Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide the formulas in Excel (IF, Absolute Cell References etc.) for these answers. Question Link - https://www.chegg.com/homework-help/questions-and-answers/use-excel-calculate-various-payroll-withholdings-net-pay-create-related-journal-entries-lo-q75874992?trackid=HkqeTZKa Federal Income tax State Income tax thumbs up!

Provide the formulas in Excel (IF, Absolute Cell References etc.) for these answers.

Provide the formulas in Excel (IF, Absolute Cell References etc.) for these answers.

Question Link - https://www.chegg.com/homework-help/questions-and-answers/use-excel-calculate-various-payroll-withholdings-net-pay-create-related-journal-entries-lo-q75874992?trackid=HkqeTZKa

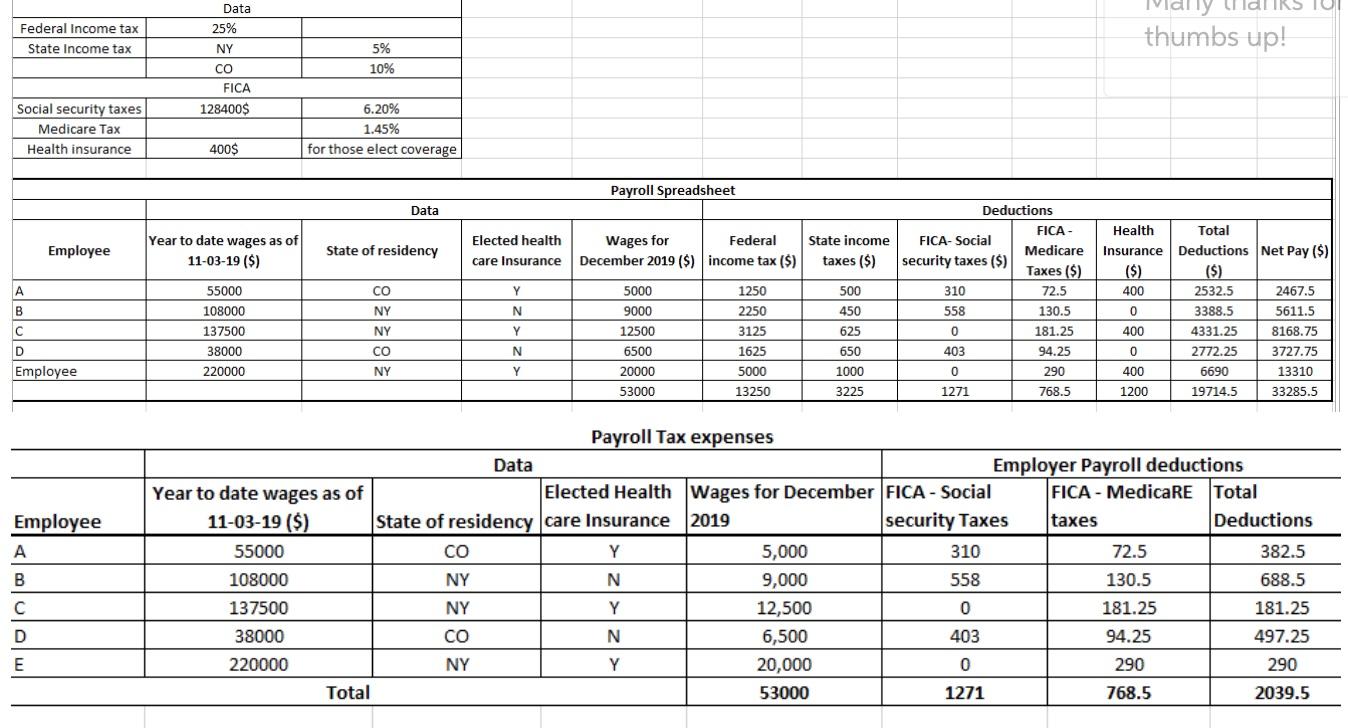

Federal Income tax State Income tax thumbs up! Data 25% NY CO FICA 128400$ 5% 10% Social security taxes Medicare Tax Health insurance 6.20% 1.45% for those elect coverage 400$ Payroll Spreadsheet Data Employee Year to date wages as of 11-03-19 ($) State of residency Elected health care Insurance Wages for Federal December 2019 ($) income tax ($) State income taxes ($) B c CO NY 55000 108000 137500 38000 220000 Y N Y N Y 5000 9000 12500 6500 20000 53000 NY 1250 2250 3125 1625 5000 13250 500 450 625 650 1000 3225 Deductions FICA- FICA- Social Medicare security taxes ($) Taxes ($) 310 72.5 558 130.5 0 181.25 403 94.25 0 290 1271 768.5 Health Total Insurance Deductions Net Pay ($) ($) 400 2532.5 2467.5 0 3388.5 5611.5 400 4331.25 8168.75 0 2772.25 3727.75 400 6690 13310 1200 19714.5 33285.5 CO D Employee NY Employee Payroll Tax expenses Data Employer Payroll deductions Year to date wages as of Elected Health Wages for December FICA - Social FICA - MedicaRE Total 11-03-19 ($) State of residency care Insurance 2019 security Taxes taxes Deductions 55000 CO Y 5,000 310 72.5 382.5 108000 NY N 9,000 558 130.5 688.5 137500 NY Y 12,500 0 181.25 181.25 38000 CO N 6,500 403 94.25 497.25 220000 NY Y 20,000 0 290 290 Total 53000 1271 768.5 2039.5 B D E Federal Income tax State Income tax thumbs up! Data 25% NY CO FICA 128400$ 5% 10% Social security taxes Medicare Tax Health insurance 6.20% 1.45% for those elect coverage 400$ Payroll Spreadsheet Data Employee Year to date wages as of 11-03-19 ($) State of residency Elected health care Insurance Wages for Federal December 2019 ($) income tax ($) State income taxes ($) B c CO NY 55000 108000 137500 38000 220000 Y N Y N Y 5000 9000 12500 6500 20000 53000 NY 1250 2250 3125 1625 5000 13250 500 450 625 650 1000 3225 Deductions FICA- FICA- Social Medicare security taxes ($) Taxes ($) 310 72.5 558 130.5 0 181.25 403 94.25 0 290 1271 768.5 Health Total Insurance Deductions Net Pay ($) ($) 400 2532.5 2467.5 0 3388.5 5611.5 400 4331.25 8168.75 0 2772.25 3727.75 400 6690 13310 1200 19714.5 33285.5 CO D Employee NY Employee Payroll Tax expenses Data Employer Payroll deductions Year to date wages as of Elected Health Wages for December FICA - Social FICA - MedicaRE Total 11-03-19 ($) State of residency care Insurance 2019 security Taxes taxes Deductions 55000 CO Y 5,000 310 72.5 382.5 108000 NY N 9,000 558 130.5 688.5 137500 NY Y 12,500 0 181.25 181.25 38000 CO N 6,500 403 94.25 497.25 220000 NY Y 20,000 0 290 290 Total 53000 1271 768.5 2039.5 B D EStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started