Answered step by step

Verified Expert Solution

Question

1 Approved Answer

provide the correct answer. posted it before and I was given the incorrect answer. make it is correct this time please. The Trial Balance TBA

provide the correct answer. posted it before and I was given the incorrect answer. make it is correct this time please.

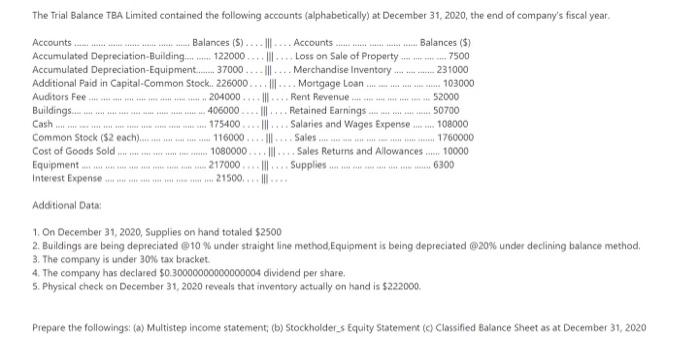

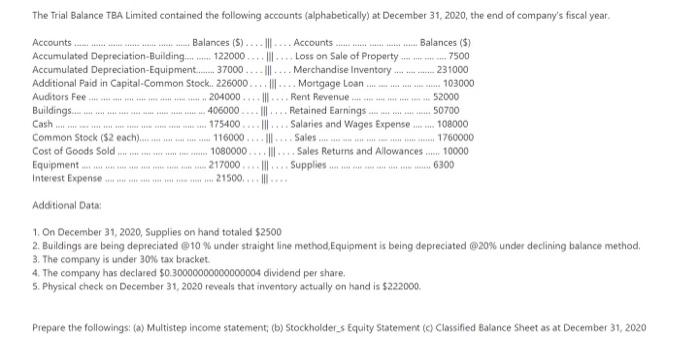

The Trial Balance TBA Limited contained the following accounts (alphabetically) at December 31, 2020, the end of company's fiscal year Accounts Balances (5) Accounts .......... Balances ($) Accumulated Depreciation Building....... 122000... ...Loss on Sale of Property7500 Accumulated Depreciation Equipment... 37000 Merchandise Inventory.... 231000 Additional Paid in Capital-Common Stock 226000.... ...Mortgage Loan.......... 103000 Auditors Fee ....... 204000 Rent Revenue52000 Buildings. 406000 |:...Retained Earnings ... 50700 Cash ................................ 175400 ..Salaries and Wages Expense....... 108000 Common Stock ($2 each)............. 116000.....Sales................... 1760000 Cost of Goods Sold .............1080000.... Sales Returns and Allowances... 10000 Equipment ................. 217000...I Supplies............. 6300 Interest Expense.............. 21500 Additional Data 1. On December 31, 2020, Supplies on hand totaled $2500 2. Buildings are being depreciated 10 % under straight line method, Equipment is being depreciated 20% under declining balance method 3. The company is under 30% tax bracket 4. The company has declared $0.30000000000000004 dividend per share. 5. Physical check on December 31, 2020 reveals that inventory actually on hand is 222000, Prepare the followings: (a) Multistepincome statement, (b) Stockholders Equity Statement (Classified Balance Sheet as at December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started