Answered step by step

Verified Expert Solution

Question

1 Approved Answer

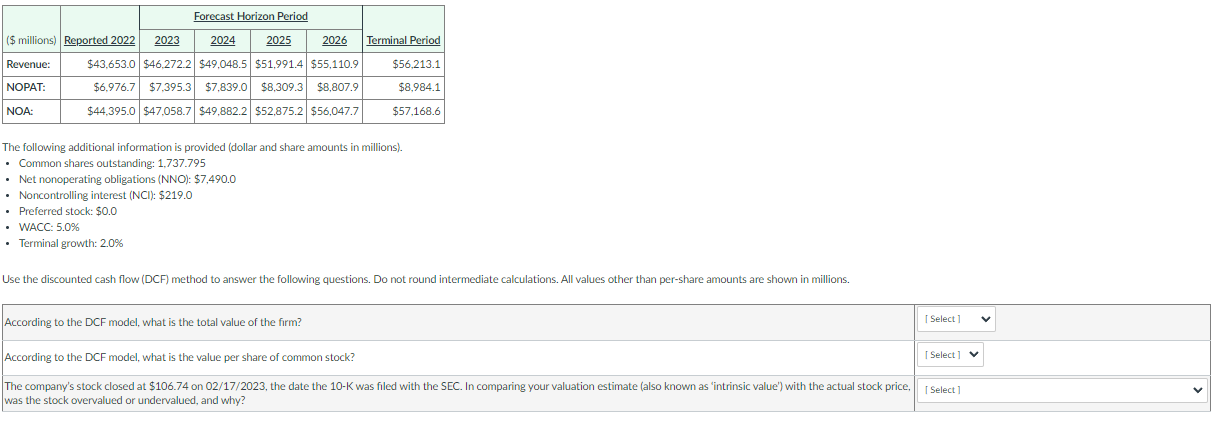

Provided below are an analysts forecasts of revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 12/31/2022 for Abbott Laboratories.

Provided below are an analysts forecasts of revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 12/31/2022 for Abbott Laboratories.

This is multiple choice with possible answers above.

The following additional information is provided (dollar and share amounts in millions). - Common shares outstanding: 1,737.795 - Net nonoperating obligations (NNO): \$7,490.0 - Noncontrolling interest (NCl):$219.0 - Preferred stock: $0.0 - WaCC: 5.0% - Terminal growth: 2.0% Use the discounted cash flow (DCF) method to answer the following questions. Do not round intermediate calculations. All values other than per-share amounts are shown in millions. The following additional information is provided (dollar and share amounts in millions). - Common shares outstanding: 1,737.795 - Net nonoperating obligations (NNO): \$7,490.0 - Noncontrolling interest (NCl):$219.0 - Preferred stock: $0.0 - WaCC: 5.0% - Terminal growth: 2.0% Use the discounted cash flow (DCF) method to answer the following questions. Do not round intermediate calculations. All values other than per-share amounts are shown in millionsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started