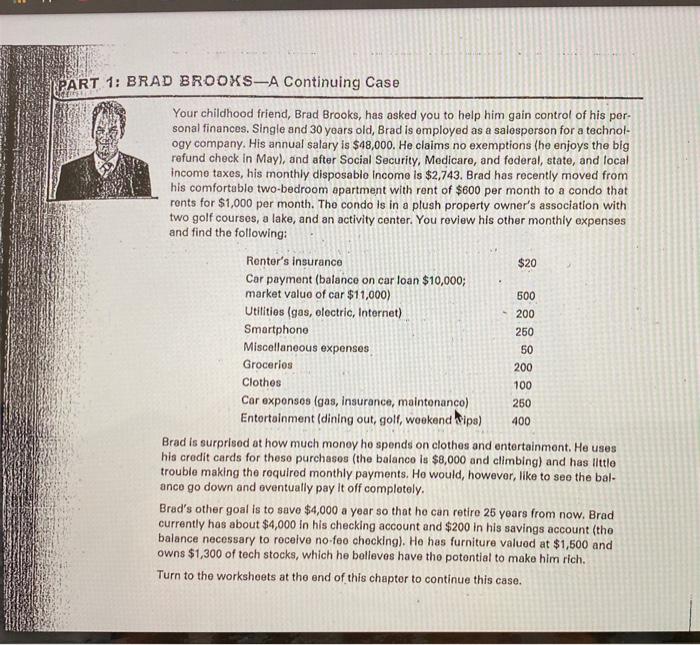

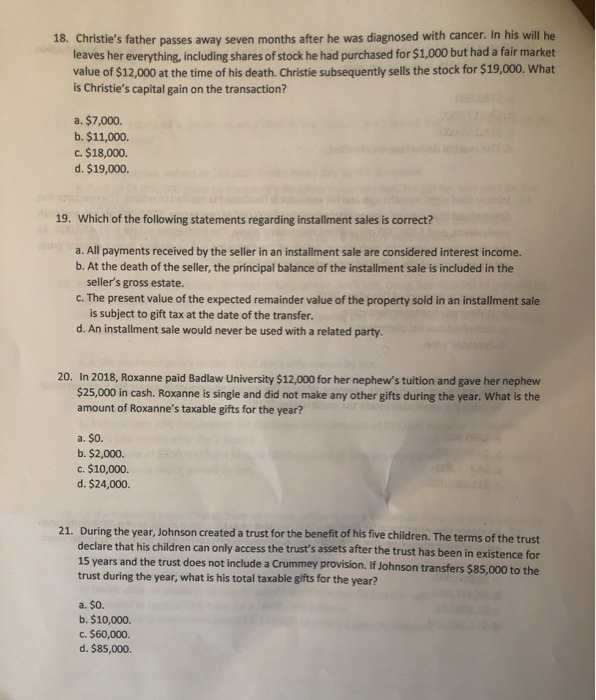

Topic 6 The following is an accounts receivable aging schedule for Caulfield Lid on 30 June 2019. Customer Total Number of days past due 1-30 31-60 61-90 Over 90 Bela 18,000 11,000 7,000 Tom 22,000 22,000 Jason 35,000 15,000 12,000 8,000 Lee 41,000 41,000 Estimated percentage uncollectable 5% 10% 25% 50% At 30 June 2019, the unadjusted balance in allowance for doubtful debts is a credit of $8,000. At 31 March 2020, a debtor named Alan declared bankrupt and unable to pay $500 owing to Caulfield Lid. At 15 May 2020, a cheque for $500 is received from Alan whose account was written-off as uncollectable on 31 March. At 30 June 2020, the unadjusted balance in allowance for doubtful debts is a debit of $500 and the ageing schedule indicates that total estimated bad debts will be $25,000. Required: a) Show the general journal entry to record the adjusting entry at balance day 30 June 2019. b) Show the general journal entry record the events and transactions related to Alan in 2020. c) Show the general journal entry to record the adjusting entry at balance day 30 June 2020.PART 1: BRAD BROOKS-A Continuing Case Your childhood friend, Brad Brooks, has asked you to help him gain control of his per- sonal finances. Single and 30 years old, Brad is employed as a salesperson for a technol- ogy company. His annual salary is $48,000. He claims no exemptions (he enjoys the big refund check in May), and after Social Security, Medicare, and federal, state, and local income taxes, his monthly disposable Income Is $2,743. Brad has recently moved from his comfortable two-bedroom apartment with rent of $600 per month to a condo that rents for $1,000 per month. The condo is in a plush property owner's association with two golf courses, a lake, and an activity center. You review his other monthly expenses and find the following: Renter's insurance $20 Car payment (balance on car loan $10,000; market value of car $11,000) 500 Utilities (gas, electric, Internet) 200 Smartphone 250 Miscellaneous expenses 50 Groceries 200 Clothes 100 Car expenses (gas, insurance, maintenance) 260 Entertainment (dining out, golf, weekend vips) 400 Brad is surprised at how much money he spends on clothes and entertainment. He uses his credit cards for these purchases (the balance is $8,000 and climbing) and has little trouble making the required monthly payments. He would, however, like to see the bal- ance go down and eventually pay It off completely. Brad's other goal is to save $4,000 a year so that he can retire 25 years from now. Brad currently has about $4,000 In his checking account and $200 in his savings account (the balance necessary to receive no-fee checking). He has furniture valued at $1,500 and owns $1,300 of tech stocks, which he believes have the potential to make him rich. Turn to the worksheets at the end of this chapter to continue this case.18. Christie's father passes away seven months after he was diagnosed with cancer. In his will he leaves her everything, including shares of stock he had purchased for $1,000 but had a fair market value of $12,000 at the time of his death. Christie subsequently sells the stock for $19,000. What is Christie's capital gain on the transaction? a. $7,000. b. $11,000. C. $18,000. d. $19,000. 19. Which of the following statements regarding installment sales is correct? a. All payments received by the seller in an installment sale are considered interest income. b. At the death of the seller, the principal balance of the installment sale is included in the seller's gross estate. c. The present value of the expected remainder value of the property sold in an installment sale is subject to gift tax at the date of the transfer. d. An installment sale would never be used with a related party. 20. In 2018, Roxanne paid Badlaw University $12,000 for her nephew's tuition and gave her nephew $25,000 in cash. Roxanne is single and did not make any other gifts during the year. What is the amount of Roxanne's taxable gifts for the year? a. SO. b. $2,000. c. $10,000. d. $24,000. 21. During the year, Johnson created a trust for the benefit of his five children. The terms of the trust declare that his children can only access the trust's assets after the trust has been in existence for 15 years and the trust does not include a Crummey provision. If Johnson transfers $85,000 to the trust during the year, what is his total taxable gifts for the year? a. 50. b. $10,000. c. $60,000. d. $85,000