Answered step by step

Verified Expert Solution

Question

1 Approved Answer

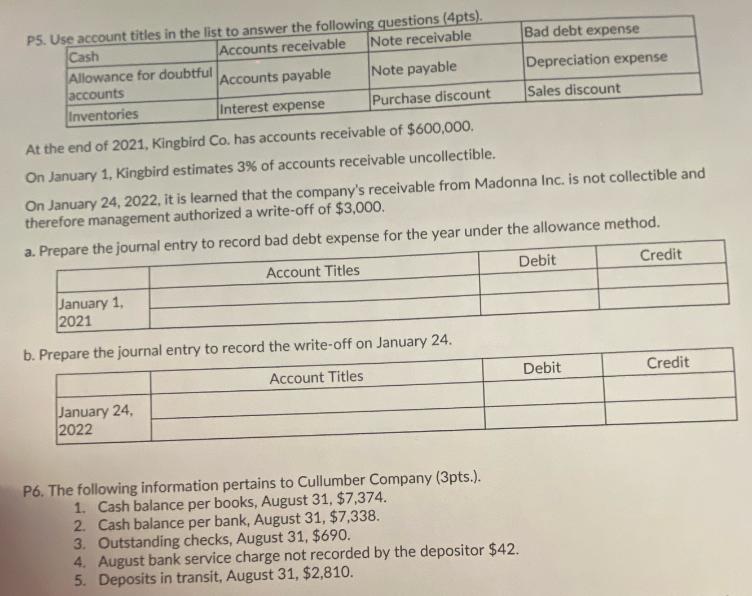

PS. Use account titles in the list to answer the following questions (4pts). Cash Note receivable Accounts receivable Bad debt expense Allowance for doubtful

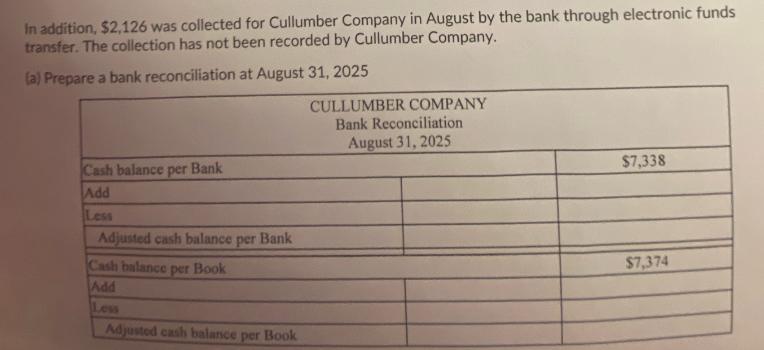

PS. Use account titles in the list to answer the following questions (4pts). Cash Note receivable Accounts receivable Bad debt expense Allowance for doubtful Accounts payable Note payable accounts Inventories Interest expense Purchase discount Depreciation expense Sales discount At the end of 2021, Kingbird Co. has accounts receivable of $600,000. On January 1, Kingbird estimates 3% of accounts receivable uncollectible. On January 24, 2022, it is learned that the company's receivable from Madonna Inc. is not collectible and therefore management authorized a write-off of $3,000. a. Prepare the journal entry to record bad debt expense for the year under the allowance method. January 1, 2021 Account Titles b. Prepare the journal entry to record the write-off on January 24. January 24, 2022 Account Titles P6. The following information pertains to Cullumber Company (3pts.). 1. Cash balance per books, August 31, $7,374. 2. Cash balance per bank, August 31, $7,338. 3. Outstanding checks, August 31, $690. 4. August bank service charge not recorded by the depositor $42. 5. Deposits in transit, August 31, $2,810. Debit Credit Debit Credit In addition, $2,126 was collected for Cullumber Company in August by the bank through electronic funds transfer. The collection has not been recorded by Cullumber Company. (a) Prepare a bank reconciliation at August 31, 2025 Cash balance per Bank Add Less Adjusted cash balance per Bank Cash balance per Book Add Less Adjusted cash balance per Book CULLUMBER COMPANY Bank Reconciliation August 31, 2025 $7,338 $7,374

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started