provided to you with historical returns from 5/1/2016 to 4/1/2021.

Assume current price of MSFT is $315/share. Use the bootstrapping approach (that estimates a return on MSFT during each of the next 24 months by assuming that the return during each month is equally likely to be any of the returns for the 60 months listed in MSFT.xlsx) to estimate MSFT ending Price in two years. Use Data Table to generate 1000 scenarios of MSFT price in two years (i.e., Run Monte Carlo simulations on stock price).

PART 1:

Estimate the probability that in two years the price of MSFT stock will be at least $400.

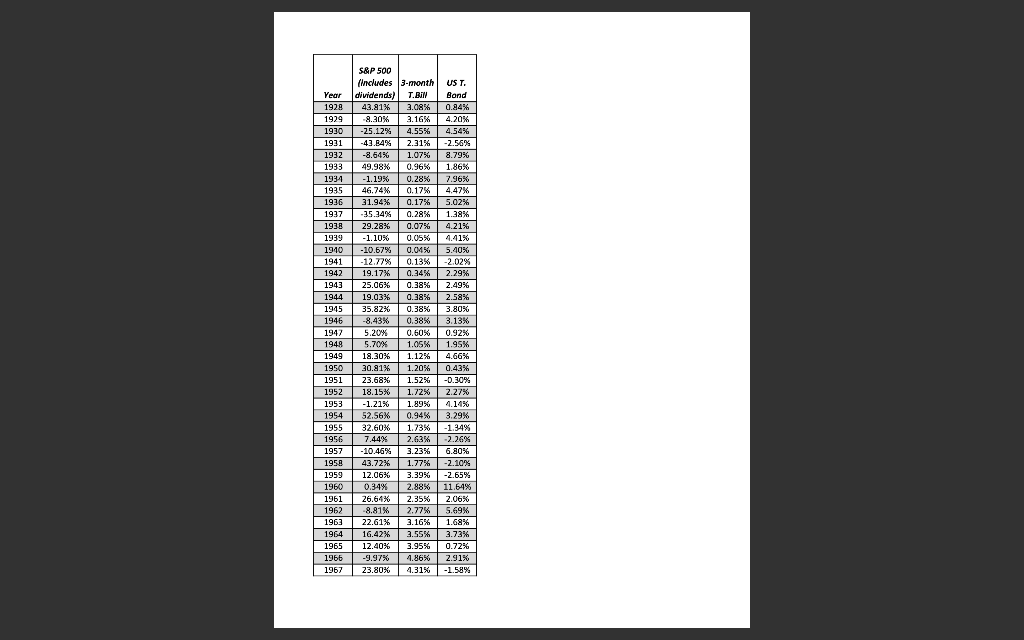

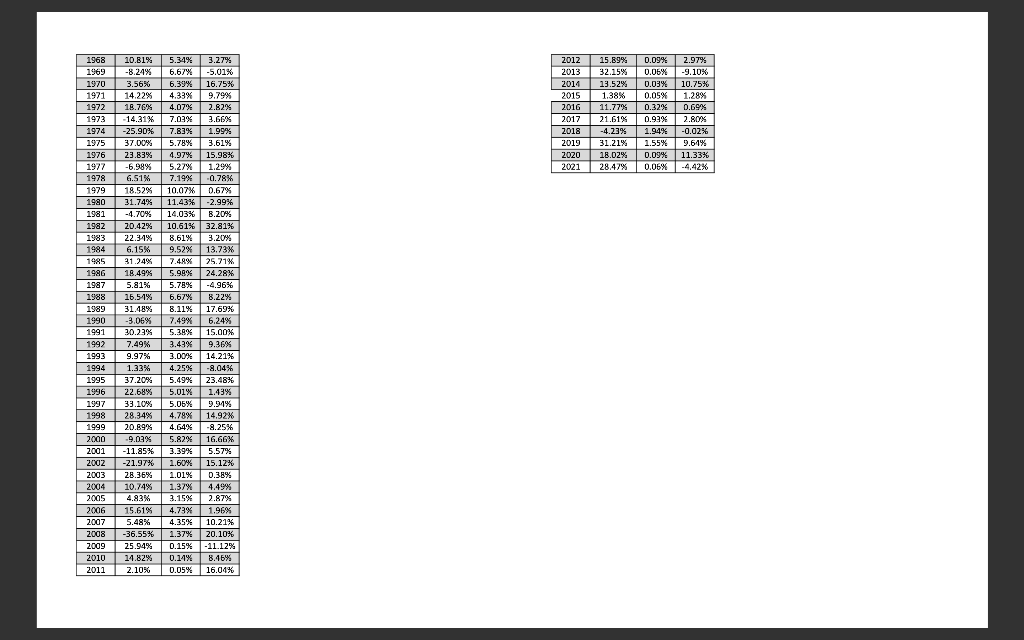

S&P 500 SP includes 3-ronth US T. Year dividends) T.BIN Bond 1928 43.81% 3.08% % 0.84% % 1929 -8.30% 3.16% 4.20% 1930 -25.12% 4.55% 4.54% % % 1931 -43.84% 2.31% -2.56% 1932 -8,64% 1.07% 8.79% % 1933 49.98% 0.96% 1.86% 1934 - 1.19% 0.28% 7.96% 1935 46.74% 0.17% 4.47% 1936 31.94% 0.17% 5.02% 1937 -35.34% 0.28% 1.38% 1938 29.28% 0.07% 4.21% % % 1939 -1.10% 0.05% 4.41% 1940 -10.67% 0.045 5.40% 1941 -12.72% 0.13% -2.02% 1942 19.17% 0.34% 2.29% 1943 25.06% 0.38% 2.49% 1944 19.03% 0.38% 2.58% % 1945 35.82% 0.38% 3.80% 1946 -8.43% 0.38% % 3.13% 1947 5.20% 0.60% 0.92% 1948 5.70% 1.05% 1.95% 1949 18.30% 1.12% 4.66% 1950 30.81% 1.20% 0.43% % 1951 23.68% 1.52% -0.30% 1952 18.15% 1.72% 2.27% 1953 -1.21% 1.89% % % 4.14% 1954 52.56% 0.94% 3.29% 1955 32.60% 1.73% -1.34% 1956 7.44% 2.63% -2.26% 1957 -10.46% 3.23% 6.80% 1958 43.72% 1.77% -2.10% 1959 12.06% 3.39% -2.65% % 1960 0.34% 2.88% 11.64% 1961 26.64% 2.35% 2.06% 1962 -8.81% 2.77% 5.69% % 1963 22.61% 3.16% 1.68% 1964 16.42% 3.55% 3.73% % % 1965 12.40% 3.95% 0.72% 1966 -9.97% 4.86% 2.91% % 1967 23.80% 4.31% -1.58% % % LAT. 2012 15.89% 0.09% 2.97% % 2013 32.15% 0.06% -9.10% 2014 13.52% 0.03% 10.75% 2015 