Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Provide your solutions in sequential order below the line. Round final answer to the nearest hundredth. Show all work and circle your final answer. You

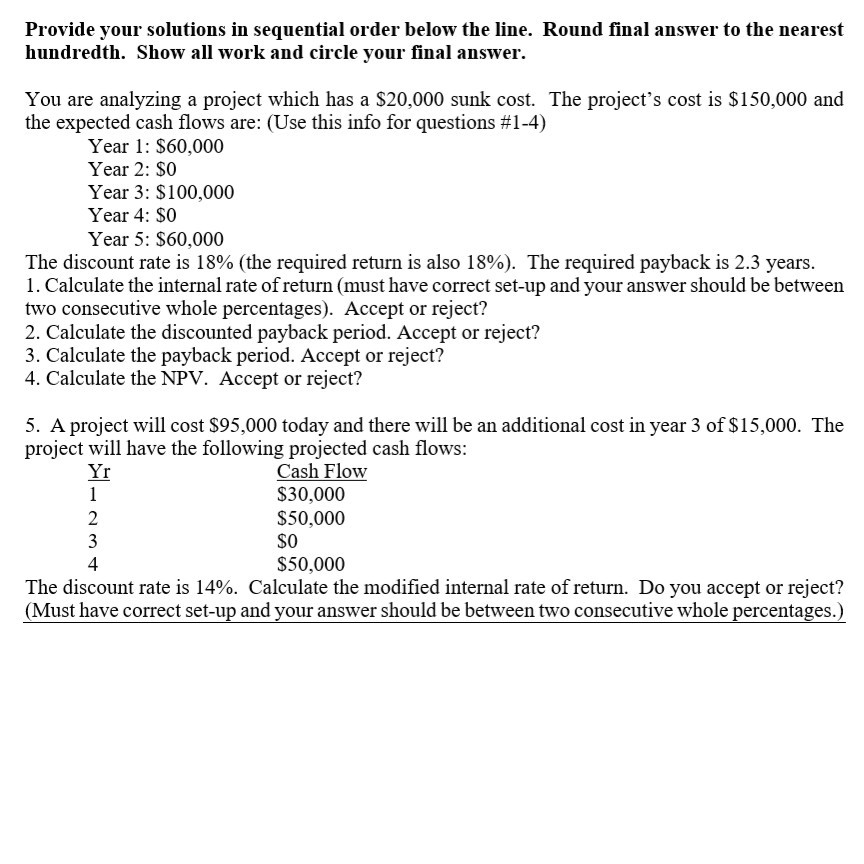

Provide your solutions in sequential order below the line. Round final answer to the nearest hundredth. Show all work and circle your final answer. You are analyzing a project which has a $20,000 sunk cost. The project's cost is $150,000 and the expected cash flows are: (Use this info for questions #1-4) Year 1: $60,000 Year 2: $0 Year 3: $100,000 Year 4: $0 Year 5: $60,000 The discount rate is 18% (the required return is also 18%). The required payback is 2.3 years. 1. Calculate the internal rate of return (must have correct set-up and your answer should be between two consecutive whole percentages). Accept or reject? 2. Calculate the discounted payback period. Accept or reject? 3. Calculate the payback period. Accept or reject? 4. Calculate the NPV. Accept or reject? Yr 5. A project will cost $95,000 today and there will be an additional cost in year 3 of $15,000. The project will have the following projected cash flows: Cash Flow $30,000 $50,000 $0 $50,000 The discount rate is 14%. Calculate the modified internal rate of return. Do you accept or reject? (Must have correct set-up and your answer should be between two consecutive whole percentages.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started