Provide the solutions..l

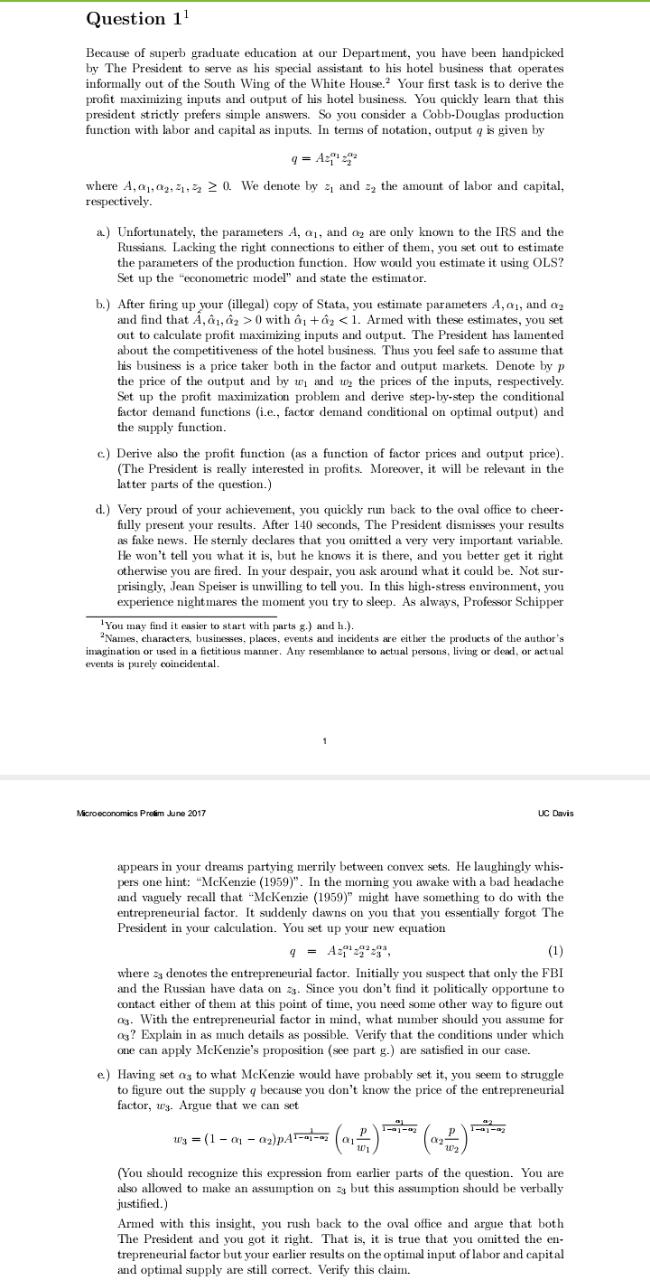

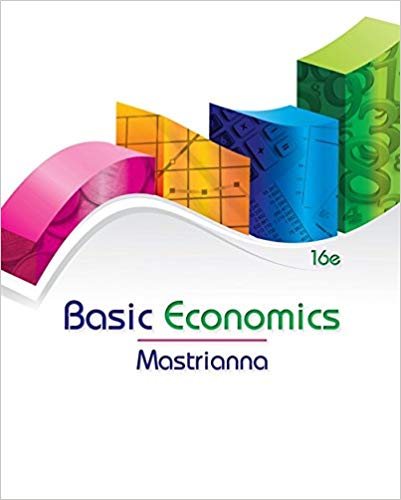

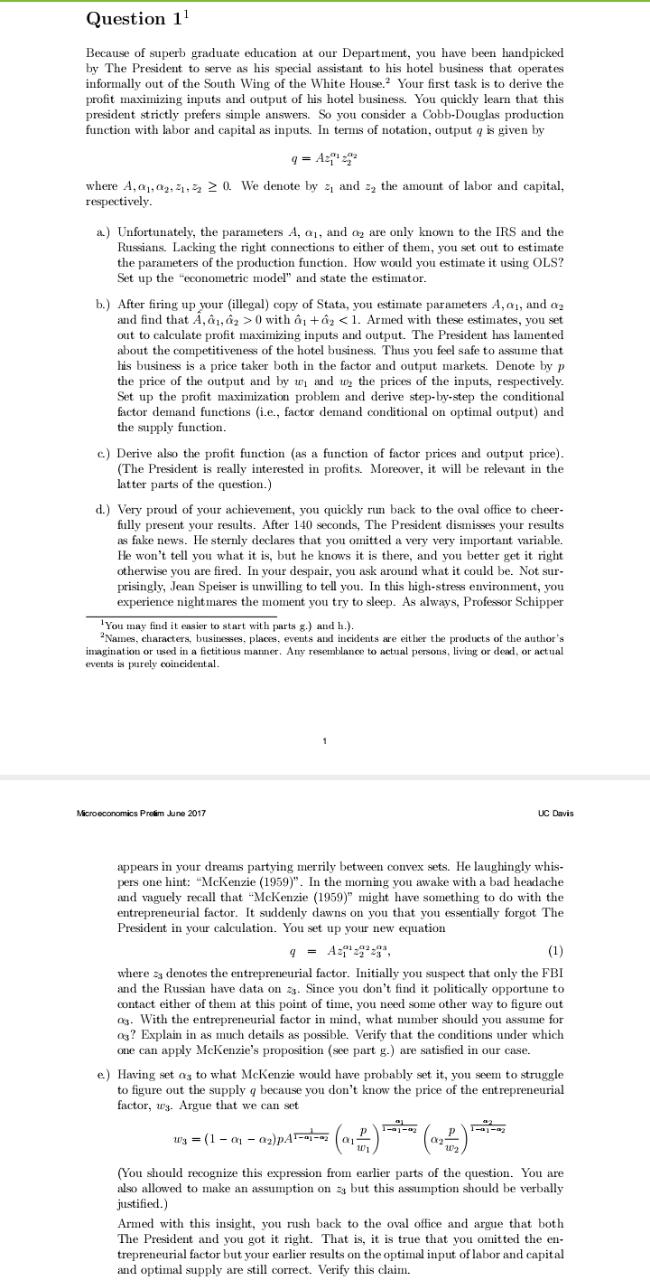

Question 11 Because of superb graduate education at our Department, you have been handpicked by The President to serve as his special assistant to his hotel business that operates informally out of the South Wing of the White House." Your first task is to derive the profit maximizing inputs and output of his hotel business. You quickly learn that this president strictly prefers simple answers. So you consider a Cobb-Douglas production function with labor and capital as inputs. In terms of notation, output q is given by where A, 01,02. 4.2 2 0. We denote by 2 and z, the amount of labor and capital, respectively. a.) Unfortunately, the parameters A, 01, and oz are only known to the IRS and the Russians. Lacking the right connections to either of them, you set out to estimate the parameters of the production function. How would you estimate it using OLS? Set up the "econometric model" and state the estimator. b.) After firing up your (illegal) copy of Stata, you estimate parameters A, or, and oz and find that A, 61, 62 2 0 with on +oy 0. The restaurant has a capacity of K, that is, only K customers can be accommodated, with A smaller than the total number of potential consumers, that is, K > 0, a solution to the UMAX[p, w] problem exists and is unique. Without attempting at this point to explicitly solve the UMAX[p, w], show that for w above a certain level, that you should made explicit, demand is insensitive to increases in wealth, whereas for values of w below this level Walrasian demand is affine in wealth. (Hint: For the second part, use the Implicit Function Theorem.) 