Answered step by step

Verified Expert Solution

Question

1 Approved Answer

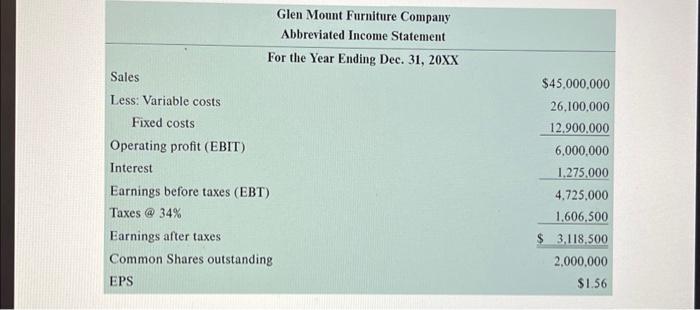

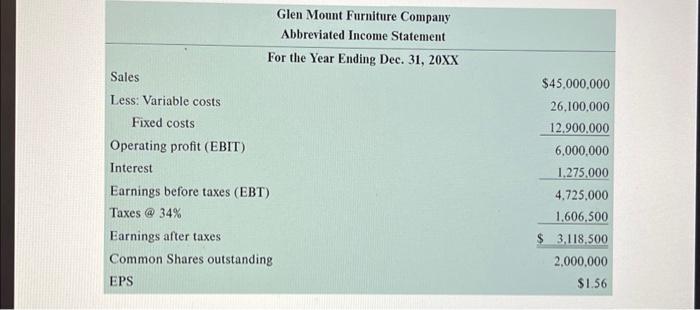

provide the ans according to table Glen Mount Furniture Company Abbreviated Income Statement The firm was considering buying back 625,000 slares of stock outstinding at

provide the ans according to table

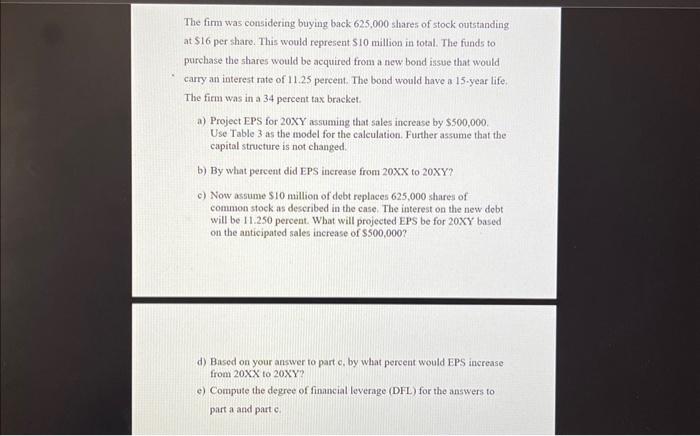

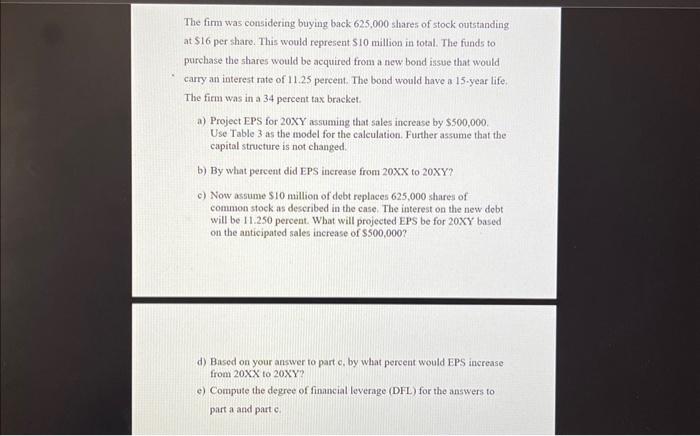

Glen Mount Furniture Company Abbreviated Income Statement The firm was considering buying back 625,000 slares of stock outstinding at $16 per share. This would represent $10 million in total. The funds to purchase the shares would be acquired from a new bond issue that would carry an interest mate of 11.25 percent. The bond would have a 15 .year life: The firm was in a 34 percent tax bracket. a) Project EPS for 20XY assuming that sales increase by $500,000. Use Table 3 as the model for the calculation. Further assume that the capital structure is not changed. b) By what percent did EPS increase from 20XX to 20XY ? c) Now assume $10 million of debt replaces 625,000 shares of common stock as described in the case. The interest on the new debt will be 11.250 percent. What will projected EPS be for 20XY based on the anticipated sales increase of $500,000 ? d) Based on your answer to part c, by what percent would EPS increase from 20XX to 20XY ? e) Compute the degree of financial leverage (DFL) for the answers to part a and part c

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started