1.38% 0.05% 1.28% 2016 11.77% 0.32% 0.69% 2017 21.61% % 0.93% 2.80% 2018 -4.23% 1.94% -0.02% 2019 31.21% 1.55% 9.61% 2020 18.02% 0.09% 11.33% 2021 28.47% 0.06% -4.42% 1968 10.81% 5.34% 3.27% 1969 -8.24% 6.67% -5.01% % % 1970 3.56% 6.39% 16.75% 1971 14.22% 4.33% 9.79% 1972 18.76% 4.07% 2.82% 1973 14.31% 7.03% 3.66% 1974 -25.90% 7.83% 1.99% 1975 37.00% 5.789 3.61% 1976 23.83% 4.97% 15.98% 1977 -6.98% 5.27% 1.29% 1978 6.51% 7.19% -0.78% % 1979 18.52% 10.07% 0.67% 1980 31.74% 11.43% -2.99% % 1981 -4.70% 14.03% 8.20% 1982 20.42% 10.61% 32.81% 1983 22.31% 8.61% 3.20% 1984 6.15% % 9.52% 13.73% 1985 31.24% 7.48% 25.71% % 1986 18.49% 5.9AX 24.28% 1987 5.81% 5.78% -4.96% 1988 15.5.1% 6.67% 8.22% 1989 31.48% 8.11% 17.69% 1990 -3.06% 7.49% 6.24% 1991 30.23% 5.38% 15.00% 1992 7.49% 3.43% 9.36% 1993 9.97% 3.00% 14.21% 1994 1.33% 4.25% -8.04% % 1995 37.20% 5.49% 23.48% 1996 22.68% 5.01% 1.43% % 1997 33.10% 5.05% % 9.94% 1998 28.34% 4.78% 14.92% 1999 20.89% 4.64% -8.25% 2000 -9.02% 5.82% 16.66% 2001 -11.85% 3.39% 5.57% 2002 -21.97% 1.60% 15.12% 2003 28.36% 1.01% 0.38% 2004 10.74% 1.37% 4.49% 2005 4.83% 3.15% 2.87% 2006 15.61% 4.73% 1.96% 2007 5.48% 4.35% 10.21% 2008 -36.55% 1.37% 20.10% 2009 25.94% 0.15% -11.12% 2010 14.82% % 0.14% 8.46% % 2011 2.10% % 0.05% 16.04% S&P 500 SP includes 3-ronth US T. Year dividends) T.BIN Bond 1928 43.81% 3.08% % 0.84% % 1929 -8.30% 3.16% 4.20% 1930 -25.12% 4.55% 4.54% % % 1931 -43.84% 2.31% -2.56% 1932 -8,64% 1.07% 8.79% % 1933 49.98% 0.96% 1.86% 1934 - 1.19% 0.28% 7.96% 1935 46.74% 0.17% 4.47% 1936 31.94% 0.17% 5.02% 1937 -35.34% 0.28% 1.38% 1938 29.28% 0.07% 4.21% % % 1939 -1.10% 0.05% 4.41% 1940 -10.67% 0.045 5.40% 1941 -12.72% 0.13% -2.02% 1942 19.17% 0.34% 2.29% 1943 25.06% 0.38% 2.49% 1944 19.03% 0.38% 2.58% % 1945 35.82% 0.38% 3.80% 1946 -8.43% 0.38% % 3.13% 1947 5.20% 0.60% 0.92% 1948 5.70% 