1.7. We now consider a society with / consumers, each endowed with the preference relation represented by u in (1.1). We denote by P= R4'the domain of prices and individual wealth vectors (p:w'....w.). Is there a subset of P for which a positive representative consumer exists? Explain. 1.8. We return to the one-consumer case. Solve the UMAX[p, w] problem for good I in the case where 2 -2, a, =a, = a and B= b * , for c > 0. Can one of the goods be inferior at a point of the domain of the Walrasian demand function? (Hint. Consider the wealth expansion paths in (x], *2) space.) 1.9. We now consider a consumer who faces uncertainty. Her ex ante preference relation satisfies the expected utility hypothesis with von Neumann-Morgenstern-Bernoulli utility function ":[0.a/b]- R. where a and b are positive parameters, and with coefficient of absolute risk aversion equal to- a - bx -. She is facing the contingent-consumption optimization problem of maximizing her expected utility subject to a budget constraint. Let there be two states of the world, s; and $2, with probabilities a and 1- n, respectively 1.9.1. Comment on her ex ante preferences. 1.9.2. To what extent is her problem formally a special case of the UMAX problem of 1.6 above? Explain. 1.9.3. Draw a plausible wealth expansion path in contingent commodity space. As her wealth increases, does the consumer bear absolutely more or less risk? Relatively more or less risk