Answered step by step

Verified Expert Solution

Question

1 Approved Answer

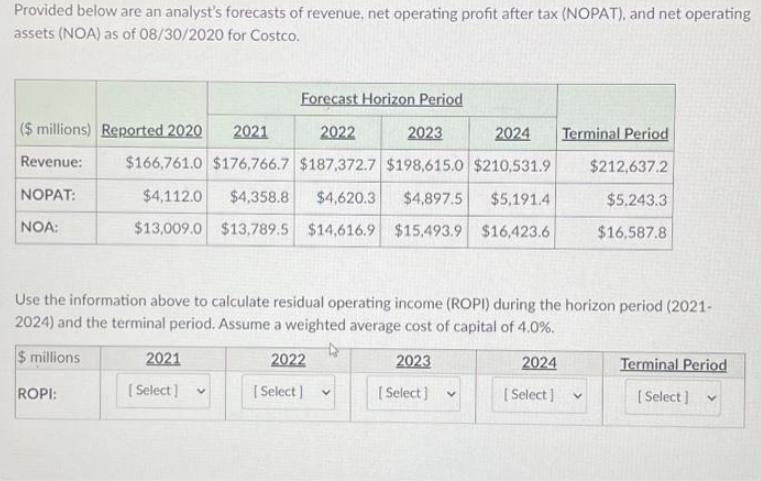

Provided below are an analyst's forecasts of revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 08/30/2020 for Costco.

Provided below are an analyst's forecasts of revenue, net operating profit after tax (NOPAT), and net operating assets (NOA) as of 08/30/2020 for Costco. ($ millions) Reported 2020 Revenue: NOPAT: NOA: ROPI: Forecast Horizon Period 2022 2021 2023 $166,761.0 $176,766.7 $187,372.7 $198,615.0 $210,531.9 $4,112.0 $4,358.8 $4,620.3 $4,897.5 $5,191.4 $13,009.0 $13,789.5 $14,616.9 $15,493.9 $16,423.6 2021 [Select] 2024 Terminal Period Use the information above to calculate residual operating income (ROPI) during the horizon period (2021- 2024) and the terminal period. Assume a weighted average cost of capital of 4.0%. $ millions 2022 2023 2024 [Select] V [Select] [Select] V $212,637.2 $5.243.3 $16.587.8 Terminal Period [Select] V

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the residual operating income ROPI during the horizon period 20212024 and the term...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started