1.05% 1.95% 1949 18.30% 1.12% 4.66% 1950 30.81% 1.20% 0.43% % 1951 23.68% 1.52% -0.30% 1952 18.15% 1.72% 2.27% 1953 -1.21% 1.89% % % 4.14% 1954 52.56% 0.94% 3.29% 1955 32.60% 1.73% -1.34% 1956 7.44% 2.63% -2.26% 1957 -10.46% 3.23% 6.80% 1958 43.72% 1.77% -2.10% 1959 12.06% 3.39% -2.65% % 1960 0.34% 2.88% 11.64% 1961 26.64% 2.35% 2.06% 1962 -8.81% 2.77% 5.69% % 1963 22.61% 3.16% 1.68% 1964 16.42% 3.55% 3.73% % % 1965 12.40% 3.95% 0.72% 1966 -9.97% 4.86% 2.91% % 1967 23.80% 4.31% -1.58% % % LAT. 2012 15.89% 0.09% 2.97% % 2013 32.15% 0.06% -9.10% 2014 13.52% 0.03% 10.75% 2015 1.38% 0.05% 1.28% 2016 11.77% 0.32% 0.69% 2017 21.61% % 0.93% 2.80% 2018 -4.23% 1.94% -0.02% 2019 31.21% 1.55% 9.61% 2020 18.02% 0.09% 11.33% 2021 28.47% 0.06% -4.42% 1968 10.81% 5.34% 3.27% 1969 -8.24% 6.67% -5.01% % % 1970 3.56% 6.39% 16.75% 1971 14.22% 4.33% 9.79% 1972 18.76% 4.07% 2.82% 1973 14.31% 7.03% 3.66% 1974 -25.90% 7.83% 1.99% 1975 37.00% 5.789 3.61% 1976 23.83% 4.97% 15.98% 1977 -6.98% 5.27% 1.29% 1978 6.51% 7.19% -0.78% % 1979 18.52% 10.07% 0.67% 1980 31.74% 11.43% -2.99% % 1981 -4.70% 14.03% 8.20% 1982 20.42% 10.61% 32.81% 1983 22.31% 8.61% 3.20% 1984 6.15% % 9.52% 13.73% 1985 31.24% 7.48% 25.71% % 1986 18.49% 5.9AX 24.28% 1987 5.81% 5.78% -4.96% 1988 15.5.1% 6.67% 8.22% 1989 31.48% 8.11% 17.69% 1990 -3.06% 7.49% 6.24% 1991 30.23% 5.38% 15.00% 1992 7.49% 3.43% 9.36% 1993 9.97% 3.00% 14.21% 1994 1.33% 4.25% -8.04% % 1995 37.20% 5.49% 23.48% 1996 22.68% 5.01% 1.43% % 1997 33.10% 5.05% % 9.94% 1998 28.34% 4.78% 14.92% 1999 20.89% 4.64% -8.25% 2000 -9.02% 5.82% 16.66% 2001 -11.85% 3.39% 5.57% 2002 -21.97% 1.60% 15.12% 2003 28.36% 1.01% 0.38% 2004 10.74% 1.37% 4.49% 2005 4.83% 3.15% 2.87% 2006 15.61% 4.73% 1.96% 2007 5.48% 4.35% 10.21% 2008 -36.55% 1.37% 20.10% 2009 25.94% 0.15% -11.12% 2010 14.82% % 0.14% 8.46% % 2011 2.10% % 0.05% 16.04%