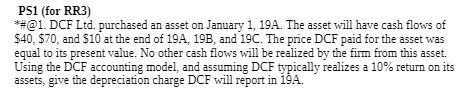

Question: PS1 (for RR3) *#@1. DCF Ltd. purchased an asset on January 1, 19A. The asset will have cash flows of $40, $70, and $10 at

PS1 (for RR3) *#@1. DCF Ltd. purchased an asset on January 1, 19A. The asset will have cash flows of $40, $70, and $10 at the end of 19A, 19B, and 19C. The price DCF paid for the asset was equal to its present value. No other cash flows will be realized by the firm from this asset. Using the DCF accounting model, and assuming DCF typically realizes a 10% return on its assets, give the depreciation charge DCF will report in 19A

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock